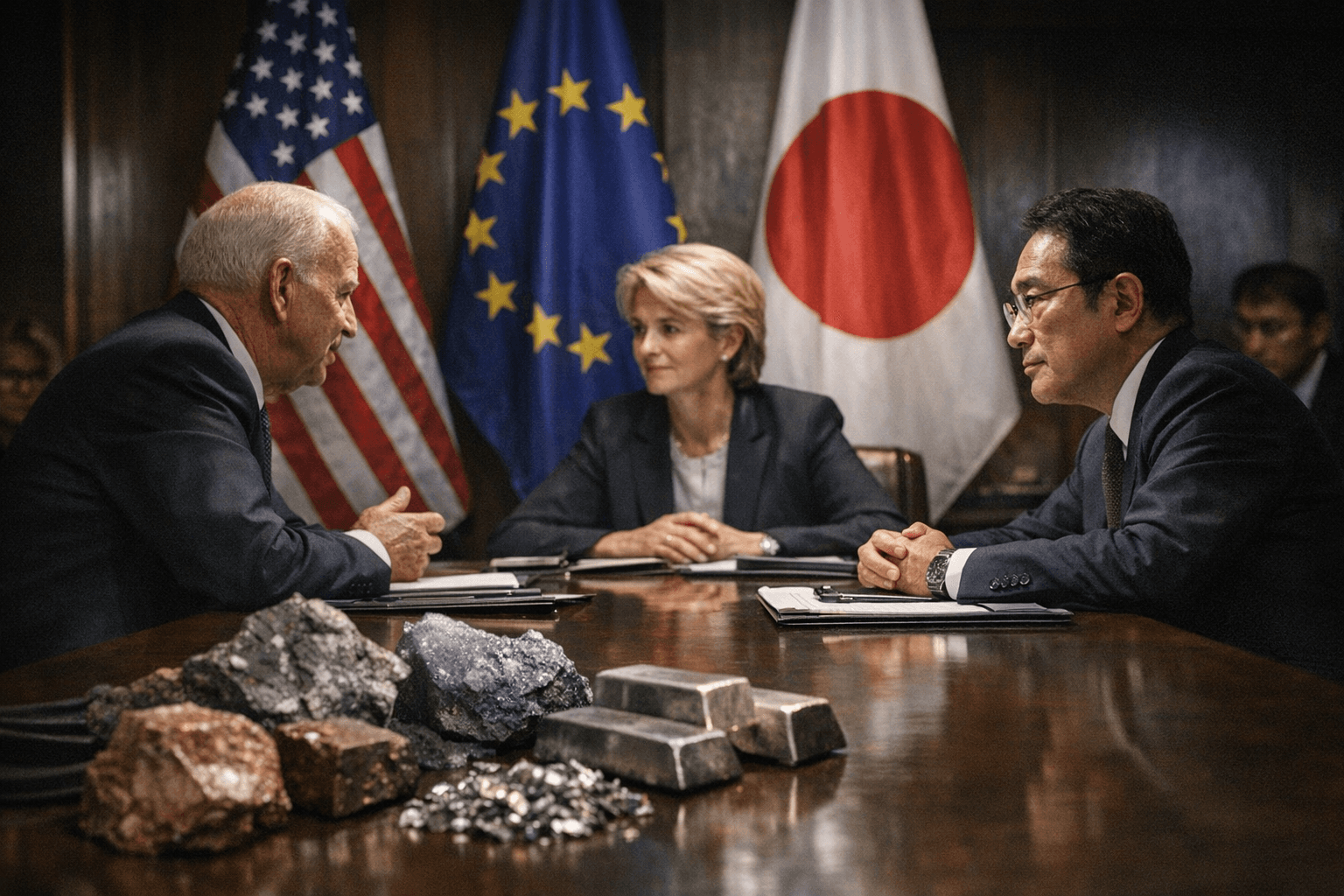

U.S., EU and Japan Forge Strategic Pact on Critical Minerals

Washington trilateral aims to secure supply chains with a rapid U.S.-EU MOU and a wider trade initiative, signaling new market interventions and geopolitical coordination.

The United States, the European Union and Japan announced a strategic partnership to strengthen resilience in critical minerals supply chains, committing to an expedited U.S.-EU memorandum of understanding and a broader trade initiative that could reshape global markets.

“The United States, the European Union and Japan are now taking significant steps towards increasing their economic security and national security by jointly enhancing resilience in critical minerals supply chains,” the joint USTR-European Commission-Japan statement said, laying out plans first revealed at a Critical Minerals Ministerial in Washington. The statement said the partners “have announced their intention to expedite cooperative efforts for a mutually beneficial Partnership, with two components,” including an MOU that USTR said will be concluded “within the next 30 days.”

Under terms sketched by officials, the MOU will target projects spanning mining, refining, processing and recycling, and will “facilitate the exchange of information on stockpiling” while promoting research and innovation, the joint statement said. The announcement builds on a U.S.-Japan framework signed Oct. 27, 2025, and signals planned outreach in fora such as the G7 and the Minerals Security Partnership.

U.S. Trade Representative Jamieson Greer framed the move in market terms, with media excerpts attributing to him: “Today’s announcement is an important signal that the world’s largest market-oriented economies are committed to developing a new paradigm for preferential trade in critical minerals.” Officials also unveiled a separate U.S.-Mexico action plan set to unfold “in the course of the next 60 days,” which Mexican and U.S. sources said will initially concentrate on a small set of minerals and explore coordinated stockpiles, shared mining and processing rules, geological mapping and rapid response tools to supply disruptions.

Media reports differ on the policy instruments under consideration. Some outlets described possible border-adjusted price floors or “price-gap” subsidies as part of a coordinated trade initiative; others used phrases such as “minimum prices.” Those formulations appeared in reporting by The Straits Times, Aa Com Tr and CNBC, which noted the administration is exploring coordinated market measures with like-minded partners. The joint press statement itself lists demand stimulation and supply diversification as core goals but does not enumerate concrete price mechanisms.

The geopolitical rationale was stark. Secretary of State Marco Rubio told 9News that “55 countries attended the talks in Washington,” and warned that supplies are “heavily concentrated in the hands of one country,” a situation he said had become “a tool of leverage in geopolitics.” Some coverage explicitly links the push to China’s market dominance; the official statement does not name any country.

Markets reacted within hours. Shares of U.S. critical-minerals companies fell sharply after the announcement, with MP Materials down about 10 percent and USA Rare Earth off roughly 12 percent, CNBC reported, reflecting investor concern about potential new pricing rules and trade distortions.

Policy and market analysts now face several open questions: which specific minerals will be prioritized, whether any agreed price mechanisms can be reconciled with World Trade Organization rules, and whether stockpiling will be informational or involve coordinated procurement. For industry, the move signals greater state involvement in raw-material markets and a potential reconfiguration of supply chains that underpin electric vehicles, telecommunications and defense — sectors that depend on rare earths and other critical minerals. USTR noted the partners will continue work in international fora and that the MOU deadline is intended to produce a rapid, tangible plan; officials and market participants will be watching whether that plan favors subsidies, trade adjustments or targeted investment to rebuild nonconcentrated capacity.

Know something we missed? Have a correction or additional information?

Submit a Tip