QatarEnergy signs 27-year LNG deal to supply Japan’s JERA with 3.0 MTPA

QatarEnergy and JERA agreed a 27-year LNG sale supplying roughly 3.0 MTPA to Japan, a long-term pact that reinforces energy security and underpins Qatar’s export push.

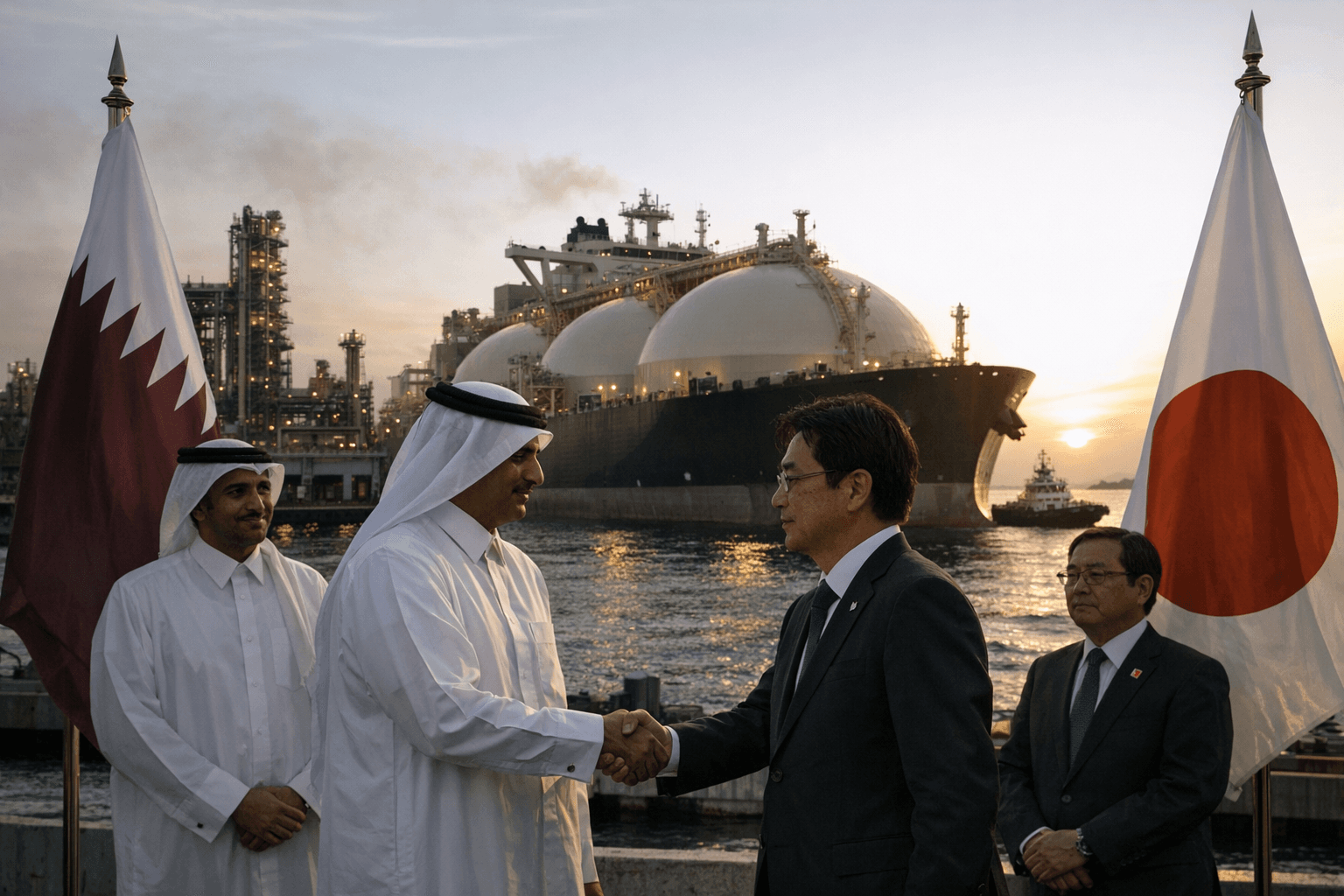

QatarEnergy and Japan’s JERA have signed a long-term sale and purchase agreement under which QatarEnergy will supply approximately 3.0 million tonnes per annum of liquefied natural gas to JERA for 27 years, with deliveries expected to begin in 2028, an original report said. The companies announced the deal on Feb. 3, and Qatar‑tribune reported the signing took place on the sidelines of the 21st International Conference and Exhibition on Liquefied Natural Gas, LNG 2026, in Doha.

Qatar‑tribune named HE Saad Sherida Al Kaabi, Minister of State for Energy Affairs and president and CEO of QatarEnergy, and Yukio Kani, global CEO and chair of JERA Inc., as the signatories, adding that the ceremony was held in the presence of senior executives from both companies. Al Kaabi said, “We are delighted to further strengthen our long-standing relationship with JERA, a strategic partner and one of the leading LNG players globally, and to reaffirm our continued commitment to supporting Japan’s long-term energy needs,” Qatar‑tribune reported.

Bloomberg framed the agreement as “a 27-year deal to sell liquefied natural gas to Japan's biggest utility,” and described it as “the first long-term supply accord between the two,” language that underscores the significance of the transaction for Japan’s utility sector and for QatarEnergy’s commercial outreach.

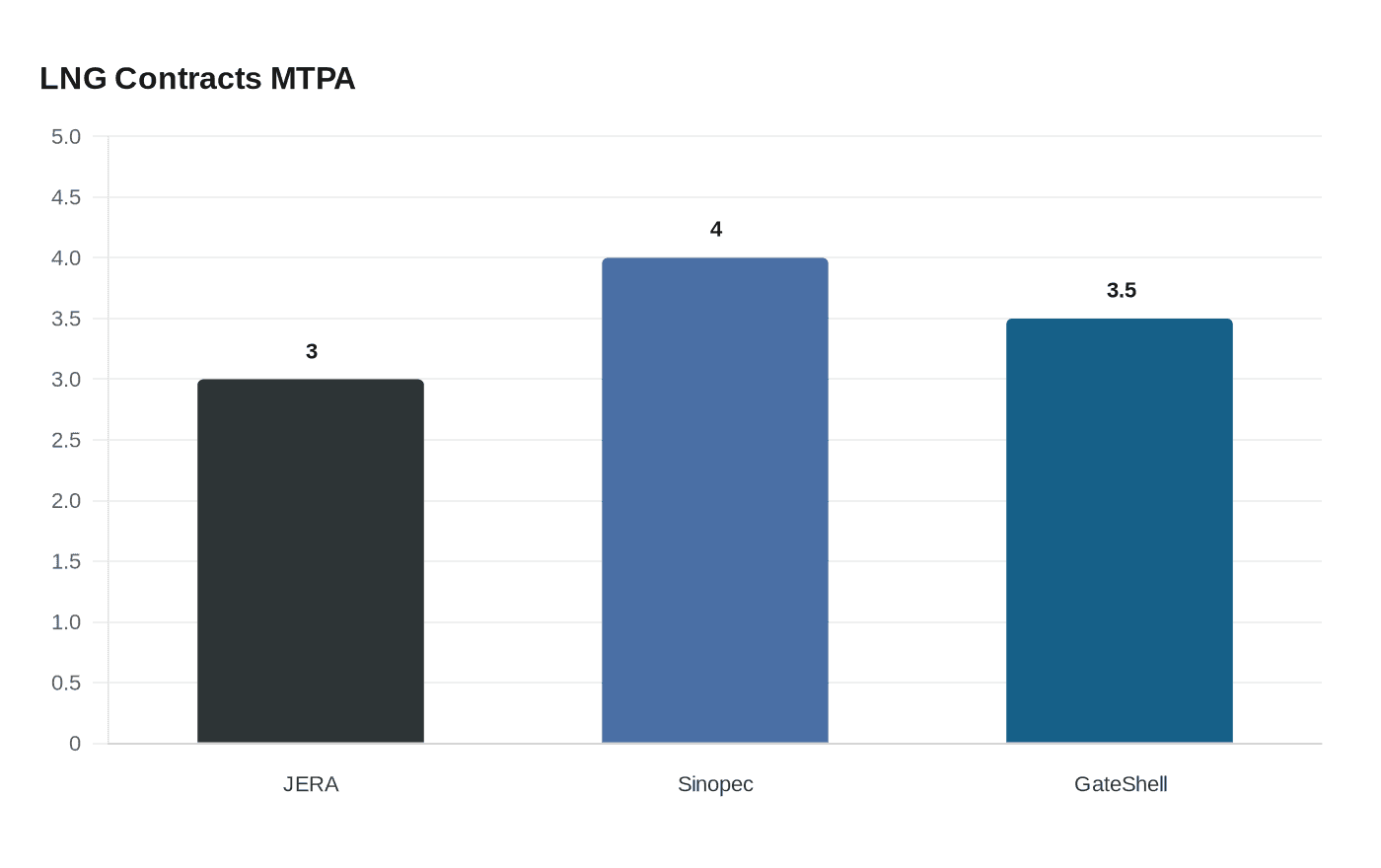

The JERA pact forms part of a string of long-term 27-year SPAs recently tied to QatarEnergy’s expansion of output. Offshore‑energy Biz reported a 27-year SPA with China Petroleum & Chemical Corporation, Sinopec, for 4 MTPA that will be supplied from Qatar’s North Field East project and delivered to Sinopec’s terminals in China. LNG Industry and Aa Com Tr previously reported that affiliates of QatarEnergy and Shell signed two 27-year SPAs for up to 3.5 MTPA to the Gate terminal in Rotterdam, with deliveries due to start in 2026. Aa Com Tr also noted the North Field expansion will raise Qatar’s LNG production capacity from 77 MTPA to 126 MTPA by 2026.

From a market perspective, multiple multi-decade SPAs of this scale lock in demand and revenue streams that can underpin financing for large upstream and liquefaction investments. For buyers such as JERA, a near-3.0 MTPA steady supply beginning in 2028 would bolster Japan’s long-term energy security as the country manages fuel mix transitions and reduces reliance on more carbon-intensive fuels. For QatarEnergy, the pattern of long tenors and large contracted volumes signals a strategy to secure anchor customers across Asia and Europe as North Field capacity ramps up.

Significant details remain undisclosed in the reporting: none of the sources provided pricing, the precise delivery schedule beyond the 2028 start year, destination terminals in Japan, or which specific North Field expansion tranche would supply the JERA volumes. Those gaps leave open questions about contract flexibility, pricing indexation and any provisions tied to decarbonization or emissions intensity, matters that can materially affect market allocation and downstream utilities’ planning.

The agreement adds to a wave of long-term commitments that will shape LNG balances as new Qatari capacity comes online, reinforcing Qatar’s role as a central supplier to both Asian and European gas markets while tightening links between state-backed producers and major utility buyers.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip