Volatile February 2026 Gold Near $5,100 per Ounce Pressures Jewelry Margins

TradingEconomics registered gold trading around $5,109.17 per troy ounce on Feb 20, 2026, while Fortune/Money showed $5,040 at 10 a.m. ET the same day, squeezing jewelry margins.

“Market data for February 2026 show elevated and volatile gold prices that directly affect jewelry costs and margins.” TradingEconomics reported gold trade around $5,109.17 per troy ounce on Feb 20, 2026, a multi-day high during the month, while Fortune and Money published a 10 a.m. Eastern Time snapshot of $5,040 per ounce on Feb 20, 2026, a $48 increase from the same time the prior day and $2,105 above the year-ago level.

Futures and intraday snapshots underscored the volatility. Money listed gold futures open on Feb. 20 at $5,045.39 and noted a Feb. 19 close of $4,997.40, a percent change up 0.96 percent and a five-day change down 0.02 percent. Fortune’s table placed silver at $81, platinum at $1,715, and palladium at $2,121 in the same mid-February snapshot, illustrating how raw-material inputs across the case have moved together.

The run-up follows a rapid multi-year advance. Money recorded gains of 28 percent in 2024 and 65 percent in 2025 for gold, and USAGOLD noted that “Gold enters 2026 trading near $5,000 per ounce and briefly touching $5,500, after a historic run through 2025.” USAGOLD framed the long view this way: “Since 1971, when the U.S. abandoned the gold standard, gold has risen from $35 per ounce to current levels above $5,000,” and recounted past cycles including the 1970s move from $35 to $850 and the 2000s move from $250 to $1,900.

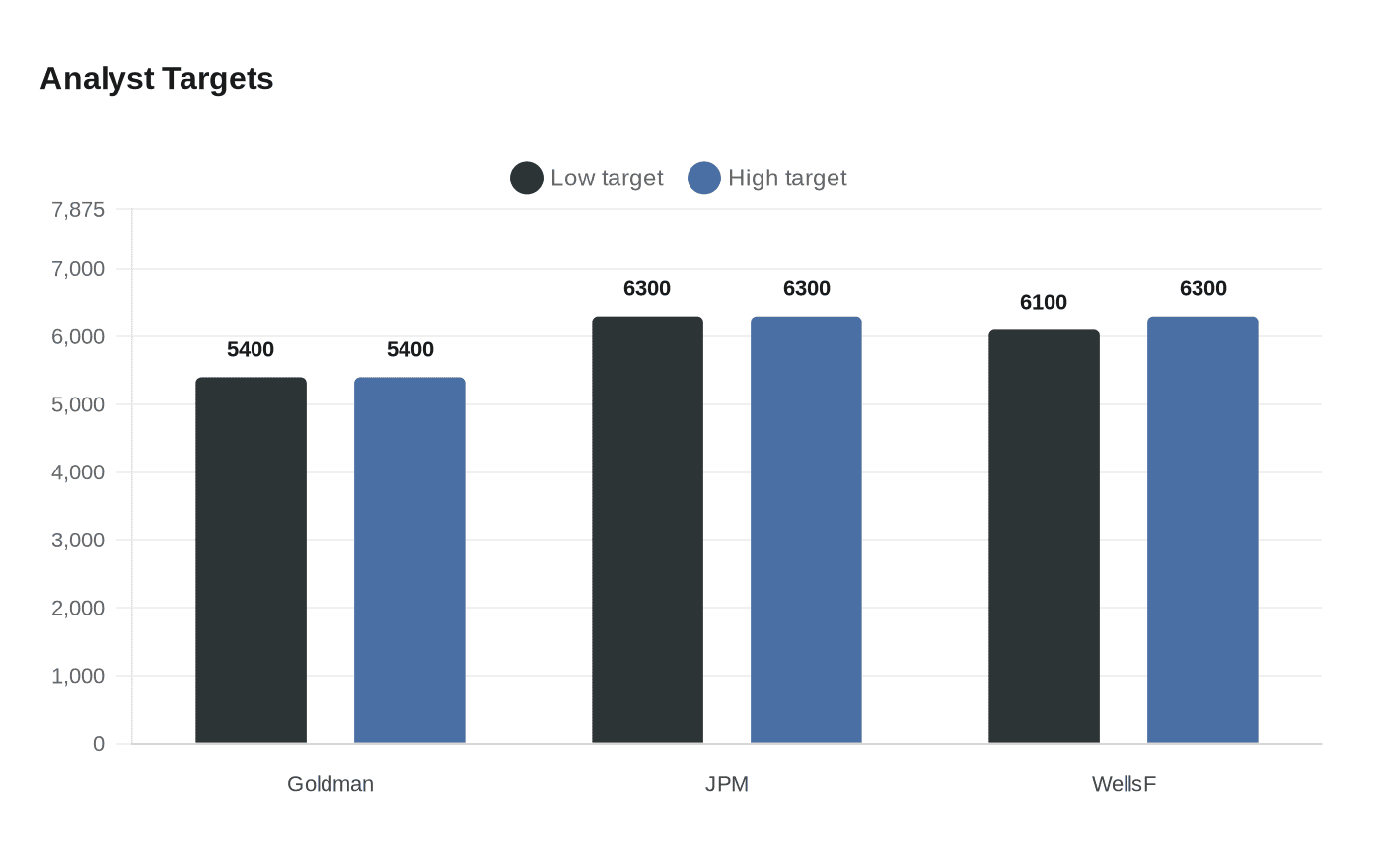

Analyst targets and scenario ranges add to retailer uncertainty. USAGOLD summarized that “Most major bank analysts project prices to remain elevated, with forecasts ranging from $4,400 on the conservative end to $6,300 or higher from the most bullish voices.” The same page listed named bank targets: “Goldman Sachs has raised its end-of-year target to $5,400, while J.P. Morgan projects $6,300 and Wells Fargo forecasts $6,100 to $6,300.” USAGOLD tied these projections to key conditional drivers: “Whether gold consolidates, corrects, or continues climbing depends on inflation trends, Federal Reserve policy, and geopolitical developments that no one can predict with certainty.”

Market-structure and technical signals pointed to further intraday swings. Liz Ann Sonders warned viewers to “assume volatility could remain elevated, big swings in both directions, at times driven by macro data, at times driven by rate expectations, and at times driven by foreign exchange moves,” and added that “beyond those fundamental drivers, near-term price swings in both gold and silver may continue to be influenced as much by speculative positioning, margin levels, ETF flows, momentum signals, and headlines.” Cfi Trade described the XAU/USD daily chart as “a textbook example of a 'Megaphone' or 'Broadening Wedge'” and reported “an enormous rejection from the upper resistance line (near $5,600), followed by a rapid re-entry towards the midpoint.”

Seasonal and political catalysts intensified the squeeze on physical markets. Cfi Trade highlighted the Chinese Lunar New Year break running from 16 February to 23 February 2026 as a source of thin liquidity, and cautioned to “Keep an ear on Senate confirmation hearings for Kevin 'Warsh.' Any comments that reinforce the idea of a strong dollar could delay a meaningful bounce in metals.” The technical house view also urged watching physical-premium dynamics, noting in the case of silver that “despite a paper market collapse, silver is structurally in a deficit because of AI and solar demand. Traders should be watching to see whether physical premiums increase.”

For jewelers the immediate reality is clear: spot quotes between roughly $5,040 and $5,109 on Feb. 20, 2026, coupled with the prospect of rising physical premiums, create input-cost pressure without a single, source-provided national measure of margin pass-through. The market is signaling elevated risk and possible further compression until real yields, the dollar, and central-bank buying resolve into clearer trends.

Know something we missed? Have a correction or additional information?

Submit a Tip