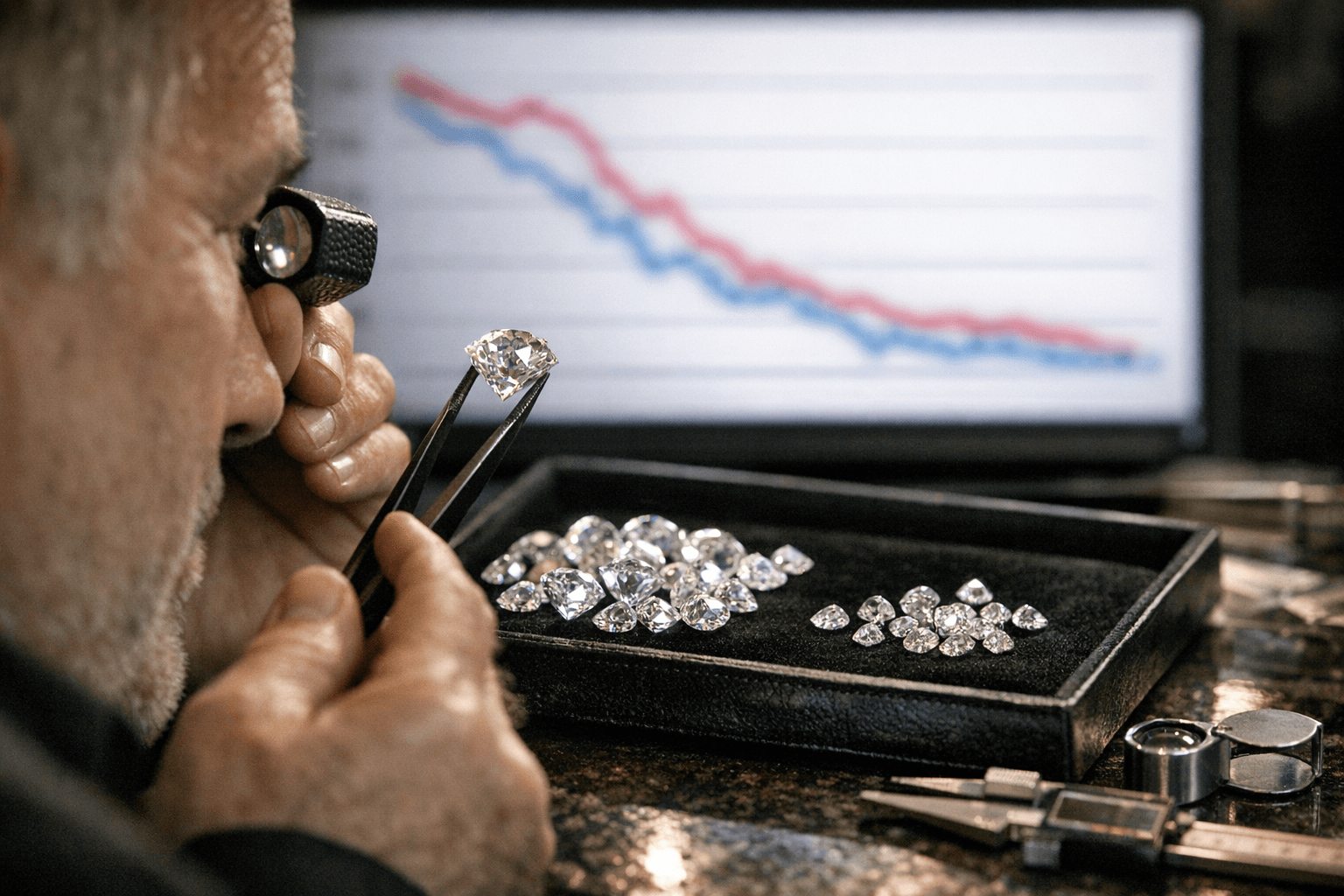

2026 Chart Shows Lab-Grown Diamond Prices Fall, Stabilize Versus Naturals

A mid‑February 2026 price chart shows lab‑grown diamonds plunged as much as 68% since 2020 then settled in early 2026, while natural prices edged down a single‑digit percentage range.

A mid‑February 2026 price chart plotting lab‑grown and natural diamonds since 2021 captures the market’s upheaval: lab‑grown averages fell sharply through 2024–2025 and showed signs of stabilization in early 2026. The pattern undercuts old assumptions about diamond pricing and crystallizes into concrete savings for buyers: a 1.0‑carat lab‑grown that cost $2,800 in 2020 now trades near $900, a decline the chart and market commentary quantify as a 68% drop since 2020.

That collapse has altered price relationships across common sizes. A trader with 15 years’ experience summarized the landscape: “In my 15 years trading diamonds, I've never seen pricing dynamics shift as dramatically as they have from 2020-2026.” The same trader lays out comparative bands for 2026: a 1.0‑carat G‑H, VS2, Excellent natural ring at $4,000‑$6,000 versus a lab‑grown at $800‑$1,500; a 2.0‑carat F‑G, VS1 natural at $22,000‑$28,000 versus lab‑grown at $3,500‑$6,000; and a 3.0‑carat F‑G, VS1 natural at $50,000‑$80,000 versus lab‑grown at $8,000‑$12,000.

Market share figures vary by source but point to broad adoption. The trader cites lab‑grown capture of 35‑40% market share, while Caratx, citing Edahn Golan Diamond Industry Research, reports lab‑grown stones now make up approximately 52% of U.S. engagement‑ring center stones and about 42% of all diamond jewellery sold. Caratx frames the consequence bluntly: “A 1‑carat natural diamond averages around $4,200, while its lab‑grown counterpart retails for $1,000 or less. This has fundamentally reset consumer expectations on size versus budget, particularly in the engagement and bridal segment.”

Channel and geography complicate raw price comparisons. Madisondia’s wholesale index shows average natural wholesale prices sliding from HKD 98,000 (≈ USD 12,560) in 2015 to an estimated HKD 55,000 (≈ USD 7,050) in 2026. At the same time MadisonDia presents a direct‑to‑consumer lab‑grown 1.0‑carat D/VVS2/3EX at HKD 2,200–2,500 (≈ USD 280–320) and a MadisonDia example at HKD 2,380 (≈ USD 305), underscoring how certification, channel and grade produce wide spreads. Madisondia notes that “Lab‑grown diamonds are graded using the same 4Cs framework as natural diamonds by GIA and IGI. In daily wear, a D‑color, VVS2, triple‑excellent lab‑grown diamond is visually indistinguishable from its natural counterpart.”

Retail structure has accelerated the shift. Online retailers now control roughly 60% of diamond sales, up from 35% in 2020, a change the trader says is “driving prices down 20‑30% vs traditional retail.” Rapaport’s industry outlook via ChatGPT predicts that “under $1,000 center stone” becomes normal for lab‑grown offerings and that retailers will tier floors with lab‑grown as everyday value and naturals concentrated in heritage and luxury lanes. Rapaport also flags regulatory pressure: Kimberley Process debates intensify under India’s 2026 chairmanship.

Resale and consumer behavior round out the picture. Samsjewelers places natural resale at 50% or more of original retail and lab‑grown resale at 20‑40%, and highlights a “3‑Carat Standard” trend where lab affordability lets buyers seek 2.5ct–3ct statement centers for under $2,000 of initial lab‑grown inventory cost.

The mid‑February chart’s headline takeaway is blunt: after a multi‑year price reset - steep declines through 2024 and 2025 - lab‑grown prices now sit on a lower, more stable baseline as of early 2026, while natural diamonds remain valued for provenance and relative resale strength but have softened 8‑12% in the 2020–2026 window.

Know something we missed? Have a correction or additional information?

Submit a Tip