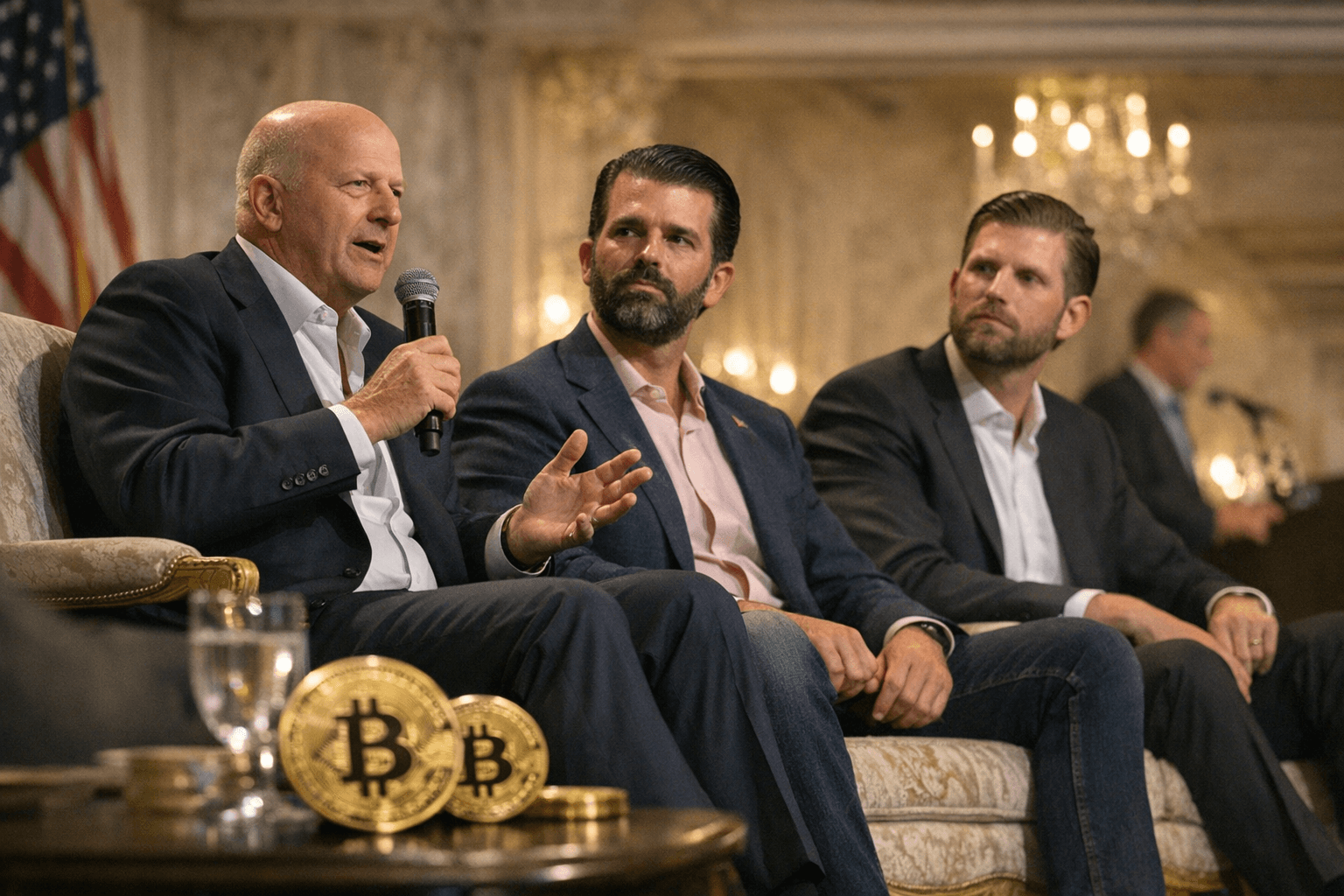

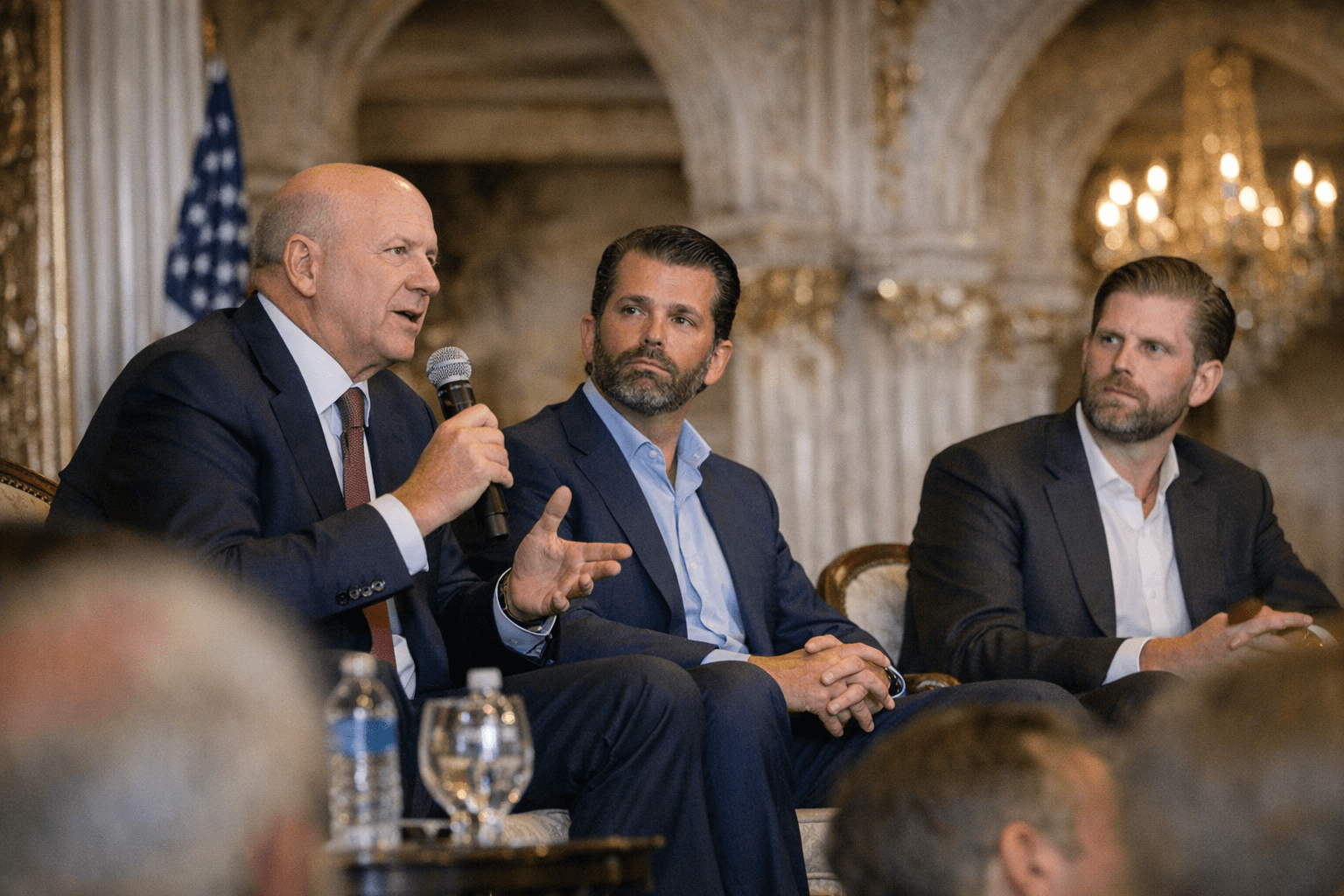

Goldman Sachs CEO David Solomon Headlined Mar-a-Lago Crypto Forum with Trump Sons

David Solomon told the World Liberty Forum at Mar-a-Lago he owns a "very, very limited" amount of bitcoin while speaking alongside Trump sons and federal regulators.

Goldman Sachs Chair and CEO David Solomon revealed during an address at the World Liberty Forum at Mar-a-Lago that he holds a "very, very limited" amount of bitcoin, a notable admission as he spoke alongside host Donald Trump Jr., co-host Eric Trump, and a roster of Wall Street executives and federal officials. The forum, organized by World Liberty Financial, brought together industry leaders and regulators at President Trump’s private Palm Beach club.

The World Liberty Forum convened on Feb. 17, 2026 at Mar-a-Lago and was presented by World Liberty Financial, described by organizers as a Trump family–backed crypto business. Expected private-sector speakers included Adena Friedman, Chair and CEO of Nasdaq; Jenny Johnson, CEO of Franklin Templeton, which oversees $1.7 trillion in assets; and Lynn Martin, President of the New York Stock Exchange. Co-hosts named on the schedule included Zach and Alex Witkoff, sons of Steve Witkoff, who is identified as a White House special envoy.

Federal officials slated to appear included Michael Selig, Chair of the Commodity Futures Trading Commission and a Trump appointee; Kelly Loeffler, Administrator of the U.S. Small Business Administration; and Jacob Helberg, Under Secretary of State for Economic Affairs. One attendee list also included Sen. Bernie Moreno (R-OH), though that name did not appear on several other published schedules for the forum.

Solomon used his remarks to critique regulatory overreach in crypto markets, saying, "When you burden this system with excessive regulation, you start to extract capital. That absolutely happened in the last five years." He also declined to quantify his personal bitcoin holdings or how long he has owned them. The CEO has previously described bitcoin as a "speculative asset without a real use case," but his disclosure and the bank’s internal work indicate a measured shift: Goldman has a team assessing how to implement stablecoins even as peers such as JPMorgan have launched tokenized products and proprietary digital tokens.

Eric Trump seized the stage with bullish remarks about bitcoin, saying, "I've never been more bullish on bitcoin in my life" and predicting, "I do think it hits $1 million…You're going to have volatility with something that has tremendous upside." Forum speakers and participants highlighted a trend of private wealth clients being allocated higher percentages of crypto exposure, particularly among investors under 50, positioning bitcoin as an investment theme for younger clients.

The gathering prompted ethical scrutiny: six legal and government ethics experts described the forum as unique but offered divergent views about whether it posed a serious conflict of interest. Critics said the overlap of regulators, financial firms, and a Trump family–backed business could be seen as supporting the family venture to curry favor. Other experts were skeptical that the event raised a constitutional legal issue and noted that presidential conflicts of interest have long been a complicated reality.

For Goldman staff working on digital assets and private wealth, Solomon’s on-stage disclosure and his public comments about regulation and stablecoins are likely to sharpen internal conversations about product strategy and client communications. At the same time, the optics of senior executives and regulators appearing at a family-backed forum at Mar-a-Lago will spur fresh questions about how corporate leaders balance business engagement with public ethics concerns.

Know something we missed? Have a correction or additional information?

Submit a Tip