Global gemstone market to surge to $72.8B by 2036, FMI says

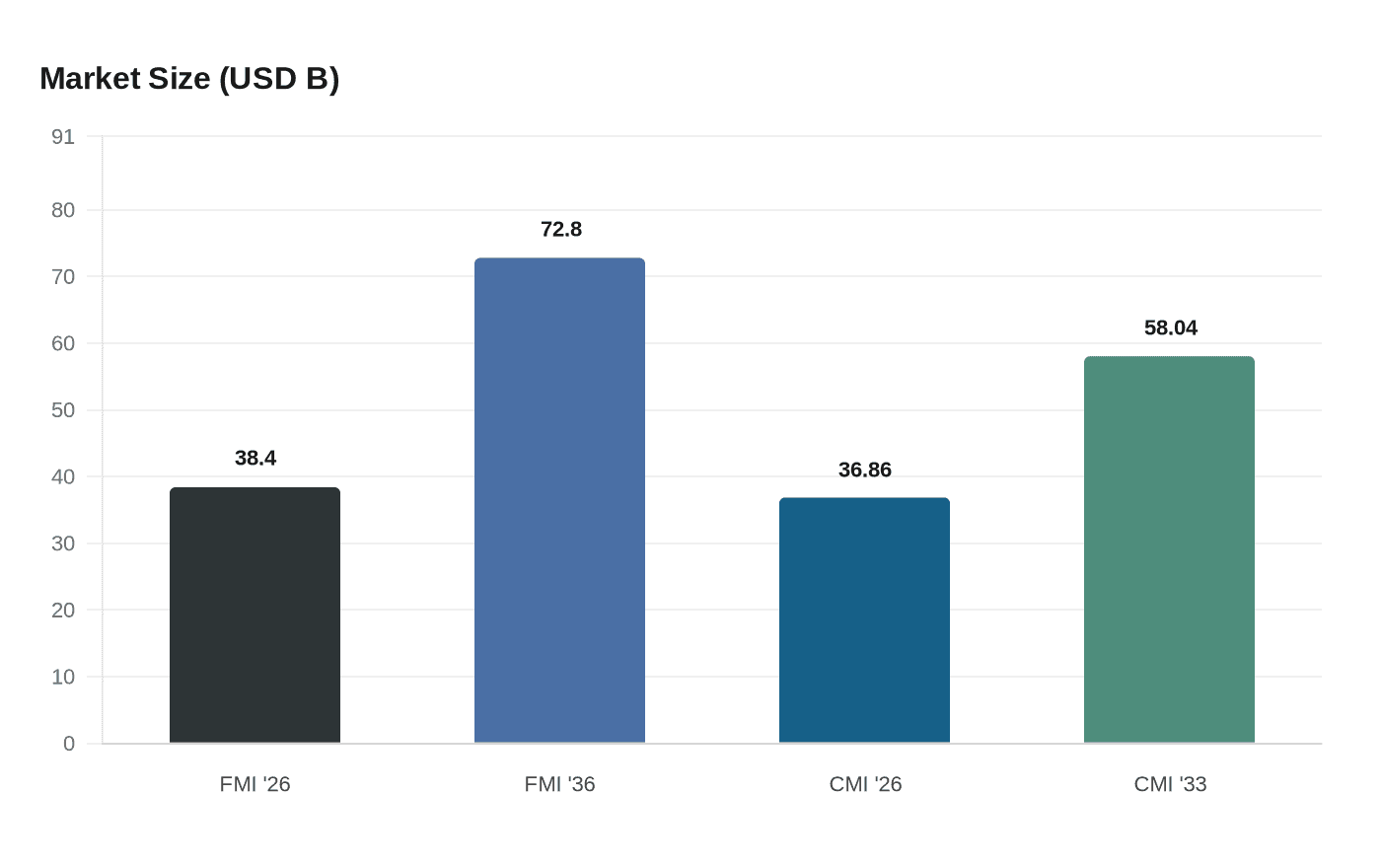

Future Market Insights projects the global gemstone market will rise from USD 38.4 billion in 2026 to USD 72.8 billion by 2036, a 6.6% CAGR per an OpenPR summary of FMI's 10-year forecast.

Future Market Insights, in a 10-year forecast summarized by OpenPR, projects the global gemstones market will expand from USD 38.4 billion in 2026 to USD 72.8 billion by 2036, registering a compound annual growth rate of 6.6%. That projection, attributed to FMI and published with a Feb 14, 2026 date in the assignment metadata, frames provenance verification, ethical sourcing and expanding lab-grown stones as the growth levers driving value more than volume. Have you sold a similar piece? Tell us what you got.

A competing estimate from CoherentMarketInsights, published Jan 07, 2026 with report code CMI9182, offers a shorter horizon and a different endpoint: USD 36.86 billion in 2026 growing to USD 58.04 billion by 2033 at a 6.7% CAGR. The Coherent snapshot also flags North America as a fast-growth region with a 21.5% share in 2026, illustrating how forecast window and geographic scope produce divergent headline numbers across industry reports.

Futuremarketinsights’ UK-focused page, dated Jan 16, 2026 and authored by Rahul Pandita in a 250-page analysis, projects UK gemstone sales of USD 4.1 billion in 2026 rising to USD 8.1 billion by 2036 at a 6.9% CAGR. That UK report identifies England as the leading regional growth area with a 7.6% CAGR, lists emerald as the leading product at 30.0% share in the UK, and profiles companies including Gem Diamonds Limited, Kiran Gems Private Limited, Gemfields Group Limited, PJSC ALROSA and Anglo American plc.

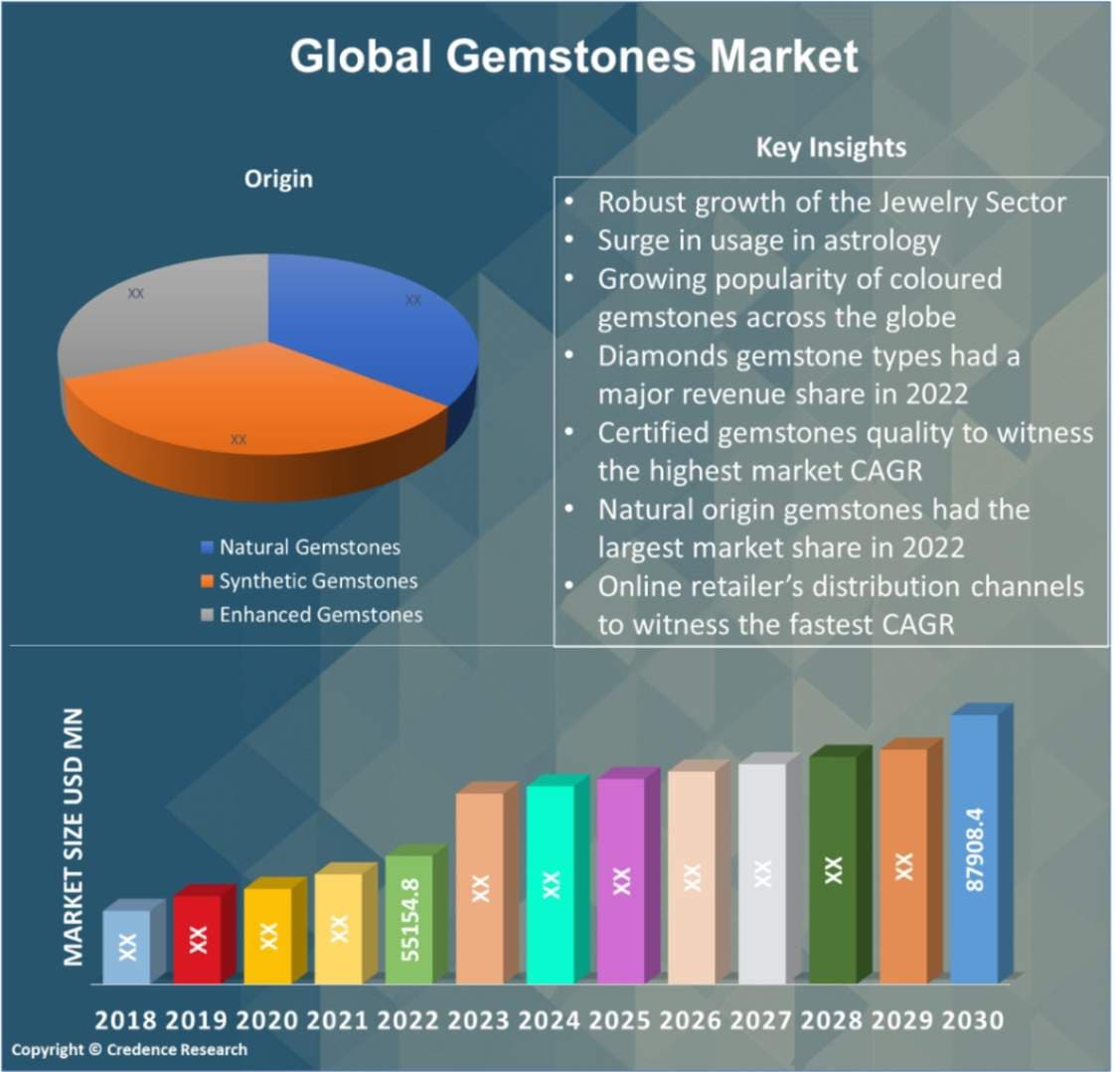

Segmentation differs by geography. OpenPR’s FMI summary states Jewelry and Ornaments accounts for roughly 78% of global demand and that the emerald segment leads globally with approximately 32.0% market share. Futuremarketinsights’ UK page, by contrast, places Jewelry and Ornaments at 55.0% of UK demand and emeralds at 30.0% share, underscoring regional market-mix differences.

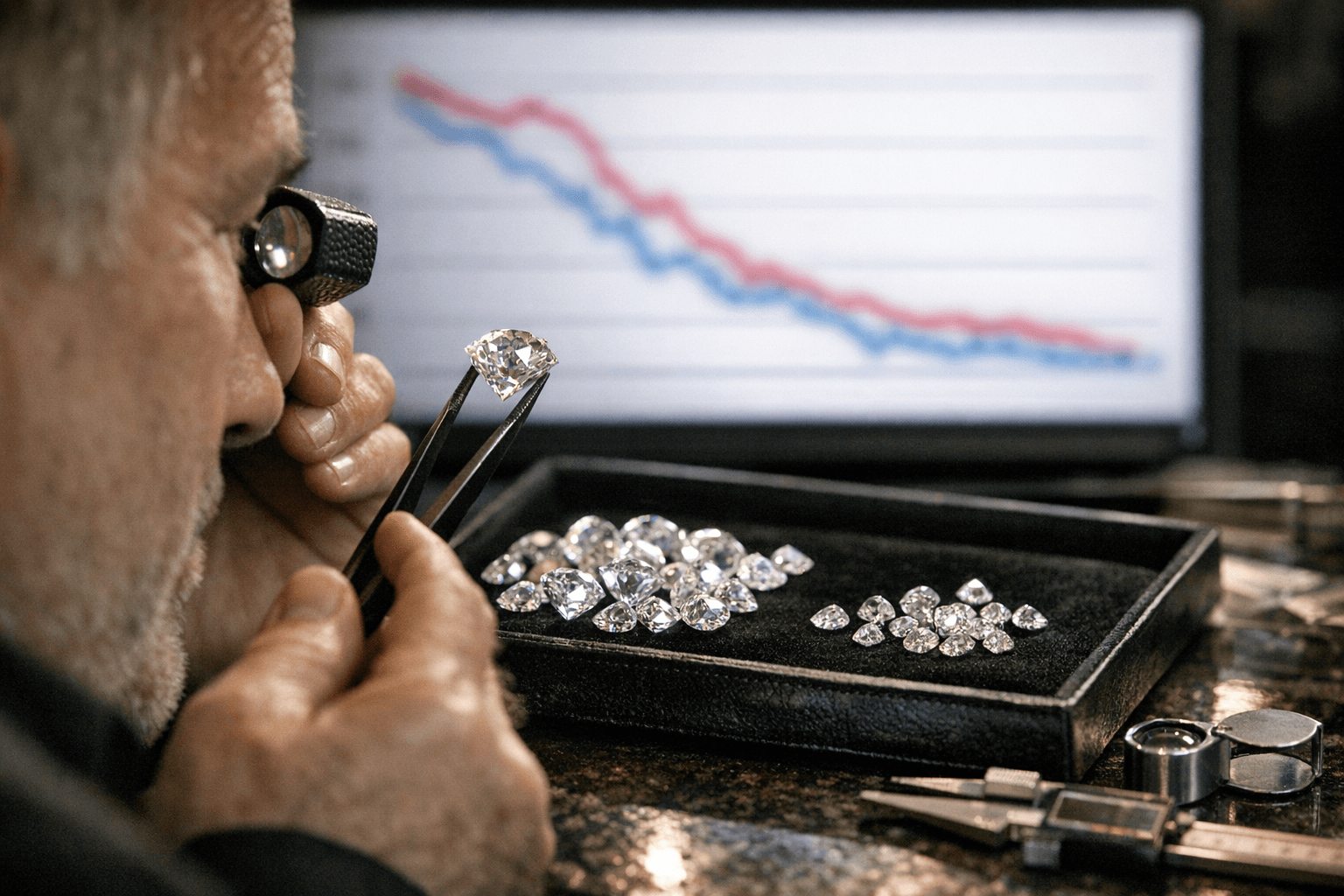

Market drivers cited across the reports are specific: growing demand for traceable and ethically sourced gemstones, premiumization of natural high-value assets, and expanding adoption of lab-grown diamonds in accessible luxury. OpenPR preserves the phrase "Provenance Premium" as a market driver, and LisbonGemex analyzes that "In 2026, value is not created by volume, but by selection, disclosure, and context," noting Millennial and Gen Z buyers’ appetite for expressive colour and provenance.

Technology and sustainability innovations given explicit mention include provenance verification technologies such as blockchain tracking and forensic tagging, nano-engraving to create "tamper-proof digital histories for each stone," AI and machine learning to optimize synthetic growth, and improvements in CVD reactors alongside closed-loop recycling and water-reduction in hydrothermal methods.

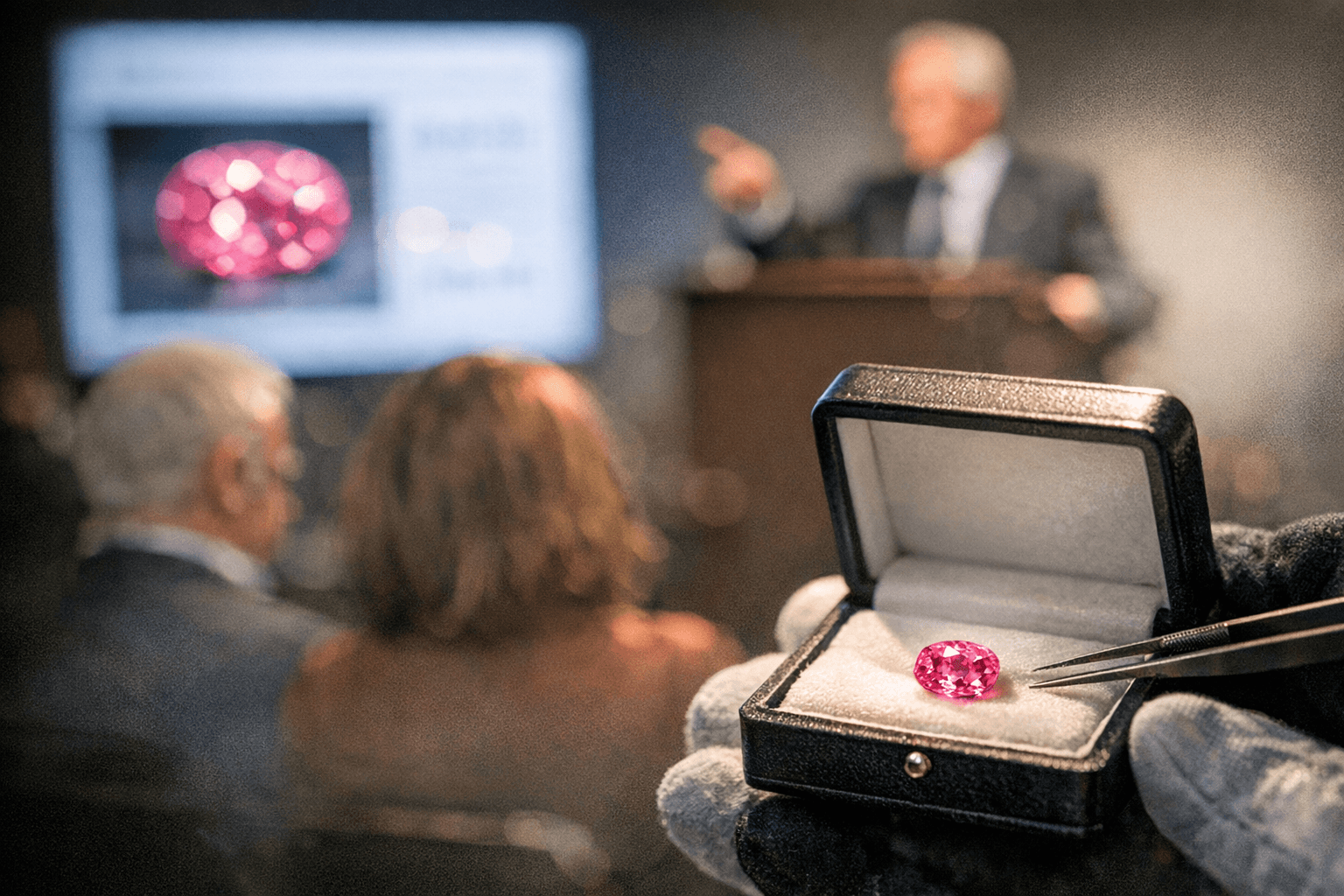

Opportunities and risks are clear and quantifiable in the notes: provenance verification and positioning coloured gemstones as investment-grade are cited as growth opportunities, while supply-demand imbalances in rough stones, inventory-management pressure across midstream players, and rising compliance and sustainability costs are cited as concrete challenges. LisbonGemex highlights auction liquidity for rubies, sapphires and emeralds and rising collector demand for alexandrite, spinel, Paraíba tourmaline and rare sapphire colour variants.

Practical checklist for buyers and owners: verify provenance using blockchain or nano-engraving records, benchmark against auction results for rubies, sapphires and emeralds, and note that Jewelry and Ornaments accounts for roughly 78% of global demand per FMI. If you sold a comparable stone, share the result so we can compare market experience.

Know something we missed? Have a correction or additional information?

Submit a Tip