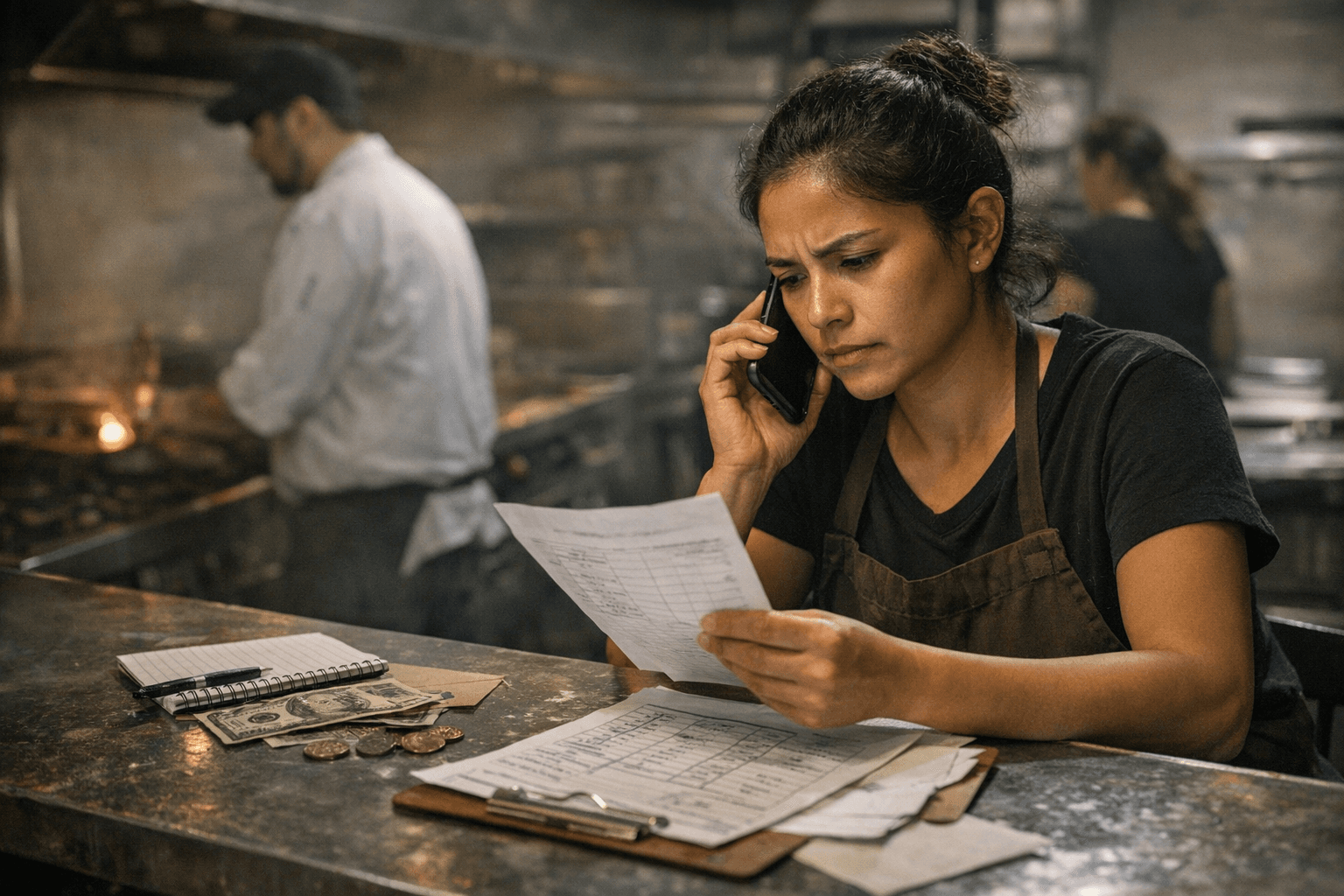

How restaurant workers can document and fight stolen tips and unpaid wages

Restaurant employees can use federal, state and local channels to report wage theft, recover withheld pay, and get anti-retaliation protections. Start collecting records, call the Wage and Hour helpline, and reach out to worker centers.

Restaurant workers who suspect stolen tips, unpaid final pay, unlawful tip pooling, or other wage-hour violations have clear channels to pursue remedies and protections. The U.S. Department of Labor Wage and Hour Division (WHD) offers an online complaint process, guidance on what evidence to collect, and a toll-free helpline at 1-866-4-US-WAGE (1-866-487-9243). WHD materials outline investigation steps and anti-retaliation protections for employees who file complaints.

State and city labor enforcement units provide a second path for relief and in some cases can move faster or pursue additional damages. Municipal programs often add local safeguards and multilingual services; for example, New York City’s Department of Consumer and Worker Protection publishes a Workers’ Bill of Rights and instructions for filing local complaints and getting help in multiple languages. Workers in any city should check their state or municipal labor department for parallel claim procedures and local intake options.

Worker-advocacy organizations and legal aid groups play a practical role in protecting restaurant employees. Worker centers, the National Consumers League and local legal clinics can help with anonymous reporting, documentation strategies, and anti-retaliation planning. These groups commonly provide templates and checklists that make it easier for front-of-house and back-of-house staff to preserve the facts while minimizing risk to job security or immigration status.

What to collect and how to act: keep meticulous, contemporaneous records of shifts, clock-in and clock-out times, tip-outs and tip-pool allocations, and any POS or payroll screenshots showing tip-app payments. Hold on to pay stubs, schedules, written policies, and any communications about tips or final pay. Photograph or screenshot electronic records if your employer uses payroll apps. Workers are advised to contact WHD and their state labor office at the same time, and to seek assistance from a local advocacy group or legal clinic if anonymity or immigration concerns are present.

The impact on workers is immediate: missing tips or unpaid wages reduce take-home pay, strain household budgets and undermine trust between staff and management. On the floor, disputed tip pools and withheld final pay create tension between servers, bartenders and managers, and can ripple through staffing and morale. Pursuing formal complaints can restore pay and deter future violations, but it also changes workplace dynamics and may require anti-retaliation measures.

For restaurant employees, the next step is practical: start compiling records now, call the WHD helpline at 1-866-4-US-WAGE, check your state or city labor office for local filing instructions, and reach out to a worker center or legal clinic for help preserving anonymity and building a claim. Taking those steps can recover withheld earnings and help make your workplace more accountable.

Know something we missed? Have a correction or additional information?

Submit a Tip