Copper soars above $14,000 amid volatile, China-driven speculative rally

LME three-month copper hit intraday records as speculative flows from China and supply fears drove extreme volatility, raising questions about demand and market stability.

Copper futures erupted in a volatile session on Jan. 29, 2026, with benchmark London Metal Exchange three-month contracts racing to intraday records before paring much of their gains. Market reports recorded a cluster of highs: Investing said the LME contract "surged as much as 7.9% to $14,125 a metric ton during Asian trading before trimming," Economies.com reported a peak of $14,268 and a later level of $14,147 by 13:15 GMT, while Reuters and The Globe and Mail cited an intraday high of $14,527.50. In official open-outcry trading Economies.com recorded a rise to $13,950.

The Shanghai Futures Exchange amplified the move. The most-active SHFE contract hit an intraday record of 110,970 yuan and closed the daytime session up 6.7% at 109,110 yuan, about $15,708.77, according to Economies.com and The Globe and Mail. Trading volumes surged across Asian venues, with market commentators pointing to large leveraged positioning and heightened activity in China as the immediate catalyst.

Analysts and reporters framed the spike as driven more by financial flows than by a sudden tightening in physical markets. Reuters described the move as "driven largely by speculative buying, particularly from China, and by concerns around mine disruptions." Neil Welsh of Britannia Global Markets captured the market psychology in a research note: "Copper recorded its biggest daily gain in years, driven by intense speculative activity from bullish investors in China." He added that "Investors are flowing into base metals on expectations of stronger economic growth in the United States, and increased global spending on data centers, robotics, and energy infrastructure."

Yet key physical indicators painted a different picture. The Yangshan copper premium, a proxy for Chinese spot import demand, fell to $20 per ton on Wednesday, its lowest level since July 2024 and markedly down from $55 in December. Economies.com also noted that exchange-monitored global inventories remain elevated, particularly in the United States. Several outlets warned that the divergence between record futures prices and weak physical demand raises the risk that the rally is not fully supported by current supply-and-demand fundamentals and could curb real industrial buying.

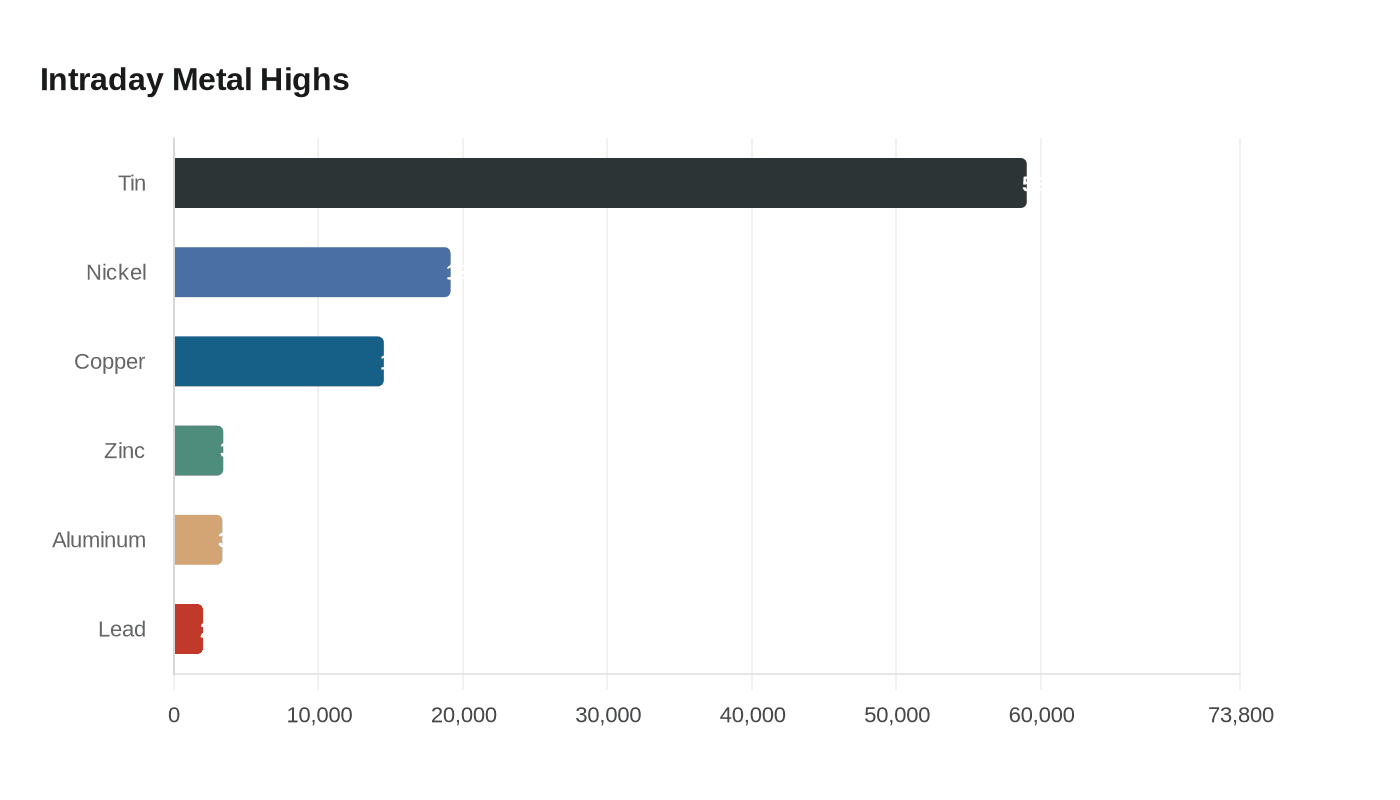

The price spikes rippled across other base metals. The Globe and Mail reported tin touched an intraday record of $59,040 a ton before retreating to $54,540, LME aluminium climbed to $3,356 then fell back to $3,222, zinc strengthened to $3,412, nickel surged to an intraday $19,150 before easing to $18,355, and lead dipped to $2,012.

For markets and policymakers the episode underlines two tensions. First, pass-through from commodity spikes to consumer inflation is a risk if elevated metals prices persist, complicating central bank trajectories even as dollar weakness and geopolitical tensions encourage flows into hard assets. The Globe and Mail highlighted a weaker U.S. dollar index near multi-year lows as supportive of the move. Second, the event spotlights structural demand drivers: copper remains essential to electrification and infrastructure and China consumes roughly half of global output, but near-term industrial buyers may balk at the higher nominal prices.

With intraday whipsaws and conflicting settlement figures reported across outlets, traders and regulators will watch whether the surge induces position unwinds or prompts a return to fundamentals. If the rally is sustained by financial positioning rather than stronger physical consumption, prices could reverse sharply once industrial demand reasserts itself.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip