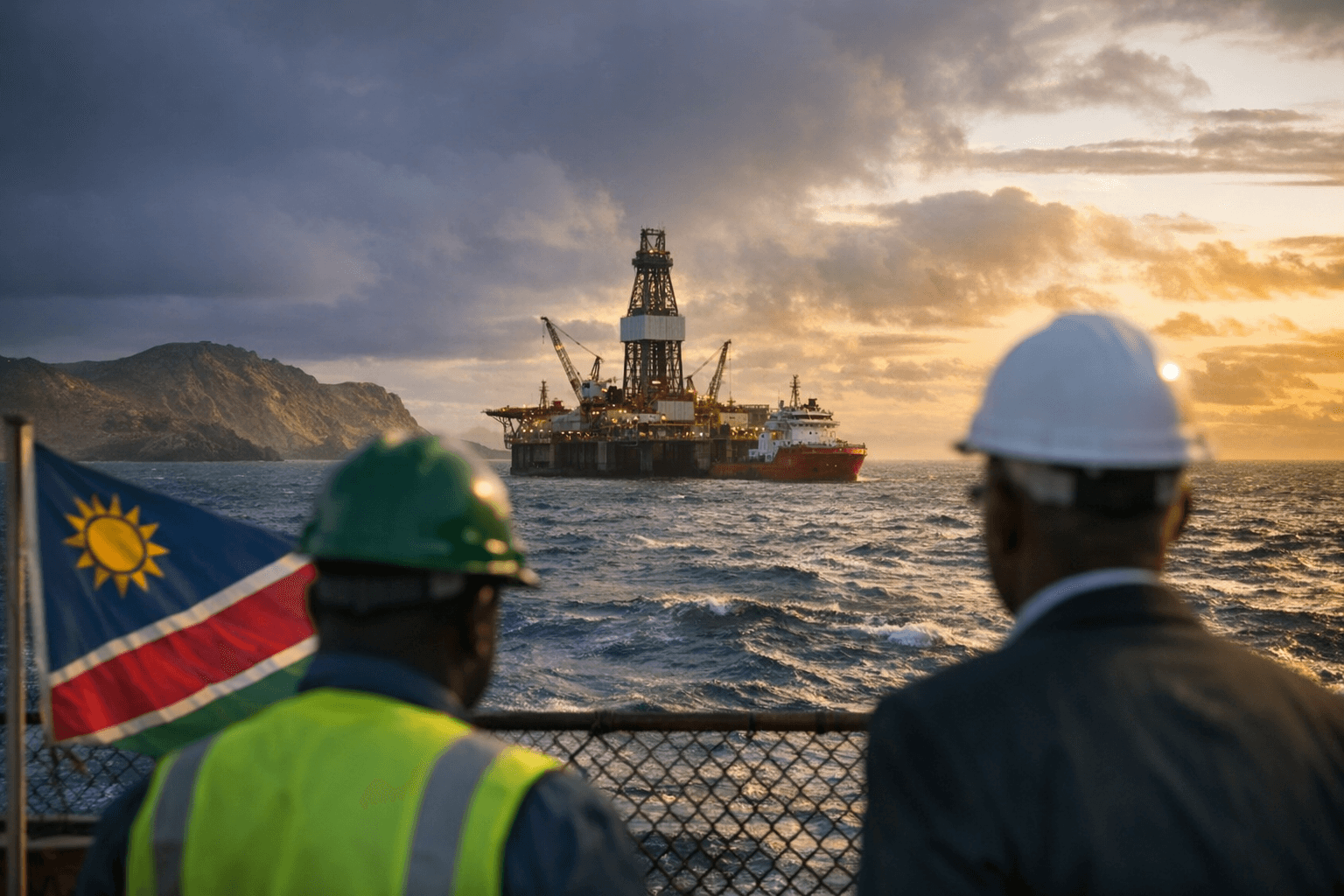

Namibia ministry alleges TotalEnergies and Petrobras acquired stakes without approvals

Namibia’s energy ministry says TotalEnergies and Petrobras acquired stakes in a Luderitz Basin licence without prior approval; industry posts link bids to Galp’s Mopane.

Namibia’s Ministry of Industries, Mines and Energy said on Feb. 8 that it was concerned that TotalEnergies and Petrobras had acquired stakes in an offshore exploration licence in the Luderitz Basin without informing the ministry or obtaining required prior approvals. The statement, supplied in truncated form, did not include further detail on stake sizes, transaction timing or next steps.

The ministry’s allegation stands alongside industry commentary suggesting a related commercial scramble. A LinkedIn industry post, which repeatedly used qualifiers such as “reportedly” and “if confirmed,” said TotalEnergies was “reportedly in the lead with a winning bid for the equity stake in Galp Energia’s Mopane discovery offshore Namibia” and described Mopane as “nestled in the Orange Basin.” That post estimated roughly 300–400 direct jobs during appraisal and pre-FPSO construction and projected fiscal benefits of N$1–1.5 billion in government revenues, citing unspecified reports.

The two sources raise overlapping but unresolved claims. The ministry singled out an exploration licence in the Luderitz Basin, while the industry post referred to Galp’s Mopane discovery in the Orange Basin. Neither source in the material provided confirmed whether the two references describe the same licence or separate assets. Critical transactional details are absent from both accounts: the supply does not identify sellers, stake percentages, transaction dates, or whether any regulatory approvals had in fact been sought before the alleged transfers.

For Namibia, the regulatory issue goes to core governance of its nascent upstream sector. The ministry’s statement, by invoking lack of prior approvals, implies a breach of domestic petroleum licensing procedures that typically require notification and consent for transfers of participating interests. If transfers occurred without formal sign-off, companies may face remedial requirements, delays to exploration programmes, or potential administrative penalties once the full ministry record is released.

The market implications could be immediate. Industry commentary framed a potential TotalEnergies win as shifting “regional upstream dynamics,” with multiple consortiums reportedly bidding and Petrobras named as another strong contender. Even absent confirmation of a completed sale, the prospect of new major-operator involvement tends to accelerate local supply-chain planning, from FPSO tendering to port and logistics upgrades, and raises expectations for local content and skills transfer. The LinkedIn post’s fiscal and employment estimates—~300–400 jobs and N$1–1.5 billion—underscore why clarity matters for public stakeholders and investors, though those figures were not attributed to a named study in the provided material.

For now, the authoritative element in the record is the ministry’s Feb. 8 comment. The supplied ministry text was truncated and did not set out whether formal enforcement or remedial steps will follow. Industry sources continue to qualify reports of bids and wins. Absent company confirmations or full regulatory documentation provided in the material at hand, the transaction status and regulatory compliance remain unresolved. The outcome will shape investor sentiment in Namibia’s offshore frontier, where clarity on licensing transfers and oversight is essential to securing both foreign capital and the projected local economic gains.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip