Devon and Coterra to merge in $58 billion all-stock deal

Devon and Coterra will combine in an all-stock deal to form a $58B shale giant, targeting $1B in annual synergies and a $5B-plus share buyback.

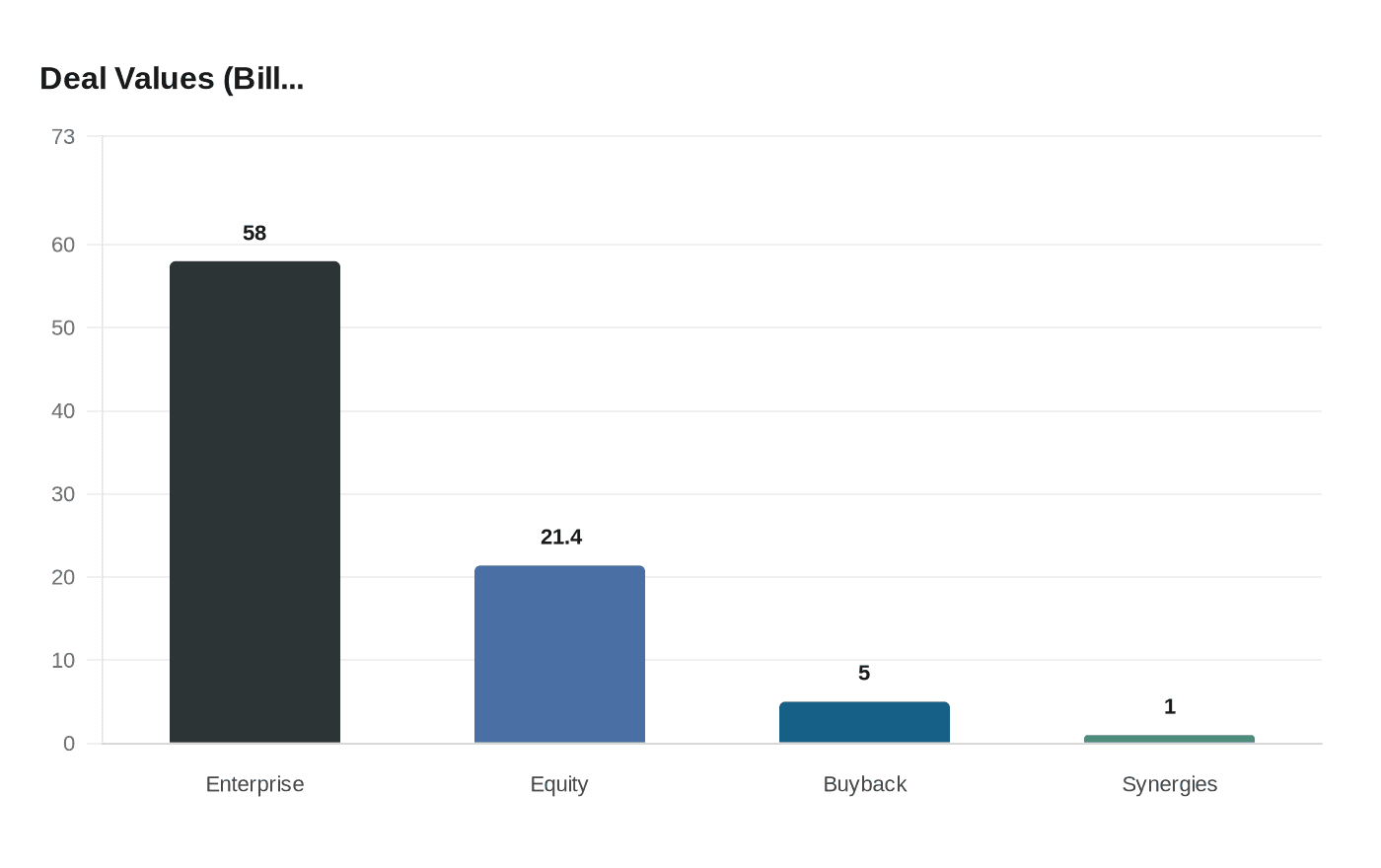

Devon Energy and Coterra Energy signed a definitive all-stock merger agreement that will create a combined company with an implied enterprise value of roughly $58 billion, the firms said in a joint press release datelined Oklahoma City and Houston. The deal, announced Feb. 2, 2026, will leave the combined company named Devon Energy, headquartered in Houston while retaining a significant presence in Oklahoma City.

Under the terms, Coterra shareholders will receive 0.70 share of Devon common stock for each Coterra share, producing a fully diluted ownership split of about 54 percent for existing Devon holders and 46 percent for Coterra holders. The boards of both companies unanimously approved the agreement, which is expected to close in the second quarter of 2026 subject to regulatory approvals and customary closing conditions, including shareholder votes.

The merger immediately reshapes the U.S. shale landscape by concentrating scale in the Permian Basin’s Delaware Basin economic core. Investor materials and industry coverage cite a combined acreage position in the Delaware Basin of more than 745,000 net acres. Management and presentations emphasize complementary asset footprints and a strategy to extend drilling runways, lower per-barrel costs and sharpen capital discipline through consolidation.

Management roles were outlined in the announcement. Clay Gaspar, Devon’s president and CEO, will lead the combined company as chief executive. Tom Jorden, Coterra’s CEO, will become non-executive chairman. In the announcement Gaspar said: "This transformative merger combines two companies with proud histories and cultures of operational excellence, creating a premier shale operator. We've now built a diverse asset base of high-quality, long duration inventory to drive resilient value creation and returns for shareholders through cycles. Underpinned by our leading position in the best part of the Delaware Basin, and a deep set of complementary assets, we expect to capture annual pre-tax synergies of $1 billion. This will drive higher free cash flow and greater shareholder returns beyond what either company could achieve alone."

Financial metrics underlying the $58 billion enterprise value are tied to Devon’s Jan. 30, 2026 closing share price, according to company materials and industry reporting. Separate analysis cited by CNBC attributes an equity value of about $21.4 billion based on Reuters calculations, underscoring the distinction between enterprise value and equity market capitalization. Devon’s investor slide deck cited a representative DVN quote from Jan. 30 showing DVN 40.21.

The companies are targeting $1 billion a year in pre-tax synergies to be realized by year-end 2027 through capital optimization, operating efficiencies, lower corporate costs and technology-driven gains. Management also flagged plans to combine AI capabilities and other digital tools to boost capital efficiency. Management has said the merged company will pursue higher shareholder returns via increased dividends and a share buyback program of more than $5 billion.

Analysts framed the deal as accretive to investor interest in a sector returning to consolidation. "The combination is incrementally positive for both shareholders, as it brings together two high-quality companies to create a larger entity that should garner greater investor interest in today's volatile energy tape," said Gabriele Sorbara of Siebert Williams Shank. Locally, Chad Warmington, president and CEO of the State Chamber of Oklahoma, highlighted Devon’s historical impact on Oklahoma City, saying: "Today marks a significant moment for Oklahoma City and the State of Oklahoma. Devon Energy has been a transformative force... Oklahoma City is Devon’s birthplace, and while this announcement marks a new chapter, we are optimistic that Oklahoma City will remain an important..."

Market reaction was mixed: Coterra shares had risen about 14 percent since Jan. 15 amid takeover speculation but fell 2.4 percent on the announcement day as oil prices slipped roughly 5 percent; Devon shares had gained roughly 6 percent since Jan. 15. The transaction ranks among the largest U.S. upstream combinations in recent years and signals renewed M&A momentum as shale producers seek scale, cost savings and durable cash flow in a volatile energy market.

Know something we missed? Have a correction or additional information?

Submit a Tip