Luxury resale boom redefines fine jewelry and watch collecting in 2026

A Van Cleef Sweet Alhambra bracelet that retails for $1,540 before taxes is listed for $2,020 on Rebag, illustrating resale strength amid forecasts the market could reach $360 billion by 2030.

A Sweet Alhambra bracelet in 18‑karat gold and mother‑of‑pearl that retails for $1,540 before taxes is going for $2,020 on Rebag, a concrete example of resale outpacing retail as platforms and specialist dealers reshape collecting. The Rebag figures sit alongside forecasts that vary widely - a LinkedIn post says “In 2025, the global resale luxury market is set to hit $38.3B,” another LinkedIn post pegs the market at $56B, and an October report from Boston Consulting Group and Vestiaire Collective is reported to project the resale market could reach as much as $360 billion by 2030.

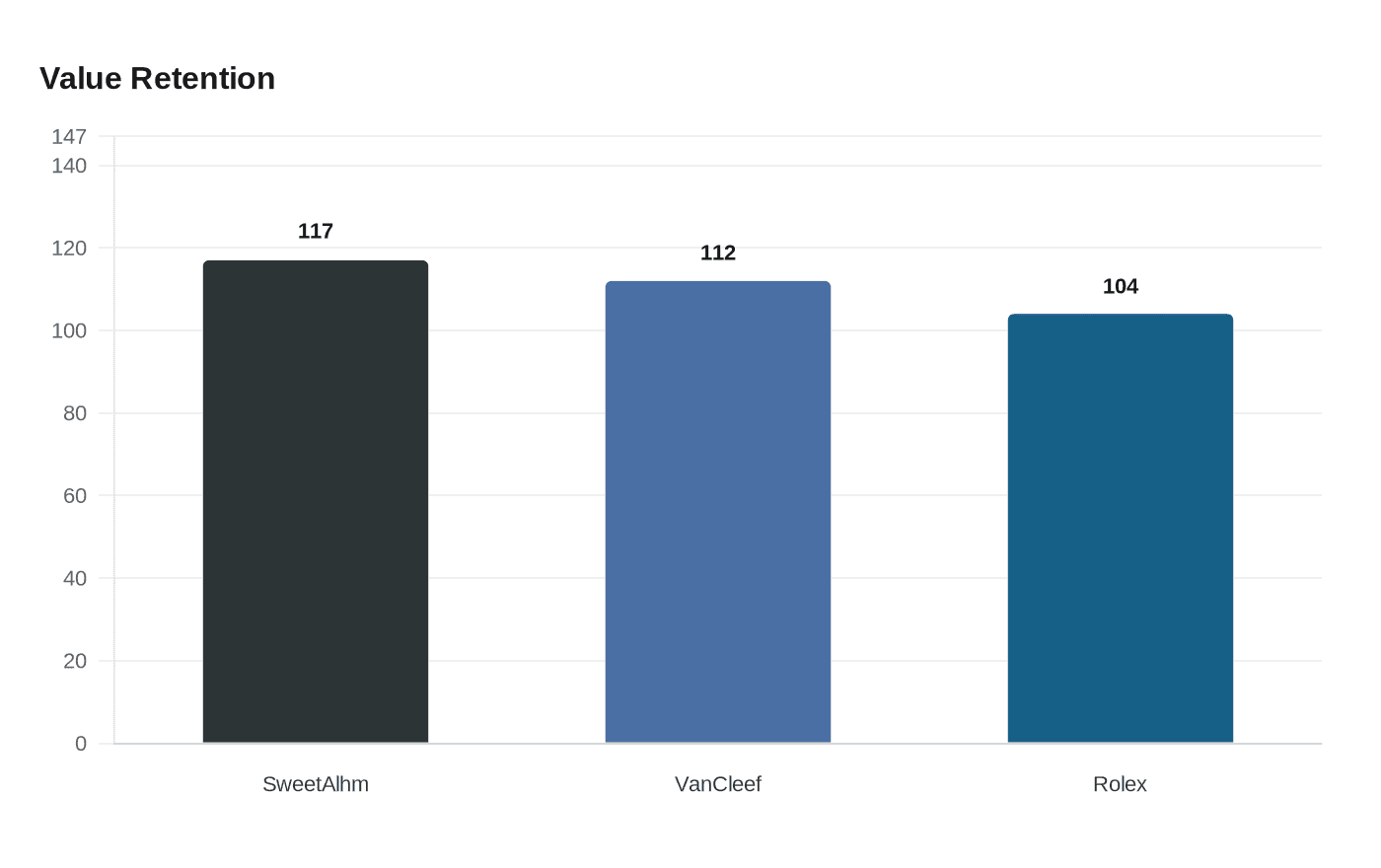

Market metrics from dealers and platforms underline that value dynamics differ by measurement. Rebag’s 2025 resale report, as reported in Business Insider, shows Van Cleef & Arpels styles holding 112% of their value on average, up 9% from 2024, and the Sweet Alhambra bracelet specifically “retained 117% of its value in 2025.” Rebag also records Rolex at a 104% value retention rate, “a 4% jump from 2024.” Separate LinkedIn commentary notes that “Rolex resale prices are up 20% YoY for iconic references,” a price-change metric that is distinct from Rebag’s value-retention calculation.

Category-level data from FashionUnited demonstrate where the gains are concentrated: “Average selling prices for fine jewelry jumped 17 percent year-over-year,” 18K gold pieces were “up 53 percent,” and “Yellow gold now retains 47 percent of its original retail value on the secondary market (up from 39 percent in 2024).” FashionUnited also reports that bracelets and watches were among the most popular pre-owned items in 2025 and that “vintage searches [are] climbing nearly 30 percent year-over-year,” signaling appetite for archive hunting and specific models.

Economic and cultural drivers are explicit. Business Insider cites Rebag saying tariffs and rising retail prices boosted demand for secondhand jewelry and watches; Rebag CEO Charles Gorra observed, “Rising primary market prices pushed more consumers to the secondary market, reaffirming its stability as a trusted and lucrative channel for collectors.” Pop-culture placements are also moving markets: FashionUnited links Cartier’s Baignoire watch surge to Timothée Chalamet wearing it at the Oscars, and cites Fendi Baguette placements on “And Just Like That” and Fendi’s 100th anniversary show as catalysts.

Restoration and trusted dealers are central to resale’s credibility. Northpennnow, profiling Gray and Sons Jewelers in Miami, wrote “The global luxury resale movement has entered a decisive era” and argued that “Preservation should enhance rather than erase history.” The profile added, “A vintage bracelet polished with care or a mechanical movement serviced by trained watchmakers carries forward its narrative into the future,” positioning stores like Gray and Sons as “cultural gatekeepers of timeless value.”

Brands are responding by mining resale data to inform design and pricing while confronting the challenge of convincing shoppers to buy new at full price; LinkedIn commentary notes “Consumers want brand verified resale” and that “Resale doesn’t dilute luxury, it redefines it.” Platforms report behavioral shifts: The RealReal told LinkedIn that “58% of shoppers now prefer resale outright,” and quoted the Wall Street Journal: “More people are spending the cash they get from reselling on other secondhand goods, bypassing the primary market altogether.”

If you have sold a meaningful piece recently, tell us what you got. The single-line comparison worth sharing: Sweet Alhambra retail $1,540 before taxes versus $2,020 on Rebag — a 117% retention example investors and collectors now cite when assessing jewelry as both craft and capital.

Know something we missed? Have a correction or additional information?

Submit a Tip