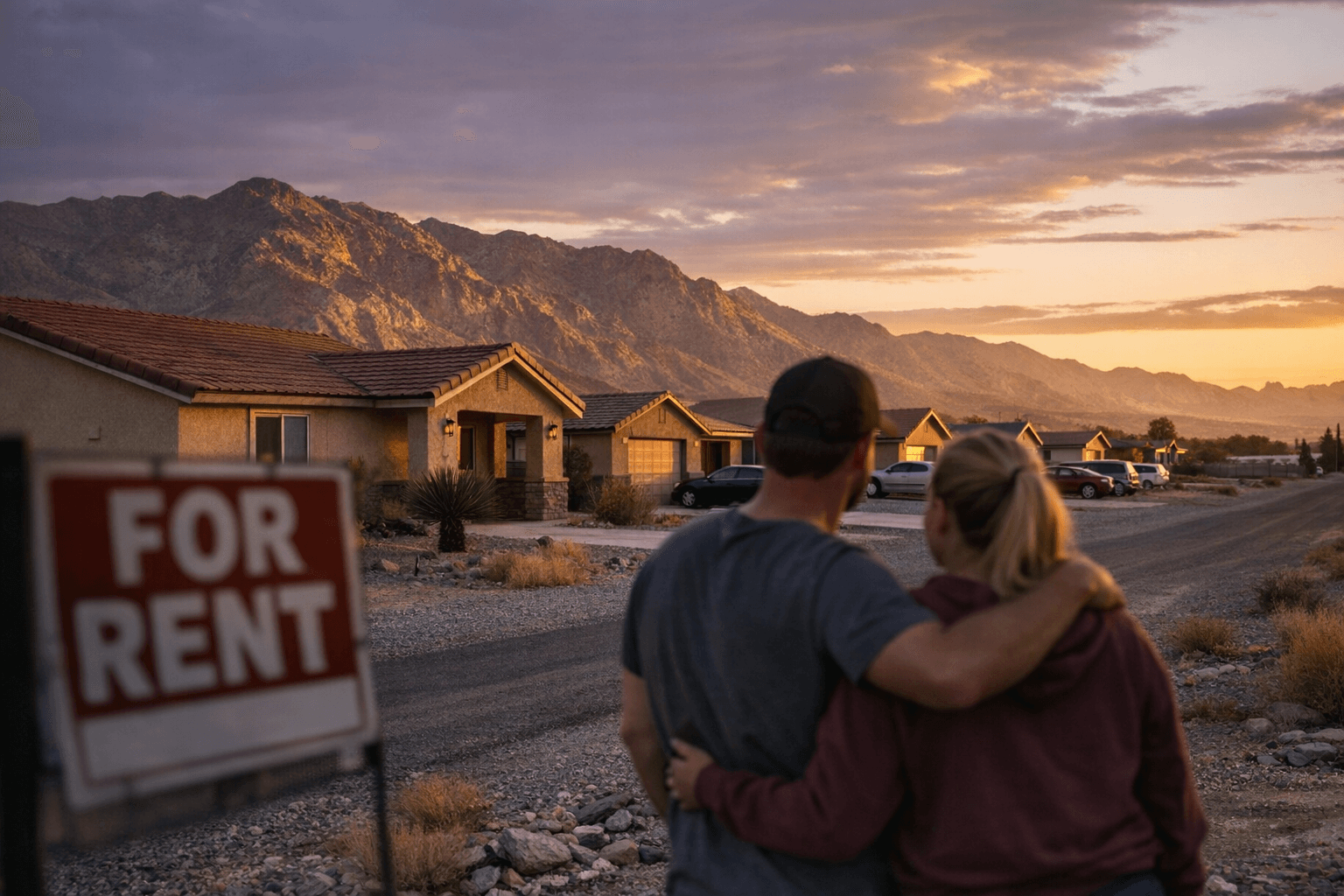

Pahrump median rent holds steady at $1,640, 14% below U.S. average

As of Jan. 16, 2026, median rent in Pahrump stood at $1,640, offering relative affordability but limited inventory. Stability matters for renters and landlords planning ahead.

As of January 16, 2026, the median rent in Pahrump was $1,640 for all bedroom counts and property types, a tally that is $260, or 14%, below the national median. The local market shows unusually low space costs, with the average price per square foot at just $0.94. Those figures reflect a small rental market: 109 listings were active in the area at the time of the count.

Breakdowns show notable spreads by unit type. One-bedroom units averaged $1,100, two-bedrooms $1,300 and three-bedrooms $1,700. Apartments averaged $1,400 while houses for rent averaged $1,950. These differentials matter for household budgeting: renters seeking more space can expect to pay roughly 19% more for houses than the overall median, while one-bedroom renters pay about 33% less.

The market has been flat on both short and longer horizons. Rents for all bedroom counts and property types remained unchanged over the last month and the last year on a rolling 30-day basis, with the local database updated daily. That stability suggests neither rapid compression nor escalation in asking rents, a contrast with volatile metro markets where monthly swings are common. For residents, steady rents reduce the risk of sudden cost shocks; for landlords, flat asking prices may pressure revenue growth absent higher occupancy or ancillary fees.

Local implications are straightforward. For renters, the median being below the national average offers breathing room relative to larger Nevada markets, but the limited pool of 109 listings means choice can be constrained, particularly for households seeking houses rather than apartments. For landlords and property managers, the higher average for houses suggests an income premium for single-family rentals, but flat rents year over year signal that raising revenue will likely depend on increasing occupancy or renovating units to command higher rents per square foot.

For county officials and housing planners, the numbers provide a snapshot for policy calibration. Low per-square-foot costs and flat rents reduce acute affordability pressure on existing tenants, but the small, static rental inventory highlights a risk of supply constraints if demand rises. Monitoring listing counts, encouraging responsible development, and coordinating with service providers on housing stability programs can help maintain affordability and choice.

For Pahrump residents, the near-term outlook is one of steadiness: rents are currently lower than the national norm and unchanged from recent periods. What comes next depends on changes in inventory and local demand; tracking listings and rental types will be the best way to know whether this market remains a bargain or begins to shift.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip