Luxury Resale Boom Redefines Gold Jewelry and Watch Collecting in 2026

Van Cleef & Arpels' Sweet Alhambra bracelet retailed at $1,540 before taxes in December and listed for $2,020 on Rebag, emblematic of resale where Van Cleef held 112% value in 2025.

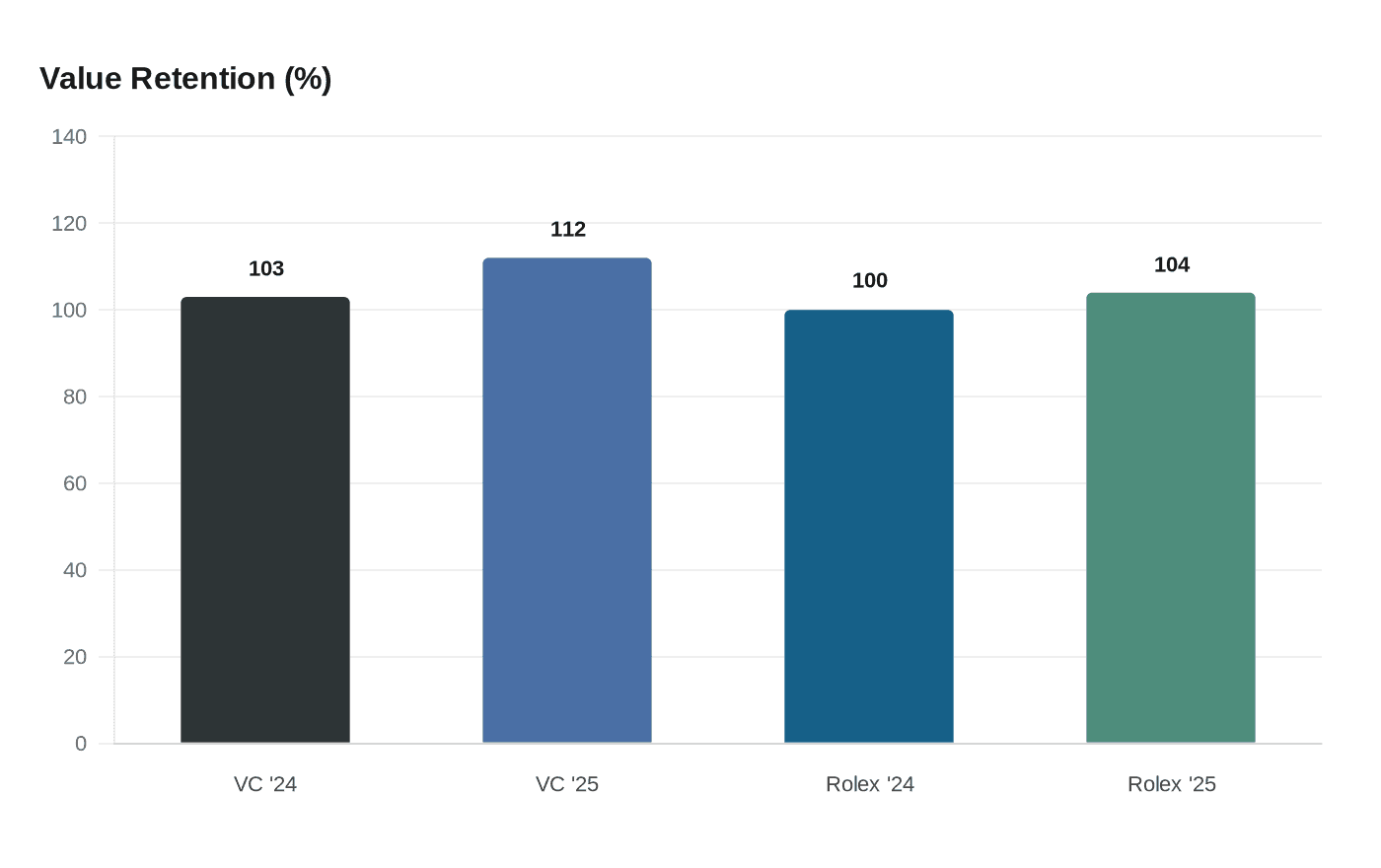

Van Cleef & Arpels emerged as a clear case study in the shifting ledger of luxury: Rebag’s 2025 data show Van Cleef styles holding 112% of their value on average, up 9% from 2024, and a Sweet Alhambra 18k gold mother-of-pearl bracelet that retailed for $1,540 before taxes as of December was listed for $2,020 on Rebag. PrismNews describes a “pronounced expansion in the luxury resale market that is reshaping fine-jewelry and watch collecting in early 2026,” and that expansion is visible in handfuls of brand-level metrics.

Market-sizing remains contested but large. A LinkedIn post places the global resale luxury market at $38.3 billion in 2025 and frames the shift with the line “Luxury is no longer just bought, it’s traded.” Separately, a Boston Consulting Group and Vestiaire Collective October report projects the resale market could reach as much as $360 billion by 2030, a projection that underpins industry expectations for rapid growth across platforms and categories.

Watches continue to lead the secondhand ascent. Rebag’s 2025 report classifies Rolex as a resale “unicorn,” with 104% value retention in 2025, a 4% jump from 2024. LinkedIn also claims “Rolex resale prices are up 20% YoY for iconic references,” a different metric but a consistent signal that certain watch references remain scarce and desirable. Fashionbi and platform commentary single out Rolex, Patek Philippe and Audemars Piguet as models whose limited production and recognizable design language give them commodity-like qualities that support resale.

Economic pressure and policy nudges have hardened demand. Charles Gorra, CEO and founder of Rebag, says, “Rising primary market prices pushed more consumers to the secondary market, reaffirming its stability as a trusted and lucrative channel for collectors.” Business Insider coverage of Rebag’s reporting notes that tariffs and rising retail prices in 2025 pushed buyers toward pre-owned, and that bracelets and watches were among the most popular pre-owned items that year.

On the ground, Miami’s Gray and Sons Jewelers stands “at the intersection of heritage craftsmanship and modern market demand,” and industry voices have reframed authentication and provenance as market infrastructure. Northpennnow places “Authentication as the New Luxury Standard” at the center of resale’s legitimacy, arguing that “Prestige today is defined by knowledge, responsibility, and lasting beauty.” LinkedIn adds that “Consumers want brand verified resale,” while Romestation observes that investor buyers such as those targeting Hermès Kelly bags or Patek Philippe watches often keep spreadsheets to track value.

Platform dynamics and limits complicate the story. LinkedIn flags the profitability of platforms like Vinted and a ca. 10% apparel market share that could grow, while Fashionbi cautions resale is not a universal fix for overproduction and instead “exposes a clear hierarchy of value” that privileges durable, controlled-scarcity items. The near-term conclusion is pragmatic: authentication, brand-verified channels and platform economics will determine which gold jewelry and watches trade above retail, which hold steady, and which remain niche curiosities as resale becomes a permanent stratum of the luxury economy.

Know something we missed? Have a correction or additional information?

Submit a Tip