India’s budget lifts capex to ₹12.2 lakh crore, stresses fiscal prudence

Finance Minister Nirmala Sitharaman unveiled a record ₹12.2 lakh crore capex plan and measures to spur manufacturing and data centres while holding the deficit steady.

Finance Minister Nirmala Sitharaman presented the Union Budget for 2026–27 in Parliament, committing a record ₹12.2 lakh crore in capital expenditure for the year beginning April 1 and framing the package as an engine for growth amid global volatility. The headline capex number equals about $133 billion and is the centrepiece of a strategy that pairs public investment with a pledge to preserve fiscal discipline.

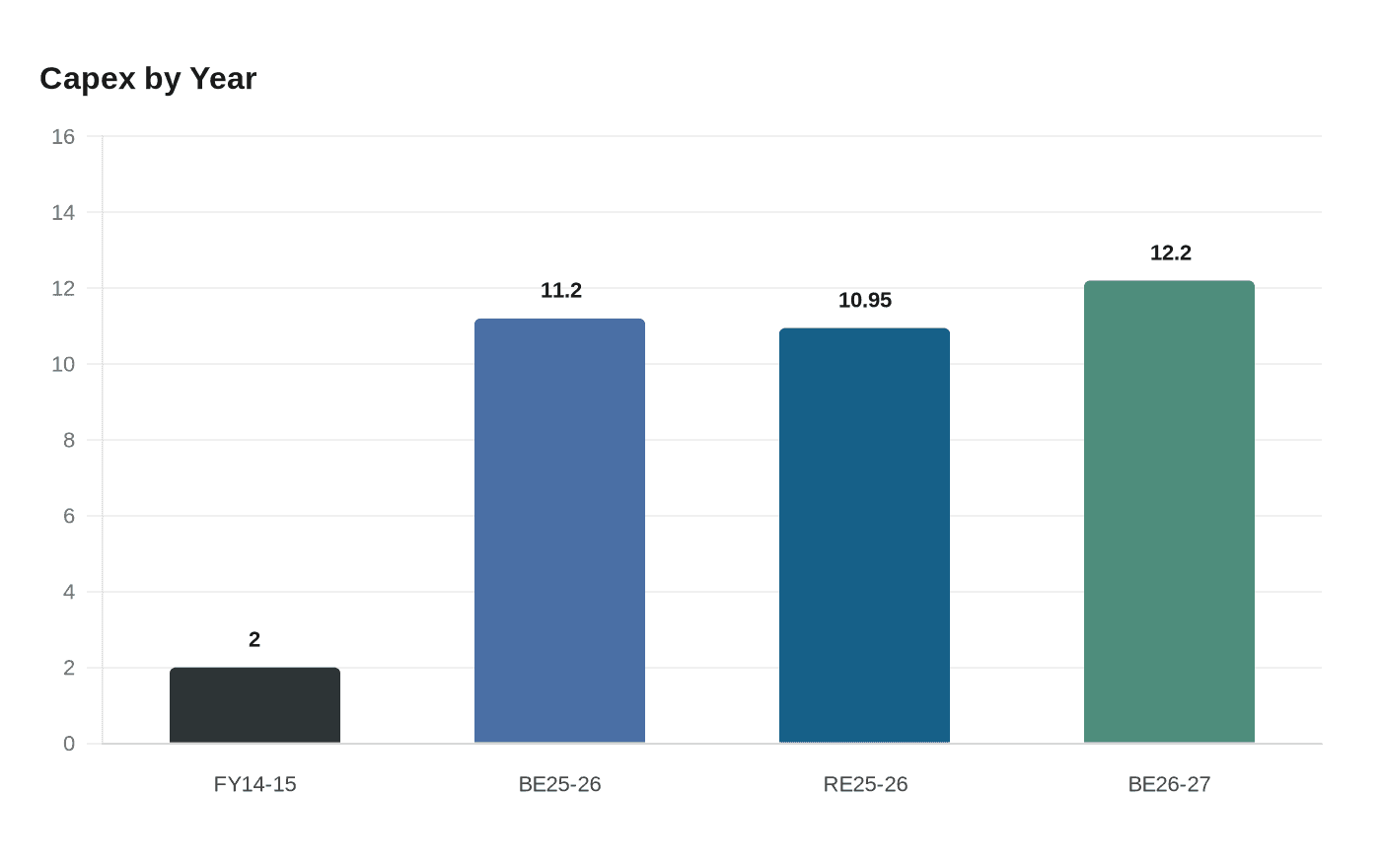

Budget documents show the capex target rises from last year’s budget estimate of around ₹11.2 lakh crore, implying roughly a 9 percent increase. Measured instead against the revised estimate for the current fiscal year, which was ₹10.95 lakh crore, the increase is about 11.4 percent. The government’s documents explicitly note the historical jump in public capex—from ₹2 lakh crore in FY2014–15 to ₹11.2 lakh crore in BE 2025–26—and state the new ₹12.2 lakh crore allocation “to continue the momentum.”

The finance ministry projected a fiscal deficit of 4.3 percent of GDP for 2026–27 and a debt-to-GDP ratio of 55.6 percent, modest improvements from the revised numbers for 2025–26. Non-debt receipts are estimated at ₹36.5 lakh crore, net tax receipts at ₹28.7 lakh crore and total expenditure at ₹53.5 lakh crore. The budget papers also include the statutory Medium-term Fiscal Policy-cum-Fiscal Policy Strategy Statement and the Macro-Economic Framework Statement under the Fiscal Responsibility and Budget Management Act.

Policy measures emphasize infrastructure, manufacturing and technology. The budget proposes an Infrastructure Risk Guarantee Fund “to provide prudently calibrated partial credit guarantees to lenders” to shore up private developers against construction-phase risks. A renewed push for domestic manufacturing includes a second semiconductor mission with an outlay of $436 million and incentives intended to draw private capital into roads, ports and rail projects.

A long-term tax incentive for cloud and data-centre investment seeks to mobilize global firms. The proposal offers a tax holiday extending up to 2047 for foreign cloud companies that build data centres in India and provide cloud services globally. “This provides long-term fiscal certainty for a highly capital-intensive sector, significantly improving investment viability and accelerating capacity creation,” said Ritika Loganey Gupta of Ernst & Young India.

The budget also highlights social and health investments: support for assistive-technology manufacturing via ALIMCO, the creation of retail-style Assistive Technology Marts, and the establishment of a second National Institute of Mental Health and Neuro Sciences facility along with upgrades to regional mental health institutes.

Market reaction mixed. “The capex outlay for fiscal year 2027 looks a bit modest and misses market expectations slightly, but overall, a positive for the manufacturing sector. It will also be good for private sector capex,” said Amit Anwani of Prabhudas Lilladher. Analysts noted that the combination of sustained public investment and targeted tax incentives aims to crowd in private spending even as the government trims deficit targets.

The finance minister framed the measures within a longer political narrative: “Since we assumed office 12 years ago, India’s economic trajectory has been marked by stability, fiscal discipline, sustained growth and moderate inflation,” she said, underscoring the administration’s emphasis on reform and investment as global headwinds persist. Images released with the presentation showed the minister holding the traditional red budget folder and scenes of under-construction infrastructure that the package is intended to accelerate.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip