BNP Paribas to cut about 1,200 asset management jobs after AXA IM

BNP Paribas will eliminate roughly 1,200 asset management roles, about 20% of the unit, under a voluntary, phased plan tied to the AXA IM integration.

A union source said BNP Paribas plans to cut roughly 1,200 positions in its asset management division, equal to about 20 percent of that workforce, as part of cost savings linked to integrating AXA Investment Managers. The reductions, described to staff at a works council meeting, are scheduled in three waves beginning mid-2026 and are expected to be completed by the end of 2027 under a voluntary departure scheme.

The move follows BNP Paribas’s acquisition of AXA IM for €5.1 billion and the creation of a combined asset management platform that will oversee about €1.6 trillion in assets under management, putting the merged group among Europe’s three largest asset managers behind Amundi and UBS Asset Management. Management framed the exercise as a pursuit of synergies and efficiency gains from the consolidation of investment teams, product platforms and back-office functions.

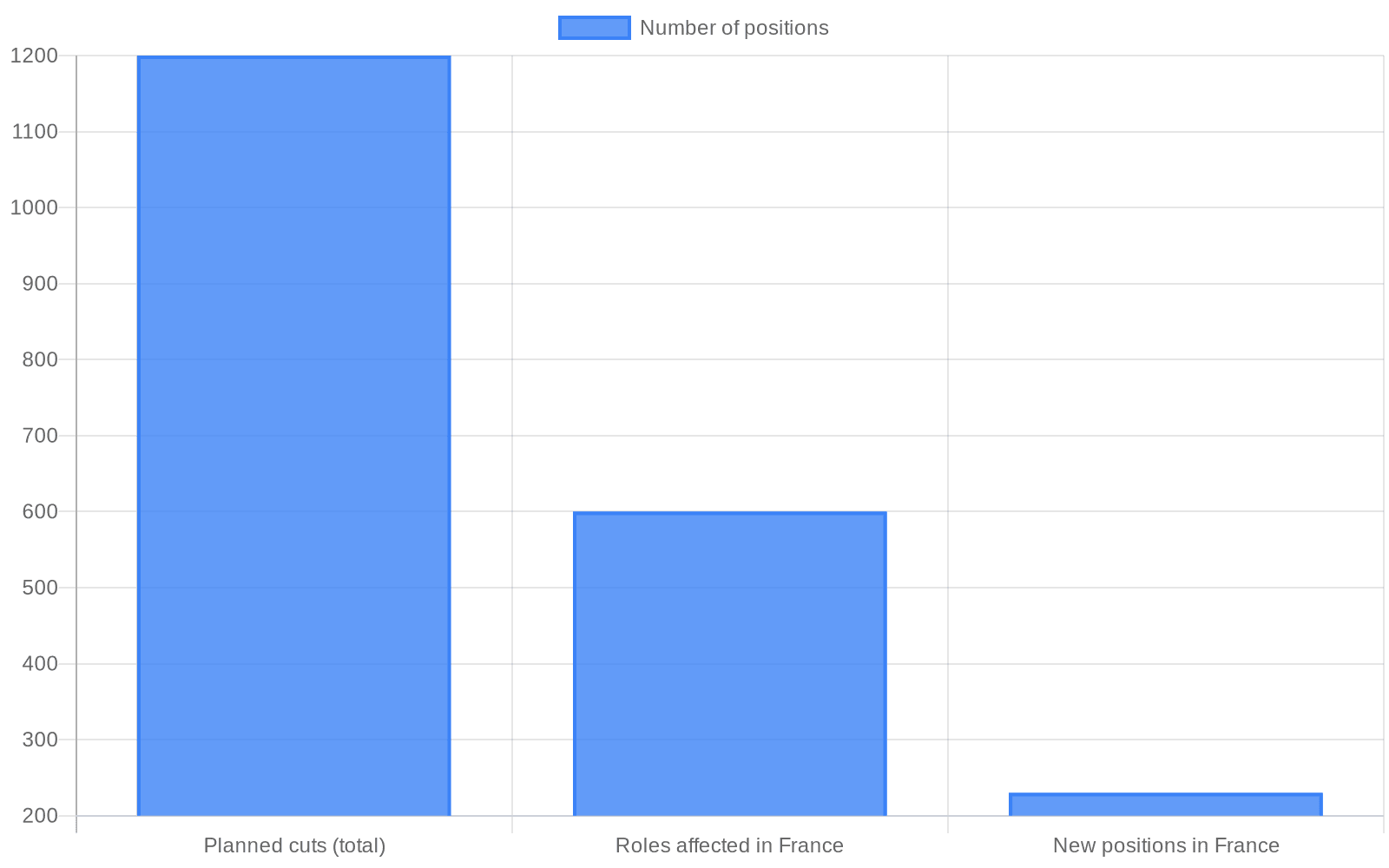

People familiar with the matter say the 1,200 figure is a starting point for talks with unions and could be adjusted during negotiations. The plan reportedly affects roughly 600 roles in France, while also envisaging the creation of about 230 new positions in the country, leaving a net change that has not been publicly clarified. The departure scheme was presented as voluntary, signalling an attempt to minimize compulsory layoffs, and will be phased to manage client servicing continuity and integration risks.

The restructuring will have immediate human costs for staff and potential ripple effects across markets that value stability in asset managers. Eliminating one in five roles in a unit that will manage €1.6 trillion raises questions about operational capacity for client servicing, institutional mandates and product continuity, particularly in specialized active strategies where relationship teams can be pivotal. For investors and clients, the chief near-term risk is talent flight and disruption to portfolio management during the integration.

For BNP Paribas, the calculations are partly arithmetic. Large-scale mergers in asset management often promise cost-income ratio improvements as fixed costs are spread over a larger AUM base. If successfully implemented, the cuts could lower operating expenses and improve margins in a sector where fee pressure from passive products and continued investor scrutiny have compressed revenue growth. Yet achieving anticipated synergies depends on retaining key portfolio managers and maintaining client trust during the transition.

The plan also sits within a broader pattern of consolidation and cost discipline across European banking and asset management. Firms that have sought scale through acquisitions increasingly emphasize headcount rationalization to justify purchase prices and deliver returns to shareholders. At the same time, national political sensitivities around job cuts and France’s labor regulations, which require consultation through works councils, mean negotiations with unions could reshape the timetable or scale of reductions.

There was no immediate on-the-record confirmation from BNP Paribas or AXA IM in available reporting. Industry watchers will be watching the outcome of union negotiations, the exact mapping of roles deemed redundant, and how the group balances cost savings with the near-term imperative to keep client relationships intact as the integration proceeds.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip