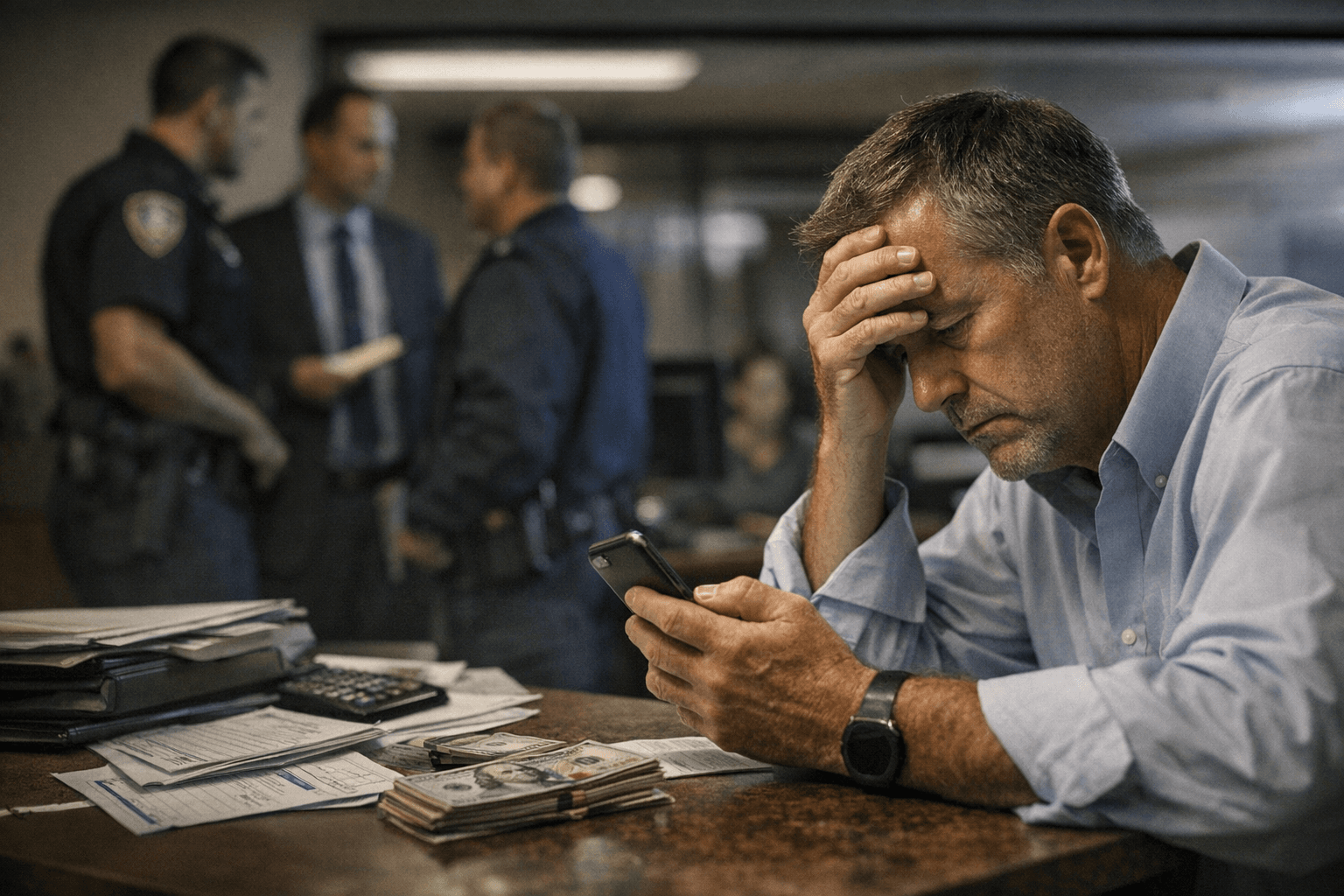

Media parent Ballantine loses $276,000 to phone spoofing fraud

a Ballantine Communications bank account lost more than $276,000 after a caller spoofed Alpine Bank; police and local bank units are investigating.

Ballantine Communications, parent company of The Durango Herald, The Journal and The Tri-City Record, reported that more than $276,000 was fraudulently transferred out of a company bank account on Jan. 17, prompting an active investigation by local police and bank fraud teams.

Durango Police Department investigating officer Isaiah Grijalva said a suspect obtained account information from a Ballantine staff member by posing as a representative of Alpine Bank. The account was then accessed without authorization and the funds were moved to multiple banks outside Colorado. The company’s accounting department uncovered the transfers, and Ballantine CEO John Blais told staff the company’s insurance carrier has been notified. Blais also said subscriber, advertiser and employee records were not affected and that payroll and day-to-day operations continued normally.

Alpine Bank Colorado President Eric Eicher warned residents that fraud techniques are evolving. Eric Eicher said, "Fraudsters are getting better at what they do." He singled out email account compromises, wire transfer scams and so-called "spoofed" number phone calls as common tactics, noting that spoofing disguises the caller’s displayed number or name to appear legitimate. Eicher advised anyone receiving a call that asks for sensitive financial credentials to hang up and call back using a verified phone number or to visit their bank in person. He emphasized that no bank will call and ask for a login password.

Local law enforcement, Alpine Bank’s fraud unit and Ballantine’s insurance team are coordinating on the probe. Because Alpine Bank is federally insured, the case could be referred to federal authorities, raising the possibility of an FBI investigation depending on findings and interstate banking links. Transfers to multiple out-of-state accounts increase the complexity of recovery efforts and cross-jurisdictional tracing.

For San Juan County residents and small businesses, the episode highlights a practical risk: impersonation scams can bypass basic trust in familiar institutions. Local nonprofits, sole proprietors and news organizations that rely on a small accounting staff are especially vulnerable when a single point of contact is targeted. The swift detection by Ballantine’s accounting team limited operational disruption, but the financial hit underlines the importance of verification protocols, multi-factor approvals for transfers, and immediate notification to banks when suspicious contact occurs.

The Durango Police Department’s investigation is ongoing. For now, the key takeaway for residents is to treat unsolicited banking calls with skepticism, verify contact information independently, and review corporate controls for outgoing transfers so a single phone call cannot trigger large wire movements.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip