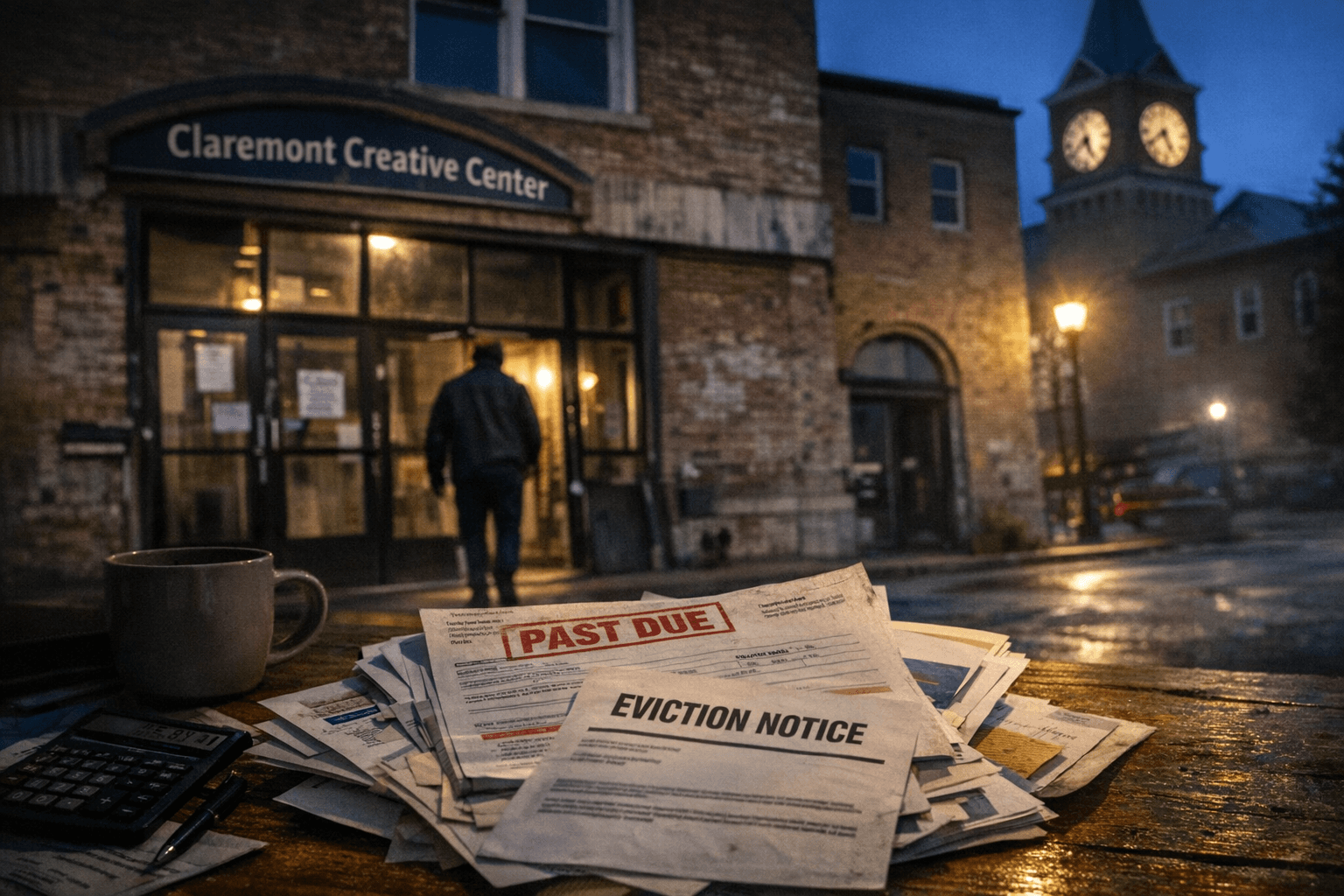

Delinquent Claremont Creative Center payments push CDA toward city bailout

City leaders say the Claremont Creative Center’s unpaid taxes, rent and loans tied to 56 Opera House Square have pushed the Claremont Development Authority toward a city bailout.

City leaders in Claremont say unpaid obligations by the Claremont Creative Center have created a short-term cash crisis for the Claremont Development Authority (CDA), forcing officials to consider a city bailout to keep the authority solvent. Mayor Dale Girard, who sits on the CDA’s nine-member board, told the City Council the Development Authority “may need a bailout from the city to meet its obligations.”

City officials described the problem in direct terms: “The Claremont Development Authority is in a financial crisis due in large part to delinquent payments in taxes, rent and loan repayments by the Claremont Creative Center, city officials said at a meeting last week.” The Creative Center occupies 56 Opera House Square, the CDA-owned building at the heart of the dispute.

The CDA holds several city properties that could be affected if the authority cannot cover obligations: 56 Opera House Square and the adjacent Farwell Block, Syd Clarke Industrial Park off Grissom Lane, and Ashley’s Landing on River Road. Andy Lafreniere is listed as the Development Authority president, and Councilor William Limoges is another CDA board member alongside Mayor Girard.

At the Feb. 18, 2026 City Council meeting City Manager Nancy Bates read a memo telling councilors she “wants the Development Authority to succeed” and noted prior collaboration with former planning and development director Nancy Merrill and with Andy Lafreniere to address the issues. Mayor Girard told councilors he “sees no other way out of the current financial situation,” attributing the squeeze to delayed payments from the Creative Center.

City officials warned the Creative Center’s cash problems could ripple outward. “City officials are now concerned that the Creative Center’s financial situation may compromise the Development Authority’s financial position, which could have broader consequences for the city,” council discussion recorded at the meeting said.

The CDA crisis arrives while municipal leaders are also grappling with a separate, severe school-finance emergency. The 1,500-student district has faced what Heather Whitney, chair of the Claremont School Board, called “a massive deficit, anywhere between $1 and $5 million.” A separate audit review found the district “had fallen $5 million behind in payments, with virtually no cash on hand,” and the board responded with about 40 layoffs, the closure of an elementary school, and a $4 million loan from Claremont Savings Bank due in April; James O’Shaughnessy, attorney for the school board, said the district has managed to continue classes this school year.

State-level voices have weighed in on the school situation. “It is time, long past time for the state to step up and do its financial part,” Volinsky said, adding, “The cavalry is not coming from the state.” Those remarks underscore that Claremont is confronting at least two distinct fiscal emergencies at once.

At the Feb. 18 meeting no bailout figure for the CDA was disclosed, and officials did not report a public response from the Claremont Creative Center. City Manager Bates’s memo and the CDA board’s next actions were left on the table as councilors weigh whether and how the city should intervene.

Know something we missed? Have a correction or additional information?

Submit a Tip