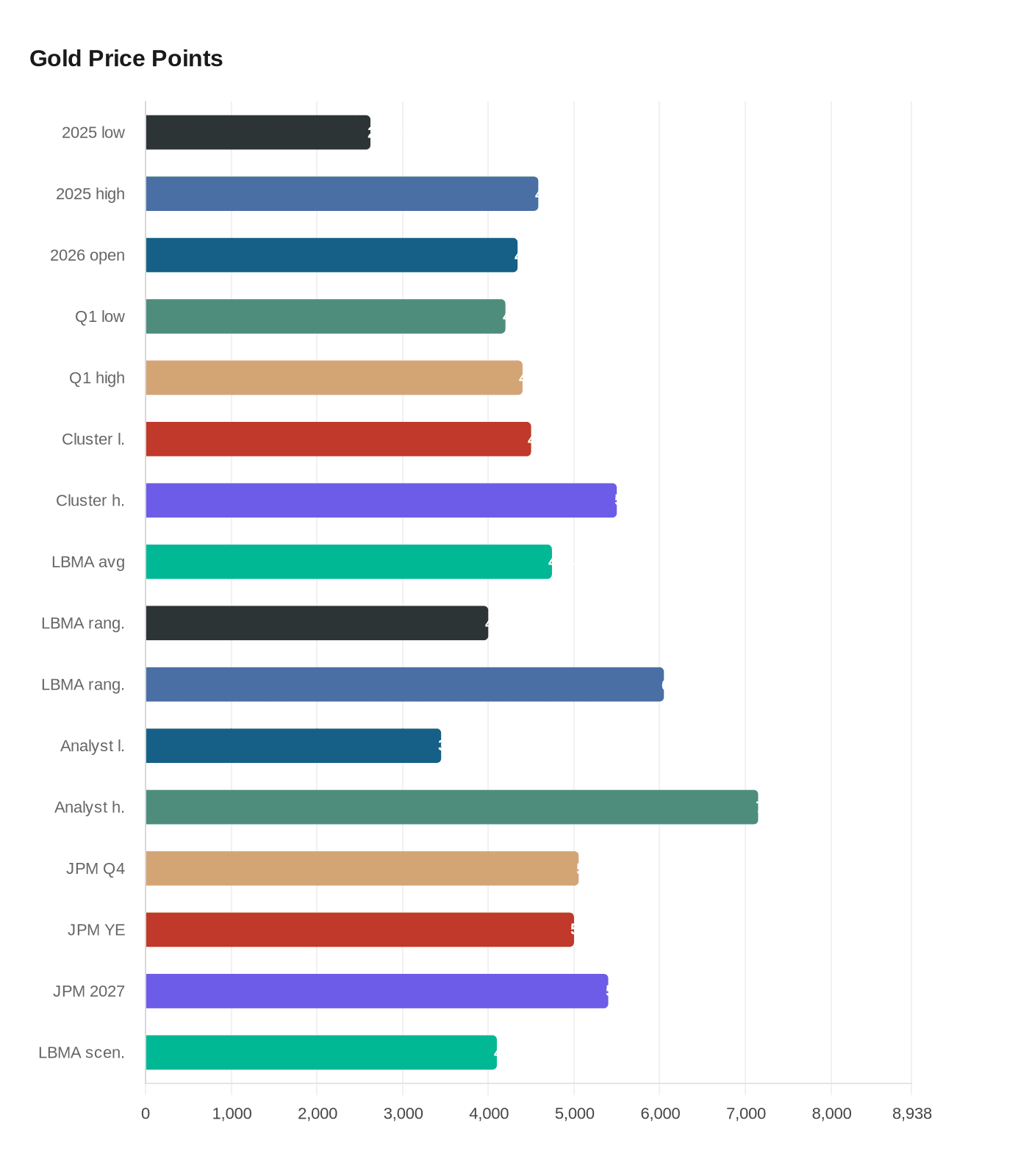

Institutional Forecasts See Gold Averaging Between $4,500 and $5,500/oz in 2026

Scottsdale’s Feb 18 update shows institutional forecasts clustering at $4,500–$5,500/oz for 2026, with the LBMA survey averaging $4,742 and gold opening 2026 at $4,342/oz.

Scottsdale Bullion & Coin updated its 2026 gold-price forecast page on February 18, 2026, and reports that many institutional forecasts target an average 2026 range of roughly $4,500–$5,500/oz. That cluster is echoed by the LBMA 2026 survey, which Ahasignals reports as showing an average forecast of $4,742 and a point-forecast range from $4,000–$6,050, with individual analyst lows and highs stretching as far as $3,450–$7,150.

The market enters that forecast window on a foundation of exceptional 2025 volatility. Discoveryalert records that gold opened 2026 at $4,342 per ounce and that the 2025 annual range ran from $2,625 to $4,584, creating a 74.7% percentage swing. Discoveryalert also notes COMEX contract volume exceeded 50 million contracts during 2025, matching levels last seen during the COVID-19 market panic of 2020, a raw indicator of sustained institutional participation across speculative and hedging strategies.

Bank-by-bank calls span the cluster and the extremes. Ahasignals cites Goldman Sachs at $4,000 by mid-2026, J.P. Morgan at $5,000 by year-end 2026, and Bank of America’s emphasis that supply tightening will drive mining-company EBITDA growth of 41%. J.P. Morgan’s research is also quoted in the supplied material as forecasting prices to average $5,055/oz by the final quarter of 2026 and to rise toward $5,400/oz by the end of 2027; Natasha Kaneva of J.P. Morgan further states, “While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted. The long-term trend of official reserve and investor diversification into gold has further to run. We expect gold demand to push prices toward $5,000/oz by year-end 2026.”

Supply and official-demand signals underpin many of the bullish calls. Ahasignals reports global central bank gold purchases reached 634 tonnes in 2025 through November, led by the National Bank of Poland and Reserve Bank of India, continuing the purchasing trend since 2022. The LBMA commentary included in the survey text anticipates “heightened geopolitical risk and strong safe-haven demand,” and offers a scenario forecast that includes an annual high at USD $7,150/oz, an annual average around USD $6,050/oz, and an annual low near USD $4,100/oz.

Not all analysis trusts the smoothness of the climb. Ahasignals warns that “directional consensus is highly uniform toward bullish” yet its Consensus Thermometer finds “dangerous fragility in this bullish consensus,” characterizing the market as showing “magnitude dispersion with directional uniformity.” Discoveryalert expects seasonal consolidation in Q1, giving a Q1 2026 target range of $4,200–$4,400 and noting a 3.1% decline from the January opening at the range midpoint.

For jewelers and designers who price raw-gold inventory and plan collections, the practical signal is concrete: major-bank central estimates cluster in the mid-$4,000s to mid-$5,000s while scenario tails extend much higher, and supply-side and central-bank flows remain active. Watch central-bank purchases, COMEX volumes, and the quarterly path—Q1 guidance at $4,200–$4,400 and LBMA survey midpoint $4,742—for near-term pressure on margins and retail pricing as 2026 unfolds.

Know something we missed? Have a correction or additional information?

Submit a Tip