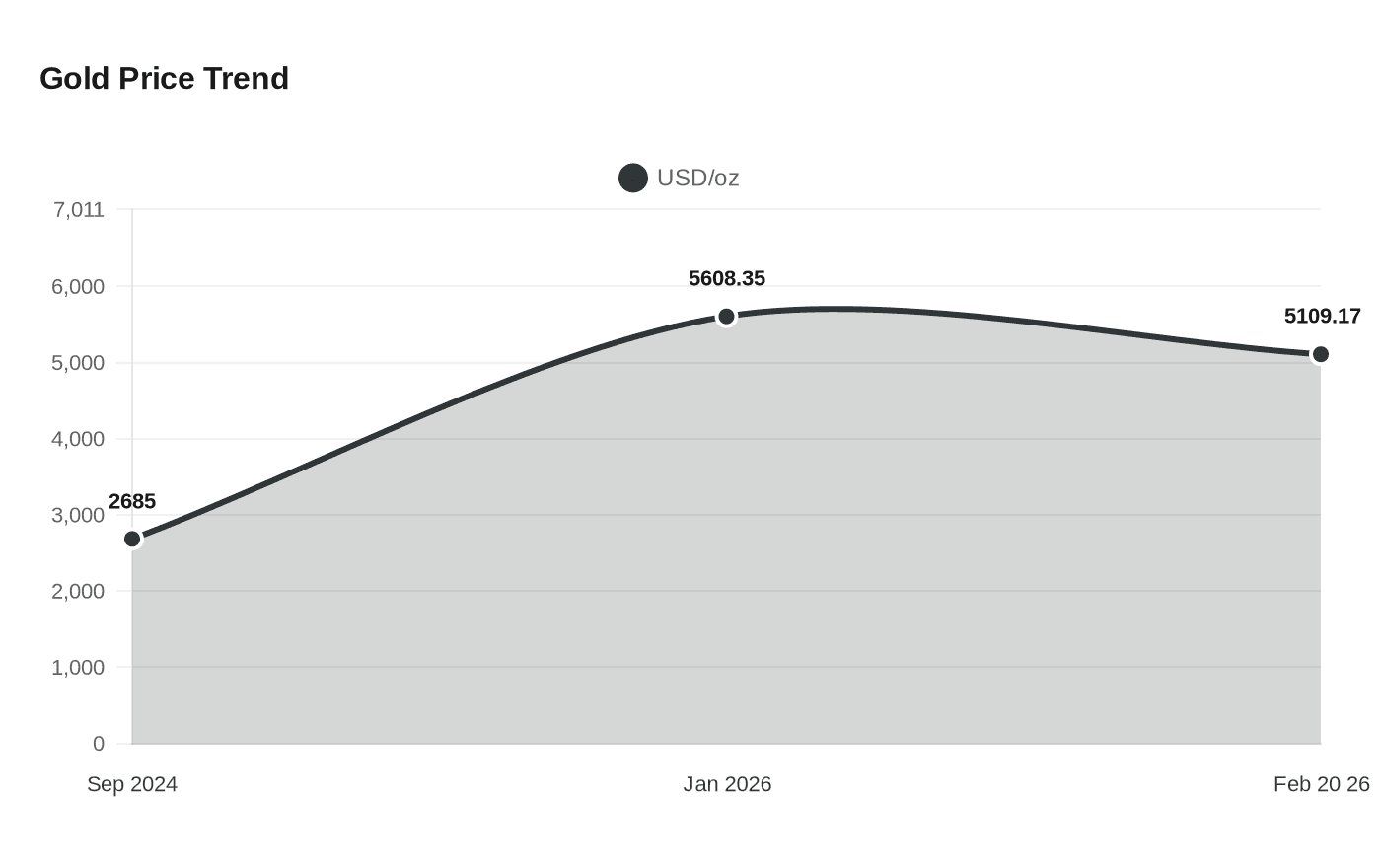

Gold Nears January Record, Trades Around $5,109/oz After 74% Yearly Surge

Gold has climbed about 74.14% year over year and was trading around US$5,109 per troy ounce, which places the metal close to its January peak and lifts the raw gold price to about $163.92 per gram.

Gold's rally has become the dominant story for anyone who works with metal. "Gold rose to 5,109.17 USD/t.oz on February 20, 2026, up 2.23% from the previous day," TradingEconomics reported, a move that contributes to a 74.14% year‑over‑year gain and a one‑month rise of 5.77% in the CFD that tracks the benchmark market. At that level the simple arithmetic of supply and craft matters: Markets / Business Insider lists "Gold Price Per 1 Gram | 163.92 USD" and "Gold Price Per 1 Kilogram | 163920.58 USD," figures that directly recalibrate the material cost base for rings, chains, and bespoke commissions.

The market snapshot is a mosaic of near‑concurrent feeds rather than a single tick. USAGOLD's Daily Market Report recorded "Gold spot price is trading at $5,062.00 per ounce, up $64.60 (+1.29%) on the day" for February 20, 2026, while USAGOLD's live panel shows "Current Price $5,107.46" and Markets / Business Insider printed 5,098.50 USD/troy ounce at 2/21/26 07:30 AM. TradingEconomics explicitly frames its number as a CFD read; BullionVault notes its "live gold price data [is] processed about every 10 seconds," which helps explain small divergences between exchanges, instruments, and timestamps. TradingEconomics also records that "Historically, Gold reached an all time high of 5608.35 in January of 2026" even as USAGOLD lists a "Yearly High $5,598.58."

Geopolitics and sovereign buying remain the levers behind this upward climb. USAGOLD wrote that "The dominant catalyst driving gold spot price today February 20, 2026 remains President Trump's 10-15 day ultimatum on Iran's nuclear program," language that frames the immediate safe‑haven impulse. At the same time, USAGOLD cites Goldman Sachs on "re-accelerating sovereign accumulation in 2026 following three consecutive years of 1,200-plus-tonne annual purchases," a structural demand signal matched in TradingEconomics' reserve table where the United States holds 8,133.46 tonnes and China 2,306.30 tonnes as of late 2025.

The latest surge sits on a clear historical arc. APMEX catalogued earlier policy turns and price milestones, writing "A new ceiling was established on September 26th, 2024, when gold reached $2,685, one week after the FOMC announced a 50-basis point cut ... This marked the first rate cut since 2020, driving gold prices upwards once again." APMEX further recorded that prices "then began an incredible climb to close out 2024 and kick off 2025 ... caused gold to reach another high of $3,004.71 on March 14th." BullionVault reminds jewellers and buyers that gold has repeatedly reset records in times of uncertainty, noting past breaks above $2,000 per ounce in August 2020 and fresh currency‑denominated highs after February 2022.

For gold jewellery makers and collectors the arithmetic matters: with Markets BI at $163.92 per gram and USAGOLD showing a YTD change of +$789.35 (+18.28%), margins, premiums, and inventory decisions will be driven by raw metal moves as much as design. Physical premium data was not available in USAGOLD's daily panel, which leaves dealers gauging spreads against these live benchmarks and the evolving cost of fabrication. Silver is also moving, with USAGOLD listing $80.62 per ounce and a compressed gold/silver ratio of 62.8, a secondary signal for designers who use mixed‑metal accents.

Looking ahead, TradingEconomics projects "Gold is expected to trade at 5152.96 USD/t oz. by the end of this quarter" and estimates it "to trade at 5536.81 in 12 months time," forecasts that, together with a Fed funds rate of 3.75% and January inflation at 2.40%, suggest raw‑material pressure will persist. For the jewellery trade that means recalibrating quotes, rethinking stock holdings, and pricing craftsmanship against a market where sovereign accumulation and geopolitical tension are now price inputs as much as karat and finish.

Know something we missed? Have a correction or additional information?

Submit a Tip