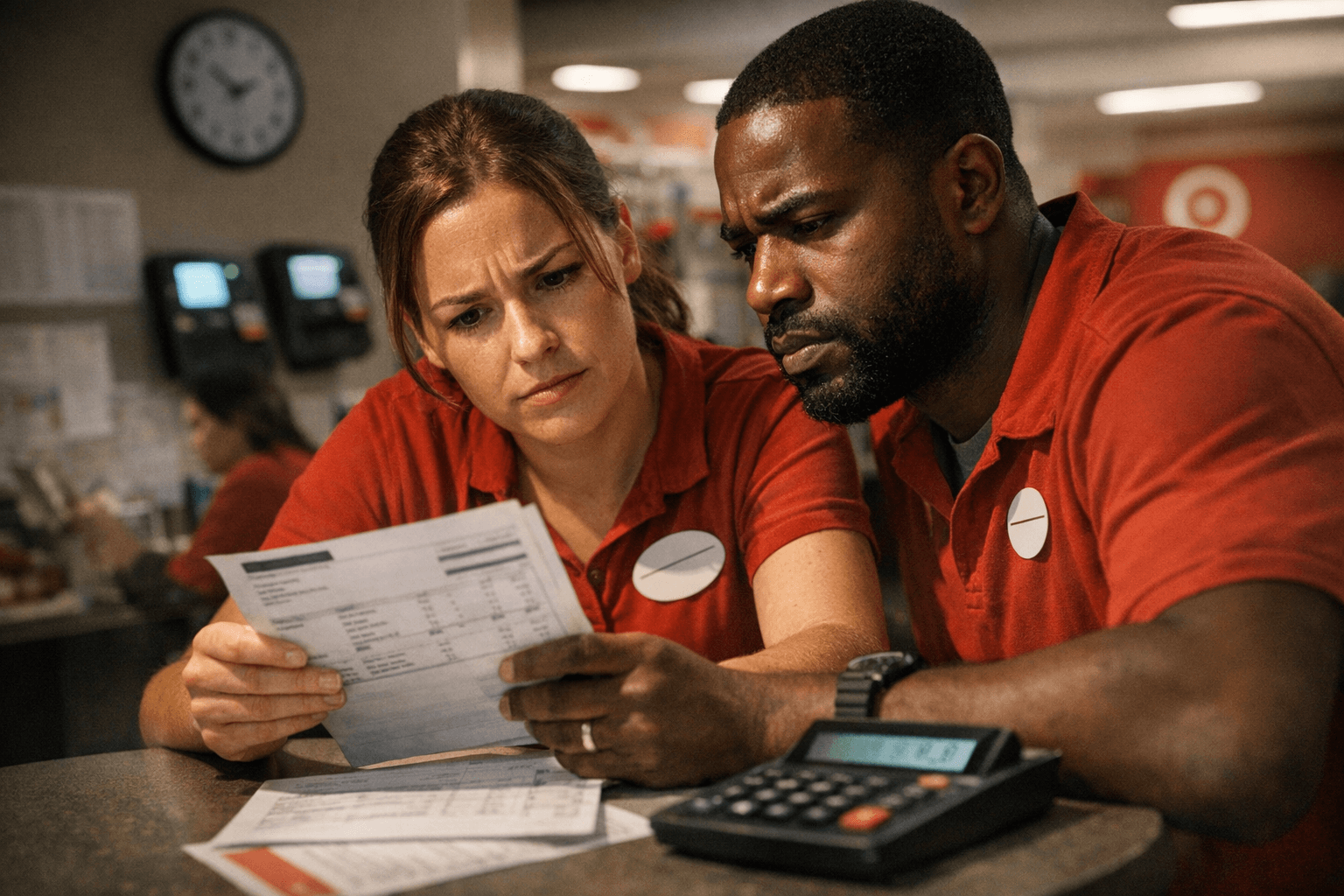

DOL overtime guidance underscores pay risks for Target hourly staff

DOL guidance clarifies overtime rules, regular-rate calculations and hours-worked definitions. That matters for Target team members checking pay, schedules and recordkeeping.

Federal wage guidance from the Department of Labor’s Wage and Hour Division lays out core Fair Labor Standards Act rules that directly affect retail workers, including those at Target. The guidance reiterates that most nonexempt employees must receive overtime pay at least 1.5 times their regular rate for hours worked beyond 40 in a workweek, and it spells out what counts as compensable time and how to compute the regular rate.

For Target team members who punch a clock, pull a shift, or handle tasks before or after scheduled hours, the guidance underscores that "hours worked" generally includes time an employer requires or permits an employee to be on duty or on the employer’s premises. That can encompass pre-shift stock checks, mandatory team huddles, closing procedures, or time spent on the sales floor when managers allow late stays. The fact sheet also reviews what types of pay may be excluded from the regular rate and warns of common pitfalls employers and workers face, such as lump-sum payments that do not qualify as overtime premiums.

The guidance is widely relied upon by workers, advocates and employers in retail to assess potential overtime claims, wage-computation issues and recordkeeping obligations. For Target, which operates thousands of stores and a mix of hourly team members, salaried supervisors and corporate staff, the rules heighten the need for accurate timekeeping and correct classification of employees as exempt or nonexempt. Missteps in calculating the regular rate can occur when bonuses, incentive pay or certain reimbursements are not properly factored into overtime calculations, and lump-sum arrangements intended to cover overtime can leave employees shortchanged.

Practical implications for team members include auditing paystubs for overtime pay on weeks with more than 40 hours, tracking on-the-clock and off-the-clock work, and raising discrepancies with store leadership or HR. For managers, the guidance reinforces the importance of clear timekeeping policies, training on compensable time, and careful payroll computation to avoid liability.

The Wage and Hour Division also points employers and workers to additional resources on hours-worked definitions, recordkeeping requirements and local WHD offices for questions. Target employees who suspect a payroll error or classification issue can use those resources to understand entitlements and next steps.

The guidance does not change the basic overtime threshold, but it sharpens focus on the details that determine pay. For Target team members and store leaders alike, the takeaway is simple: accurate clocks, transparent policies and careful payroll practices matter, and workers have federal tools to check their pay and raise concerns if needed.

Know something we missed? Have a correction or additional information?

Submit a Tip