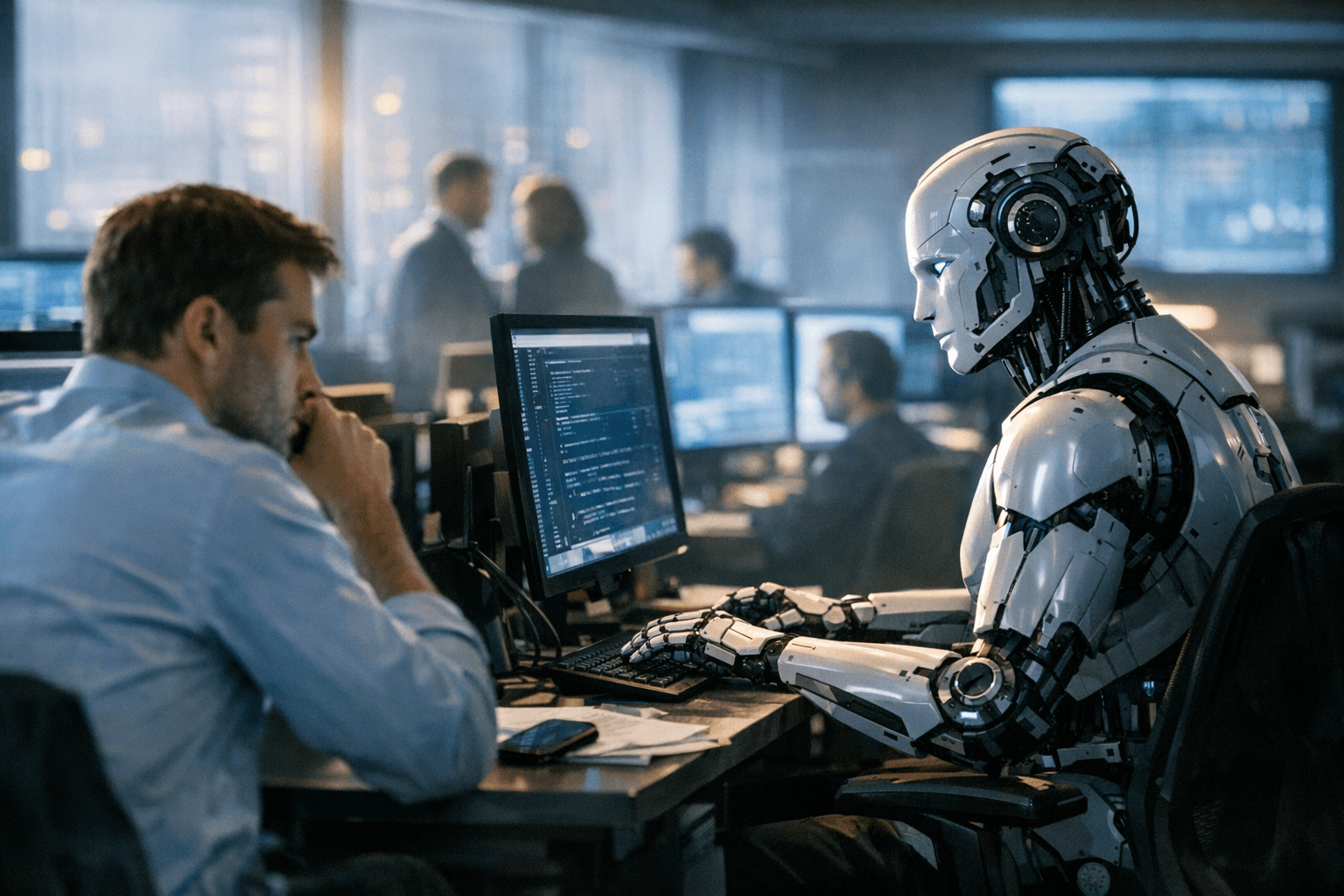

Goldman Sachs Says Generative AI Could Boost Productivity, Limit Headcount Growth

Goldman CEO David Solomon called the macro backdrop "very good broadly" after a UBS conference; a subscriber-only Business Insider roundup says CEOs expect generative AI to boost productivity and keep head count from growing.

Top executives across Wall Street are signaling a shift that could reshape hiring at Goldman Sachs and its peers: generative AI, they say, can lift productivity while limiting the need for head-count growth. A subscriber-only Business Insider roundup published online "Feb. 14–1" compiled comments from leaders including David Solomon, Jamie Dimon, Brian Moynihan and Jane Fraser that framed AI as a tool to "boost productivity, replace some roles, and keep head count from growing."

David Solomon reinforced a cautious optimism about the market at a UBS-hosted conference on Feb. 15, 2026, telling investors the macro environment facing investors is "very good broadly." Solomon's remark sits alongside the wider executive theme that banks want to "do more with fewer people, leaning on AI to boost productivity and absorb additional work," a line that appeared in the Business Insider compilation.

Citigroup CEO Jane Fraser provided one of the clearest operational examples cited in the roundup, saying AI is already helping Citi's customer-service teams resolve client inquiries faster, enabling wealth advisors to provide more personalized advice, and that the firm plans to launch an agent-based AI pilot to tackle more complex tasks. Fraser's description points to specific workflow changes staff at client-service desks and wealth management teams can expect in the months ahead.

At Wells Fargo, CEO Charles Scharf quantified the personnel impact: "Wells Fargo has already shrunk its head count more than 25% since the second quarter of 2020," he said during the company's fourth-quarter earnings call on Wednesday, adding that efficiency remains an "ongoing focus" for Wells Fargo. That 25%-plus reduction since Q2 2020 provides a concrete benchmark for how aggressively some banks have already pared payrolls while pursuing productivity gains.

The CEO comments appear against mixed macro signals. Bank of America raised its 2026 GDP forecast from 2.6% to 2.8%, and CEO Brian Moynihan told Maria Bartiromo in a Davos interview, "So we moved from 2.6% growth to 2.8%, which is well above the general consensus," pointing to stronger client activity and early January spending as supporting resilience. At the same time, The New York Times' DealBook noted that despite "blowout results," leaders such as Jamie Dimon have warned of threats ahead, with Dimon saying he is worried about finding a "cockroach" or two in the financial system.

For Goldman Sachs employees and recruiters, the immediate takeaway is procedural: Solomon's "very good broadly" assessment sits alongside an industry trend documented by Business Insider toward squeezing more output from technology and process changes rather than broad hiring. That combination suggests internal pushes to scale AI pilots and automate routine tasks could limit head-count expansion even as market activity rebounds.

Know something we missed? Have a correction or additional information?

Submit a Tip