Natural Diamond Jewellery Sales Grow 2.1% at Specialty Jewellers

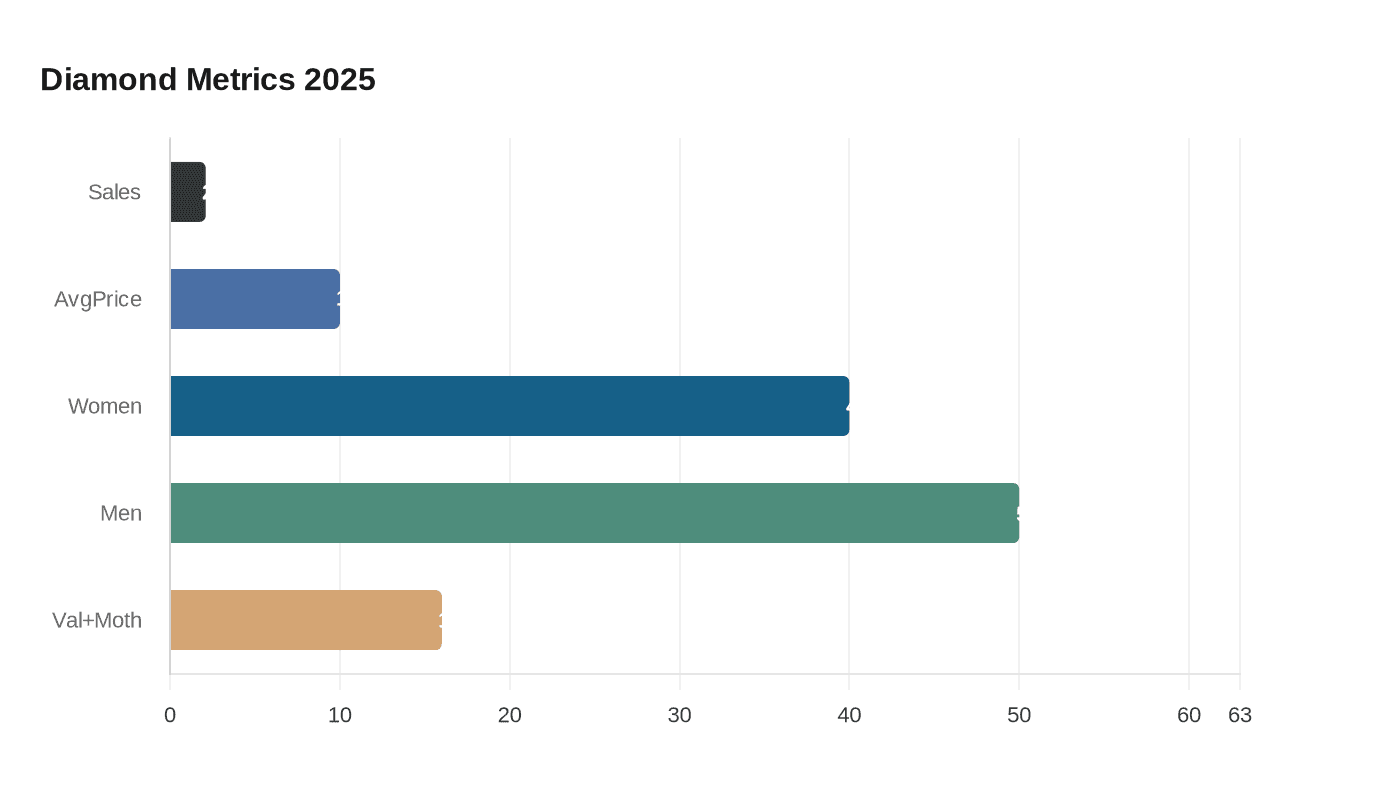

The Natural Diamond Council said speciality jeweller sales of natural-diamond jewellery rose 2.1% and the average price climbed roughly 10% in 2025.

The Natural Diamond Council reported that speciality jeweller sales of natural-diamond jewellery grew 2.1%, while the average price of natural diamond jewellery increased by roughly 10% in 2025. The figures appear in the council’s "Natural Diamond Trends: A 2025 Overview," which draws on the De Beers‑commissioned US Natural Diamond Tracker Study 2025 conducted by Ipsos.

The council cites consumer intent from the Ipsos tracker as a key demand driver: more than 40% of women and 50% of men anticipated to purchase or receive natural diamond jewellery in the next 24 months. That level of intent helps explain why average prices moved higher in 2025 even as unit growth at speciality jewellers remained modest at 2.1%.

Seasonal buying remains concentrated. A republished version of the release notes Valentine’s Day and Mother’s Day together account for 16% of annual sales, and the council’s copy cheerfully declares, "Valentine's Day is expected to be sparkly this year!" For retailers, that concentration implies inventory and display strategies that favour high-impact pieces for those two trading windows.

Younger cohorts are shaping what arrives in-store. The republished text highlights Gen Z and Millennials as the groups driving demand for unique and personalized diamond jewellery, while round brilliant shapes retain their dominance for engagement rings. Those twin trends - personalized design and proven classic cuts - help reconcile a marketplace where mix and product assortment can push average transaction values up even without dramatic increases in footfall.

The release includes a broader brand narrative as well. "Natural diamonds have been around for billions of years and adored by people for millennia. Formed by time. carried by nature. chosen to mark life's most profound moments. Not only are they here to stay, but the trend is for iconic natural diamonds that will capture attention, win hearts, and help us express ourselves with authenticity," adds Amber Pepper.

The council frames the data as an outlook as much as a report, projecting that demand for natural diamonds will continue to grow over the next two years. The release ties that expectation to the Ipsos findings but stops short of publishing sampling details on the tracker; the press material does not include sample size, fieldwork dates, or a clear market definition for the 2.1% sales figure. Similarly, the 10% rise in average price is presented as a 2025 change in the council’s text while a republished version describes it as "projected," leaving the precise measurement window and drivers - carat-weight mix, retail markdowns, or assortment shifts - unspecified in the material provided.

If the council’s numbers hold, speciality jewellers will be selling a pricier mix to a cohort that prizes personalization and provenance, with Valentine’s Day and Mother’s Day concentrating a sizable share of annual revenue.

Know something we missed? Have a correction or additional information?

Submit a Tip