Goldman Sachs Warns AI Data Centers Will Raise Electricity Prices, Fuel Inflation

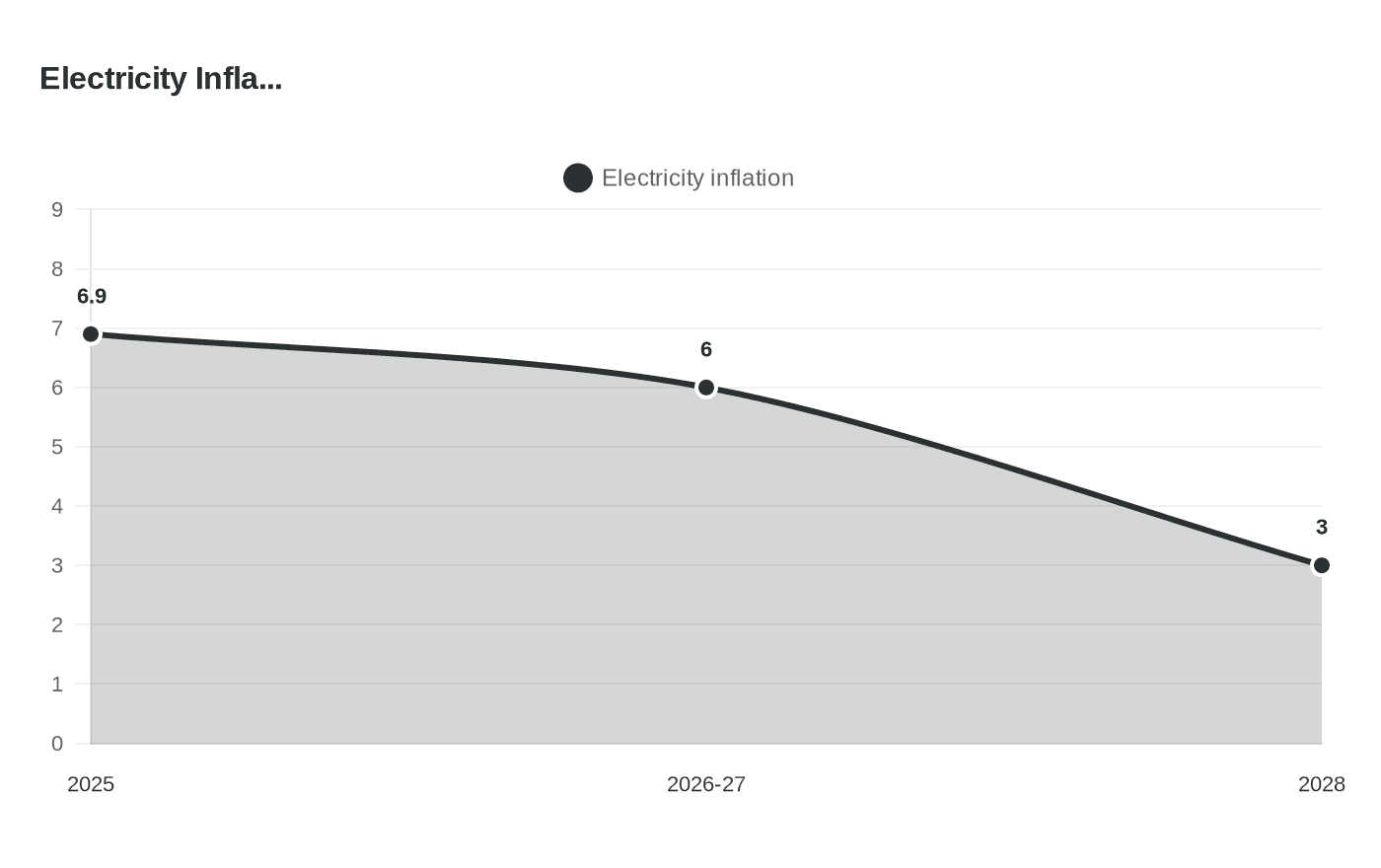

Goldman Sachs warns AI data centers helped push electricity up 6.9% in 2025 and forecasts consumer electricity inflation will climb 6% in 2026–27, lifting core inflation and trimming growth.

Goldman Sachs analysts Manuel Abecasis and Hongcen Wei said in a client note that surging power demand from AI data centers has already driven electricity prices higher and will push consumer electricity inflation up sharply through 2027. Goldman data show electricity prices jumped 6.9% year over year in 2025, and the bank forecasts consumer electricity inflation will rise 6% from 2026 to 2027 before decelerating to 3% in 2028 as natural gas prices ease. Abecasis and Wei warned, "Higher power prices will also put upward pressure on core inflation by raising business production costs."

Goldman quantified the macro effects: higher electricity bills will shave roughly 0.2 percentage points off consumer spending growth and 0.1 percentage points off U.S. GDP growth in 2026–2027. The analysts also flagged sectoral pass‑throughs, noting that larger electric bills for businesses such as hospitals and restaurants will be passed to customers and that price rises are likely to ripple into food, transportation, and clothing. Goldman additionally projects the net GDP hit could be offset by productivity gains from AI over the same period.

The bank flagged distributional and regional impacts. Manuel Abecasis said, "The income and spending drags will likely be larger for lower‑income households because electricity accounts for a greater share of their spending," and he added that "Households in regions with more data centers will also take a bigger hit." Goldman’s analysis points to concentration risk: data center deals crested above $61 billion in 2025 as hyperscalers expanded capacity, and Goldman counts data centers as responsible for roughly 40% of recent electricity demand growth.

Goldman Sachs Research set out longer‑term power math and supply responses. The research forecasts global power demand from data centers will increase 175% by 2030 versus 2023 as companies ramp up training for energy‑intensive AI models. To meet that load, Goldman expects behind‑the‑meter systems - onsite gas turbines, fuel cells and geothermal - to supply about 25%–33% of incremental demand through 2030, and estimates modular fuel cell systems could satisfy 6%–15% of incremental power needs. Goldman finds modular fuel cells can be deployed in less than a year and are 10%–30% more efficient than gas turbines.

Goldman also mapped demand risk across four scenarios that produce divergent market outcomes for so‑called bit barns. The scenarios range from demand dropping off and leaving excess capacity to demand overwhelming available supply by decade end; Jim Schneider, Goldman Sachs senior equity analyst, captured investor uncertainty when he said, "A lot of investors have struggled with the hype and quantifying what this all means." One scenario notes that if customers balk at paying for AI tools, monetization plans could falter and datacenter occupancy and lease rates could fall.

For firms, clients and investors who work on cloud, infrastructure and energy procurement, Goldman’s numbers crystallize several near‑term risks: elevated electricity bills in 2025–27, a measurable boost to core inflation through 2028, a potential regional squeeze where data centers cluster, and a policy and capital race to deploy behind‑the‑meter and fuel‑cell solutions to blunt the strain on grids.

Know something we missed? Have a correction or additional information?

Submit a Tip