Wholesale Raw Pearl Costs Rise in 2026, Squeezing Retail Margins

PearlsWholesaler's mid/late February 2026 trade note flags a supply-side farm inventory sell-off while Alyapearl shows a 10–11mm freshwater 40cm necklace plunging from ~$1,000 in 2016 to $179 in 2026.

A mid/late February 2026 trade note from PearlsWholesaler foregrounds a recent supply-side sell-off of farm inventories and says it “tracks wholesale factory-level raw-pearl costs vs. retail pricing,” an inventory shock now central to retailer margins; the note itself ends with a truncated warning that “when on‑farm inv” which leaves the mechanics of that warning unfinished in the excerpt. Have you sold a similar piece? Tell us what you got.

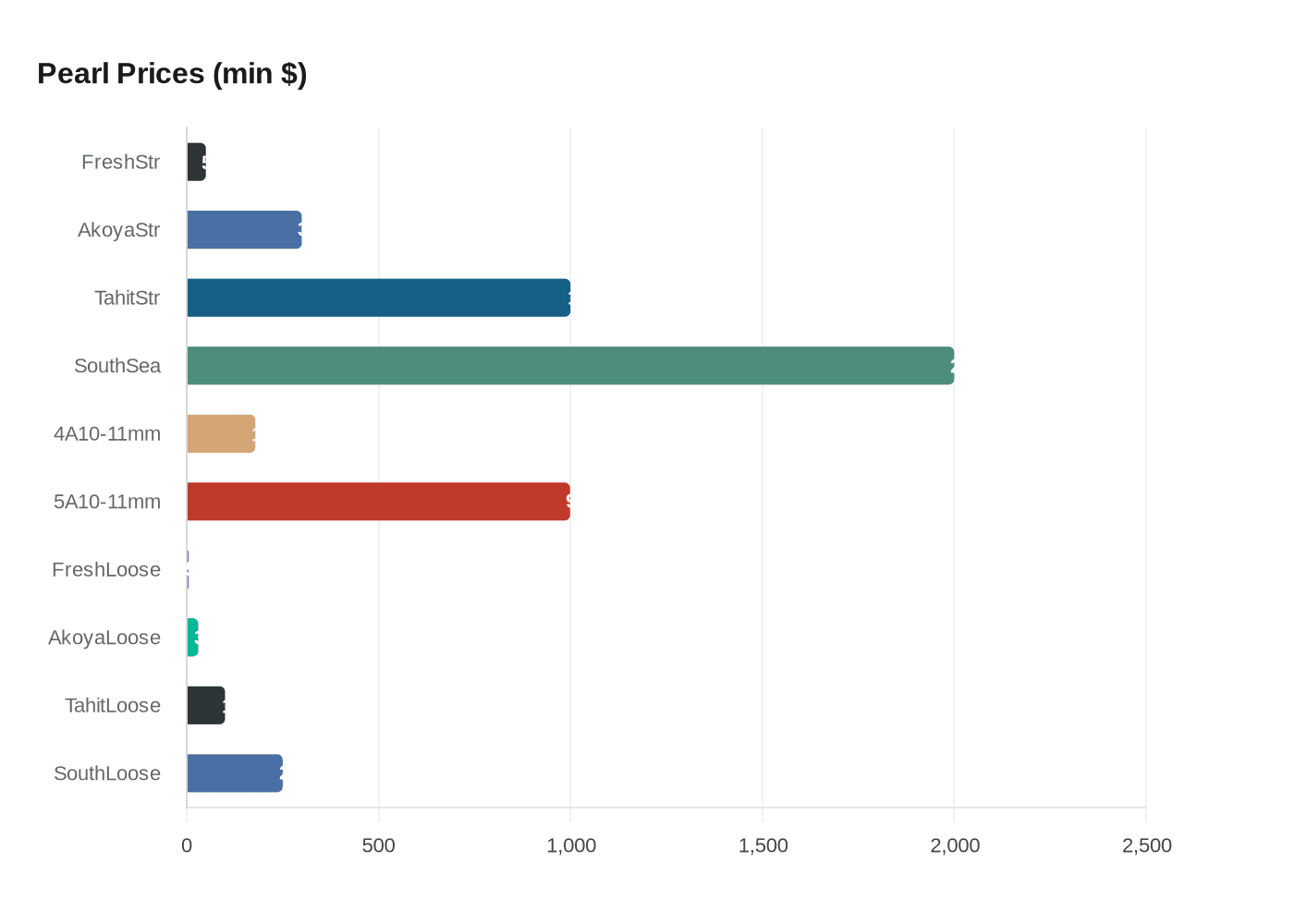

Retail pricing for the canonical freshwater strand has shifted sharply. Alyapearl’s consumer guide uses a conventional 40cm (15.5-inch) freshwater pearl necklace with a silver clasp as its benchmark and states, “Ten years back, you could spend about $1000 on a high-quality 4A-grade, 10-11mm freshwater pearl necklace. Now, in 2026, a similar 40cm necklace with stunningly large pearls can be purchased for about $179.” Alyapearl’s size-and-grade table lists 4A 10–11mm at $179 and 5A at $999, with 4A across sizes running $59 to $249 and 5A from $239 to $1,999.

At the same time the market still displays wide segmentation by origin and size. Moissanitebyaurelia’s type-by-type table prices high-quality (AAA) strands at $50–$400 for freshwater (China), $300–$3,000+ for Akoya (Japan), $1,000–$15,000+ for Tahitian (French Polynesia), and $2,000–$30,000+ for South Sea (Australia/Philippines); its loose-pearl column shows freshwater $5–$30 each, Akoya $30–$150, Tahitian $100–$600, and South Sea $250–$2,000+. Moissanitebyaurelia summarizes that “The value of a single pearl ranges from $1 to over $2,000, determined entirely by type and origin.”

Tahitian pricing noted by Pearlsonly echoes that stratification: a quality 9–10mm Tahitian strand “starts around $1,500 to $3,000,” better quality runs $4,000 to $8,000, and “exceptional strands” in 11–13mm sizes “easily blow past $10,000 to $15,000,” while single high-quality Tahitians sell for $200 to $800 apiece.

Industry-level forecasts place freshwater at the center of near-term growth. Cognitivemarketresearch’s market report excerpt states “The Global Natural Pearls Market is witnessing significant growth in the near future” and that “In 2023, the Freshwater segment accounted for noticeable share of global Natural Pearls Market and is projected to experience significant growth in the near future,” noting the report applies PESTEL and Porter frameworks to analyze regional trends and supply factors.

Secondary-market dynamics compound margin challenges for retailers and sellers. Moissanitebyaurelia advises that pawn shops “Will typically offer you $0 for the pearls and only pay for the gold clasp,” estate jewelers “Might pay 15% to 20% of the original retail price if (and only if) they are high-end Akoya or South Sea brands (like Mikimoto),” and private sale platforms can return “30-40% of retail value.” For quick authenticity checks the guide notes the “Tooth Test: Gently rub the pearl against the edge of your tooth.”

Quick fact: Alyapearl lists a 10–11mm, 4A freshwater 40cm necklace at $179 in 2026, down from about $1,000 in 2016. For retailers and buyers tracking margin pressure, verify wholesale factory-level raw-pearl cost data and the full PearlsWholesaler note to see whether the farm sell-off and factory prices altered raw-material costs across China, Japan, French Polynesia, Australia and the Philippines.

Know something we missed? Have a correction or additional information?

Submit a Tip