ArcelorMittal South Africa enters advanced talks with state lender

ArcelorMittal South Africa said it is in advanced discussions with the IDC, lifting shares as investors price potential state-backed support and a path to stability.

ArcelorMittal South Africa said it and the state-owned Industrial Development Corporation are "engaged in advanced discussions to find a sustainable solution based on a non‑binding term sheet regarding a potential transaction," a move that sent the steelmaker’s Johannesburg-listed shares up nearly 10 percent on Jan. 22, 2026. The company provided no further details and the IDC was not immediately available to comment.

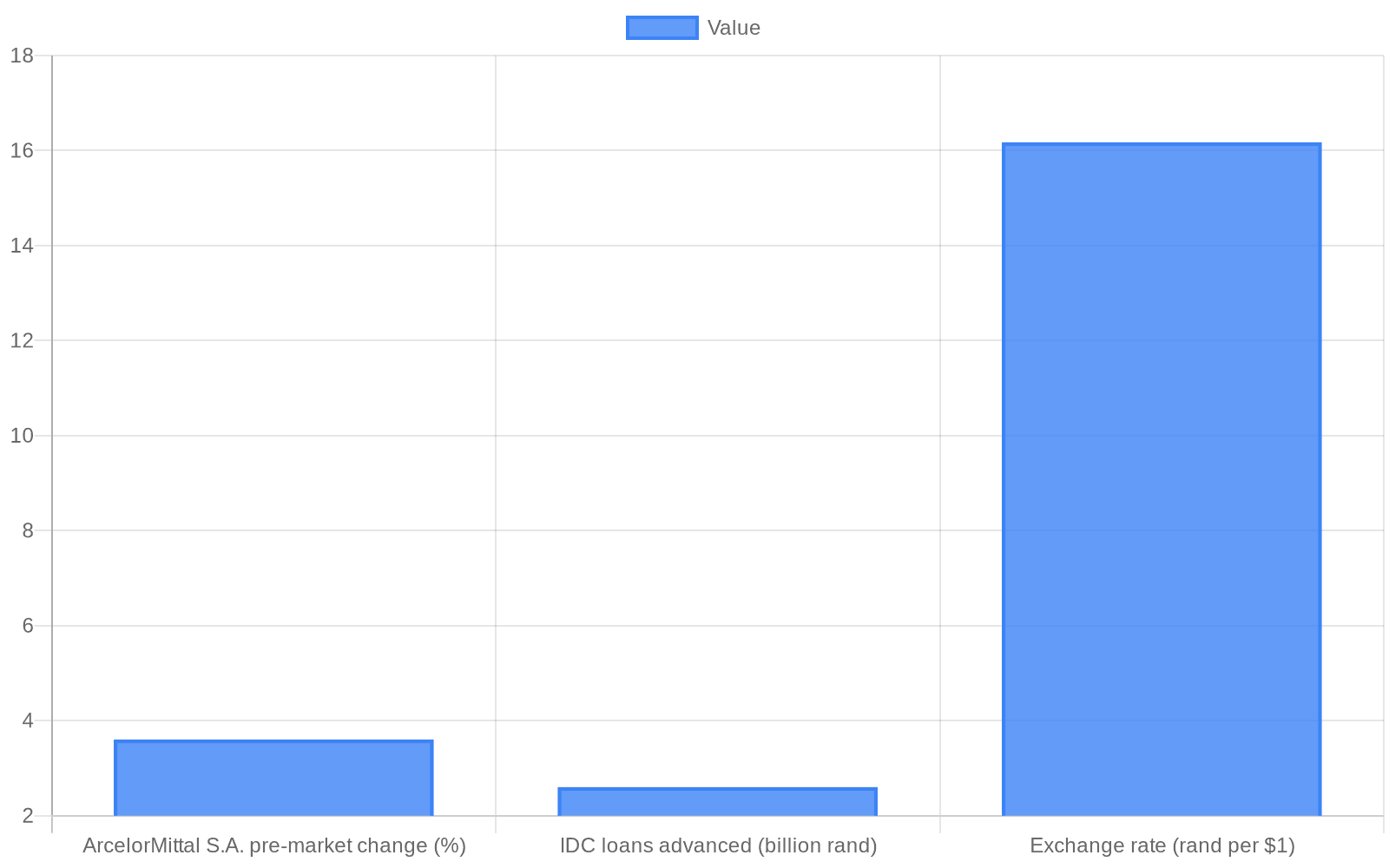

The equity reaction extended beyond the local unit. The global parent ArcelorMittal S.A. traded about 3.6 percent higher in pre-market trading after the announcement, reflecting investor hopes that state involvement could blunt losses at the South African operation and shore up value for the group.

ArcelorMittal South Africa has been a loss-making arm of the global steelmaker amid a prolonged slump in domestic steel demand, high electricity costs, rising competition from local scrap-metal recycling mini-mills, and an influx of cheaper imports from China. In 2025 the company mothballed its long-steel plants in an effort to limit cash losses, a curtailment that reduced domestic production capacity and raised questions about the longer-term viability of its integrated assets.

The IDC already has a material financial link to the unit. The development finance institution holds roughly an 8.2 percent stake in ArcelorMittal South Africa and over the past two years advanced 2.6 billion rand in loans to support operations, equivalent to about $160.8 million at an exchange rate of $1 = 16.1703 rand. Negotiations between the parties had previously stalled over valuation, but discussions have resumed and now center on a non-binding framework rather than a definitive deal.

Key unknowns remain significant. The company did not disclose the proposed transaction’s structure, whether it would take the form of an equity purchase, a debt-to-equity conversion, an asset sale, or another vehicle; it gave no indication of valuation, funding commitments, governance changes, or a timeline for a binding agreement. Those omissions mean the market rally reflects expectation rather than confirmation of state-backed rescue or restructuring terms.

Analysts caution that a non-binding term sheet is only an initial step toward stabilization. For investors to realize lasting gains, any agreement will need to clarify fresh funding sources, the treatment of creditors and minority shareholders, and operational plans for mothballed plants and the workforce. Until such terms are disclosed, the company's credit profile and cash burn remain the key determinants of its near-term survival.

The involvement of the IDC underscores the policy trade-offs facing South Africa. As a development finance institution, the IDC’s mandate includes preserving industrial capacity and jobs, but further support to a loss-making integrated steelmaker would raise questions about fiscal exposure, precedent for other troubled firms, and the effectiveness of industrial policy in addressing structural cost disadvantages such as electricity prices.

Market participants will watch closely for a binding agreement, detailed financing commitments, and statements from both the IDC and ArcelorMittal’s parent. Those disclosures will determine whether the share spike presages a substantive turn for the unit or simply a temporary repricing of politically sensitive rescue hopes.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip