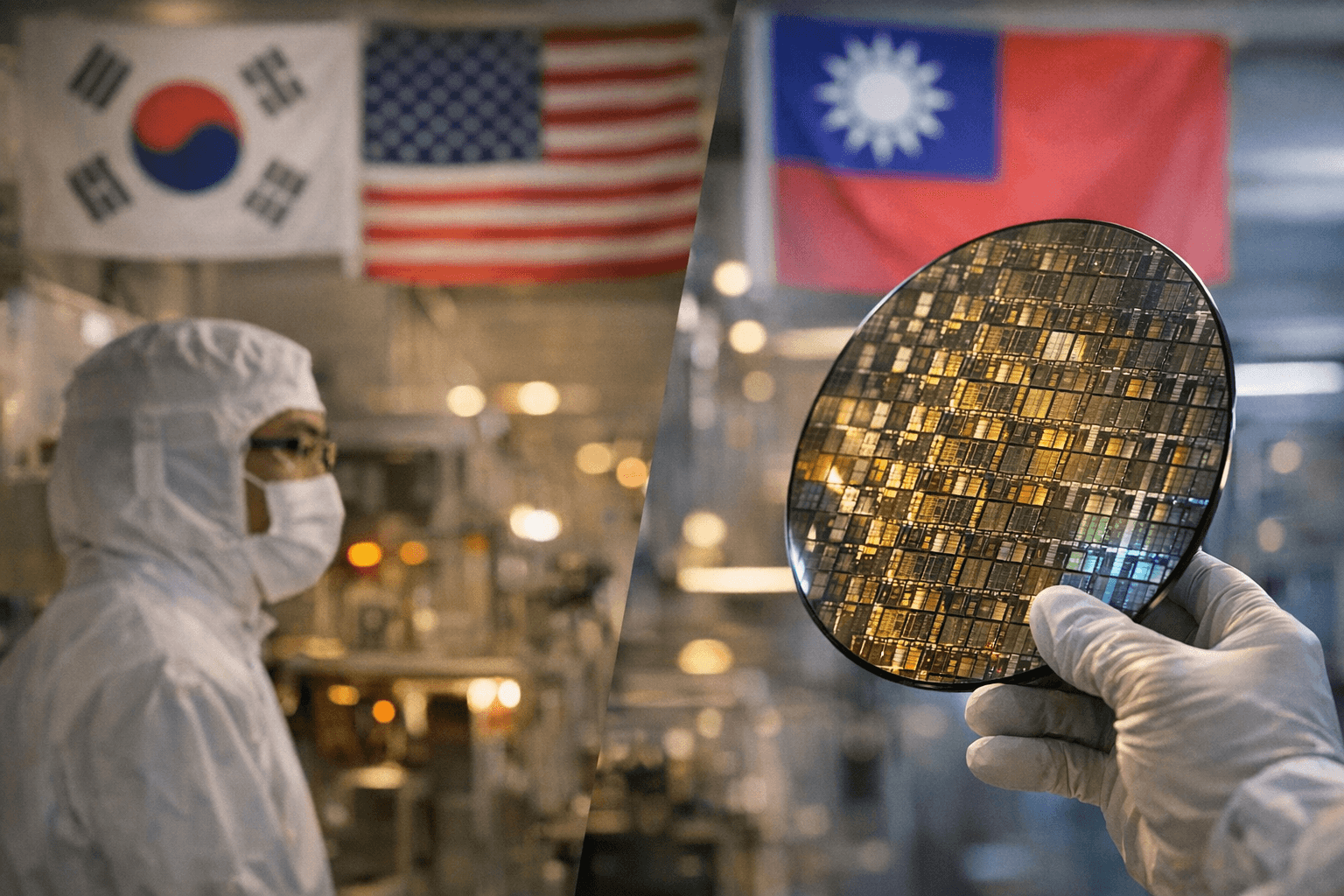

South Korea seeks parity with Taiwan over U.S. chip tariffs

Seoul will press Washington for favourable treatment under U.S. AI-chip tariffs, invoking last year’s fact sheet and cautioning broader measures could later hit memory exports.

South Korea announced it will press the United States for favourable treatment under new U.S. tariffs on advanced computing and artificial intelligence chips, saying existing bilateral understandings should prevent Seoul from facing less favourable terms than major competitors. The presidential office made the commitment during a televised briefing in Seoul on Jan. 18 as the government and industry assess risks to one of the country’s most important export sectors.

The U.S. presidential proclamation of Jan. 14 imposes a 25 percent tariff on certain advanced AI and high‑performance computing processors, citing national security concerns, and cited examples such as Nvidia’s H200 and AMD’s MI325X. The White House said the measures are narrowly targeted and exempt chips imported for U.S. data centres, startups, many consumer and civil industrial applications, and public‑sector use. South Korean officials, however, say the broader policy direction and language leave room for expansion and create uncertainty for exporters.

Trade Minister Yeo Han‑koo told reporters on Jan. 17 that the initial measures would have limited immediate impact on South Korean firms because the first phase excludes the memory chips that Samsung Electronics and SK Hynix predominantly export. At the same time, Yeo cautioned it was “not yet time to be reassured,” reflecting concern that subsequent phases could broaden the tariff scope to include memory products and raise costs for buyers and suppliers in global AI supply chains.

Seoul has pointed to a joint fact sheet agreed with Washington last year and an October 2025 summit understanding that sought to guarantee South Korea would not be treated less favourably than countries with equal or larger semiconductor trade volumes. The central negotiating question is whether Seoul can secure the same tariff carve‑outs afforded to Taiwan after Taiwan Semiconductor Manufacturing Company made large‑scale onshore investments in the United States.

U.S. officials have signalled that tariff policy could be used to incentivise domestic production. On Jan. 16, Commerce Secretary Howard Lutnick warned that South Korean and Taiwanese chipmakers that do not increase investment in the United States could face tariffs as high as 100 percent unless they commit to expanded U.S. production. That position raises the prospect of a bargaining dynamic in which tariff relief is tied to investment pledges and onshore manufacturing commitments.

Seoul faces practical limits in matching the scale of Taiwan’s commitments. South Korean reporting and official summaries indicate a joint investment and guarantee package of about $350 billion agreed with the U.S., of which approximately $150 billion is earmarked for a shipbuilding cooperation project called MASGA. Analysts warn that this allocation leaves less capacity to offer Taiwan‑style semiconductor investment packages and could complicate negotiations over parity.

The immediate market impact is muted because memory chips were excluded from the first round of tariffs, but exporters and policymakers view the episode as a test of Washington’s leverage and of South Korea’s ability to secure carve‑outs without making disproportionate industrial concessions. Samsung and SK Hynix, as two of the world’s largest memory producers, stand to be central actors in any deal.

For Seoul, the next phase will be diplomatic and commercial: invoke the joint fact sheet, press for equal treatment relative to Taiwan, and coordinate with domestic industry on potential investment offers. The outcome will shape not only short‑term export flows but also longer‑term patterns of chip production, supply‑chain geography, and the financing of industrial policy between Seoul and Washington.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip