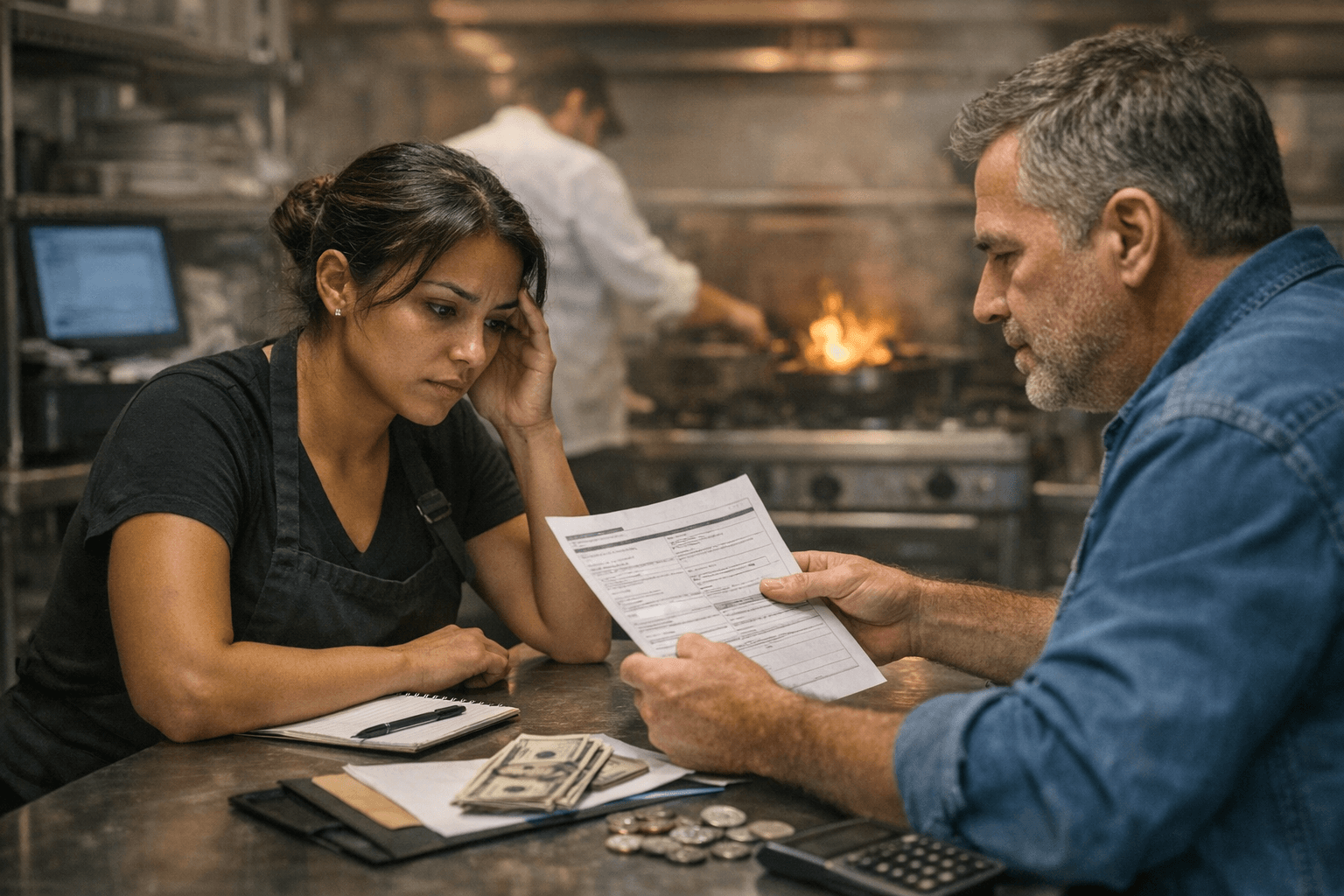

DOL Explains How Restaurant Workers Can Recover Unpaid Wages

The U.S. Department of Labor outlines how restaurant workers can find recovered back wages and file a federal claim using the Workers Owed Wages database and form WH-60.

Restaurant workers who suspect unpaid wages can now use a step-by-step process from the U.S. Department of Labor to determine whether federal investigators have recovered money on their behalf and to file a claim for any unpaid back wages. The agency’s Workers Owed Wages guidance walks employees through searching the DOL database, verifying identity, submitting the Back Wage Claim Form (WH-60), and the documents needed to support a claim.

Start by searching the Workers Owed Wages database by employer name to see whether the DOL shows recovered funds tied to a restaurant or hospitality employer. If a payroll recovery appears, workers must verify their identity and follow the page’s instructions to complete the Back Wage Claim Form (WH-60). Supporting documents that will speed processing include pay stubs, a W-2, and a Social Security number or ITIN. When required, claimants should complete electronic submission through login.gov to authenticate their identity and finalize the filing.

The guidance also explains what to expect after filing. Local Wage and Hour offices serve as contact points for ongoing questions, and the DOL provides approximate timelines and next-step notifications during processing. That means restaurant workers should save payroll records, check the database periodically for employer listings, and be prepared to respond to requests from Wage and Hour staff. Advocates, workplace organizers, and legal representatives can use the same checks to help front-of-house and back-of-house employees navigate claims.

For restaurants, the existence of a transparent federal mechanism for recovering unpaid wages raises the stakes for accurate payroll and tip-pool administration. Managers and owners risk federal claims when wages, overtime, or tips are mishandled. For servers, bussers, line cooks, and dishwashers, the process offers a practical route to recover wages without waiting for employer cooperation. It can also bring closure when investigators have already secured funds and workers need to claim their share.

The guidance turns a technical enforcement outcome into actionable steps for employees: search by employer name, assemble pay stubs or W-2s and identification, submit the WH-60, and use login.gov when prompted. For restaurant workers and their advocates, the DOL resource creates a clearer path to reclaiming pay and encourages better payroll practices in kitchens and dining rooms. Check the database, gather your documentation, and contact your local Wage and Hour office if you need assistance — the agency’s process lays out the next steps toward getting owed pay into workers’ pockets.

Know something we missed? Have a correction or additional information?

Submit a Tip