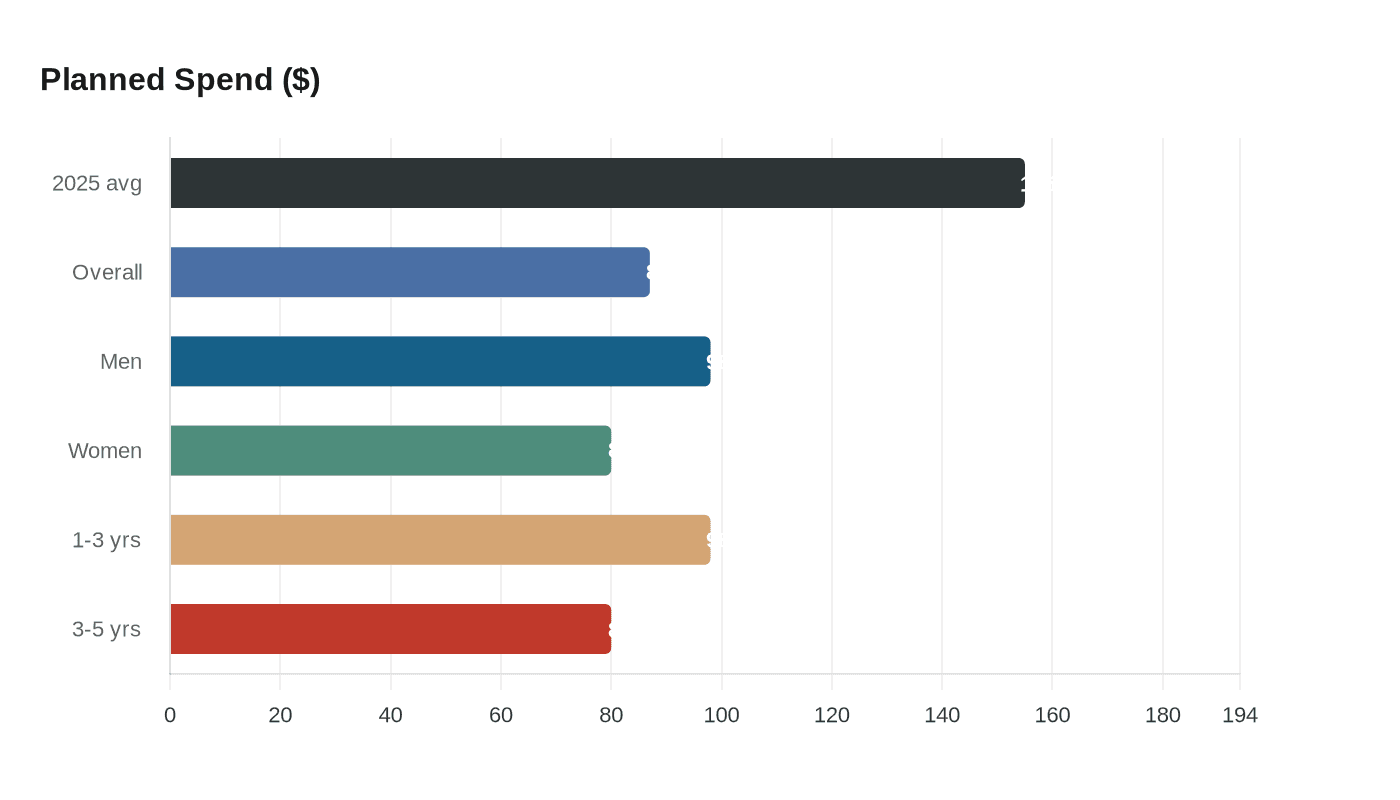

Americans Plan to Spend $87 on Valentine’s Day, Down 44% From 2025

CouponFollow survey finds Americans in relationships plan to spend $87 on a partner for Valentine’s Day 2026, down from $155 in 2025 — a roughly 44% drop.

A CouponFollow survey of 1,005 Americans in relationships found the average person plans to spend $87 on a partner for Valentine’s Day in 2026, down from $155 in 2025 — a roughly 44% decline. The report frames the shift as a recalibration rather than abandonment: “Valentine's Day in 2026 is looking more flexible, thoughtful, and low-pressure than ever,” CouponFollow writes.

The survey exposes a clear gap between planned spending and expectations. Respondents said they plan to spend $87 on a partner but expect their partner to spend $63 on them. Men reported planning to spend $98 on average while women reported $80, a 23% difference; men expect $58 from a partner and women expect $67. Payment responsibility also showed a stark gender split: 45% of men said they would cover the entire cost, compared with 6% of women.

Relationship stage and participation rates add nuance. Couples together 1-3 years were the biggest planned spenders at $98 on average, while those together 3-5 years planned $80. Roughly one in five Americans in relationships said they will skip Valentine’s Day this year, reinforcing the survey’s finding that celebration plans are more selective.

What people want has shifted toward experience and intimacy. Sixty-one percent named a romantic dinner as their ideal gift and 57% chose an experience such as a trip or concert. Handwritten cards remain important: 46% overall said they would prefer a handwritten card or letter, with a gender split showing 51% of women and 39% of men favoring that gesture. On frugality, 83% of respondents said they prefer their partner save money on Valentine’s Day rather than spend generously.

Survey respondents also weighed what counts as meaningful or excessive. On average people said $51 is the minimum someone should spend to show they care; nearly one in five said at least $100 is the minimum. Spending becomes a “red flag” at about $273 on average, with Gen Z tolerating up to $313 before it feels like too much and baby boomers drawing the line at $181.

CouponFollow senior trends analyst Clay Cary framed the change as intentional: “There has been a significant change in how Americans are approaching this holiday. They are not pulling away from Valentine’s Day, but they are being more selective on how much they are willing to, or can, spend on this holiday.” Douglas Boneparth, president of Bone Fide Wealth, urged couples to talk money and values, advising that asking “What matters to you about money? What beliefs do you have about it?” and then answering those questions together can lead to “a much more meaningful Valentine’s Day.”

Economic strain appears to be part of the story: Bureau of Labor Statistics data show cumulative inflation since early 2020 of roughly 26%, a likely factor in consumers tightening discretionary budgets. The CouponFollow findings suggest this Valentine’s season will favor thoughtful experiences and low-cost expressions over big-ticket gifts.

Know something we missed? Have a correction or additional information?

Submit a Tip