SEC asks judge to allow email service on Adani executives

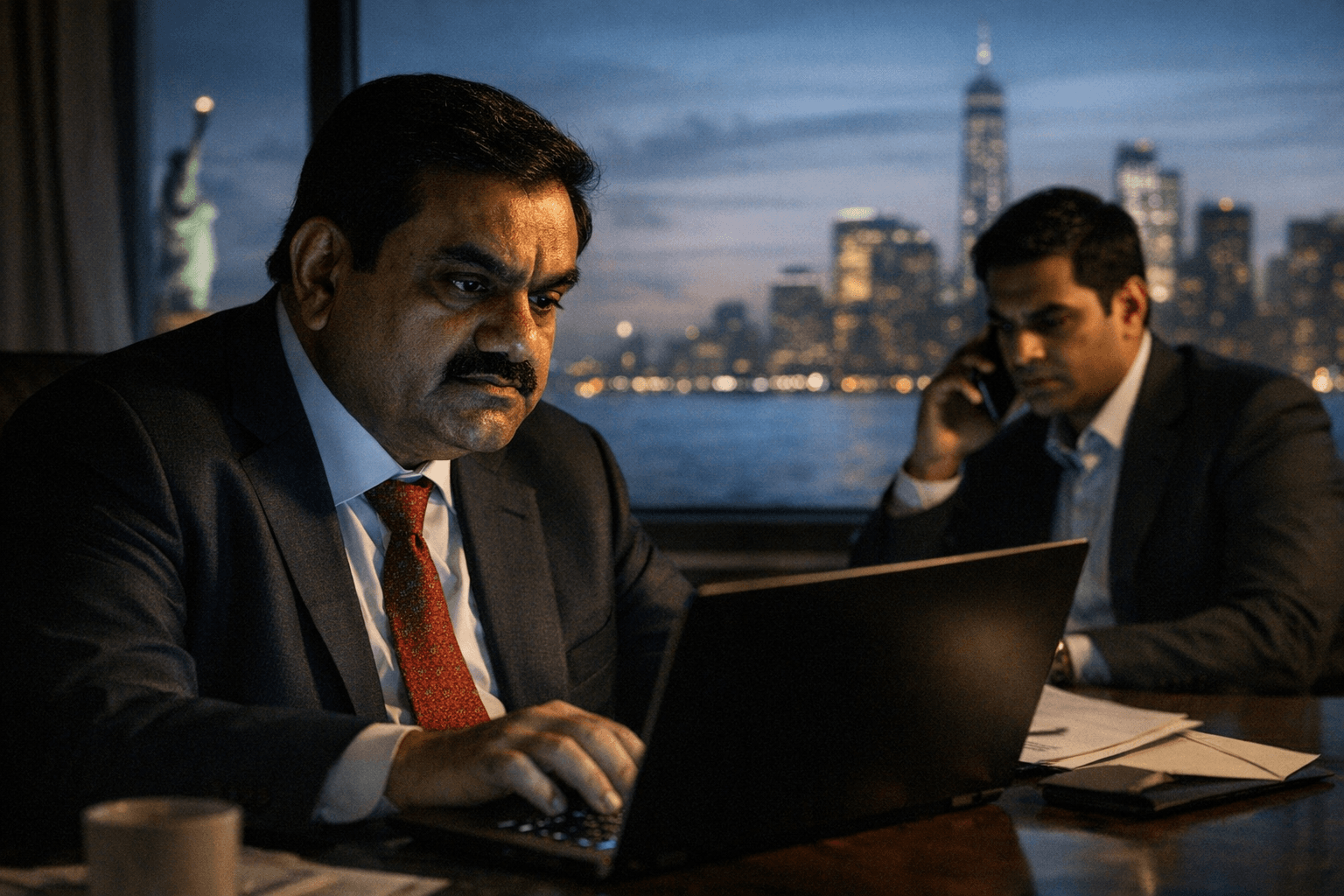

The SEC asked a New York court to permit email service on Gautam and Sagar Adani after India repeatedly refused diplomatic service, aiming to move a stalled securities case forward.

The U.S. Securities and Exchange Commission asked a federal judge in New York to let it serve subpoenas and summonses by email on Indian billionaire Gautam Adani and his nephew Sagar Adani, saying diplomatic channels through India have repeatedly blocked formal service and left the agency unable to proceed. In a motion filed January 21, 2026 in the U.S. District Court for the Eastern District of New York, the SEC invoked Federal Rule of Civil Procedure 4(f)(3) to request court-authorized alternative service.

The agency said it no longer expects service under the Hague Convention to succeed after more than a year of attempts and that further diplomatic efforts would only delay enforcement of U.S. securities laws in cases with cross-border defendants. The underlying civil complaint, filed November 20, 2024, accuses Gautam Adani and Sagar Adani of securities fraud and an alleged $265 million bribery scheme tied to Adani Green Energy and related transactions. The complaint alleges payments or promises to Indian government officials to obtain electricity purchase agreements and contends the defendants misled U.S. investors in a bond offering and related disclosures.

The SEC told Judge Nicholas G. Garaufis that India’s Ministry of Law and Justice declined at least two formal requests to serve the summonses through diplomatic channels, citing technical objections such as alleged documentation deficiencies and requirements for formal seals. In one communication, the ministry characterized the matter as a legal dispute between private firms and the United States, a position the SEC disputes with respect to Hague Convention procedures. The standoff has left the agency arguing that normal methods of international service are impracticable.

To ensure what it describes as effective notice, the SEC proposed emailing the summonses and complaint to business addresses and to U.S. counsel retained by the defendants. The motion identifies Kirkland & Ellis LLP and Quinn Emanuel Urquhart & Sullivan LLP as counsel for Gautam Adani and Hecker Fink LLP as counsel for Sagar Adani. Filings note that Hecker Fink confirmed representation of Sagar Adani on December 4, 2024, and that attorneys at Kirkland and Quinn Emanuel notified the SEC on February 28, 2025 that they represented Gautam Adani in the matter.

The request raises both immediate procedural questions and broader market and policy implications. If the court permits email service, the SEC would be able to advance the case in federal court rather than remain in diplomatic limbo, allowing discovery and adjudication to proceed. For investors and markets, resolution of the allegations could affect the Adani Group’s access to international capital and investor confidence in securities tied to the conglomerate, particularly given the size of the alleged payments and the centrality of power purchase contracts to the firms’ cash flows.

The motion arrives amid heightened regulatory scrutiny of the group. Separately, a June 2025 Department of Justice inquiry examined alleged sanctions violations involving shipments of liquefied petroleum gas through an Adani-operated port; that probe is distinct from the SEC’s civil action but adds to the regulatory pressure facing the conglomerate.

Judge Garaufis must decide whether alternative service by email satisfies due process and provides reliable notice in a complex cross-border enforcement matter. The case underscores an emerging enforcement challenge: as corporations and financial flows globalize, U.S. regulators increasingly confront procedural barriers in serving foreign defendants and must weigh judicially authorized alternatives against international comity and diplomatic norms.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip