Johnson & Johnson raises 2026 outlook above Wall Street estimates

J&J forecasts 2026 sales and earnings above analyst estimates, signaling strength despite drug-pricing and tariff headwinds.

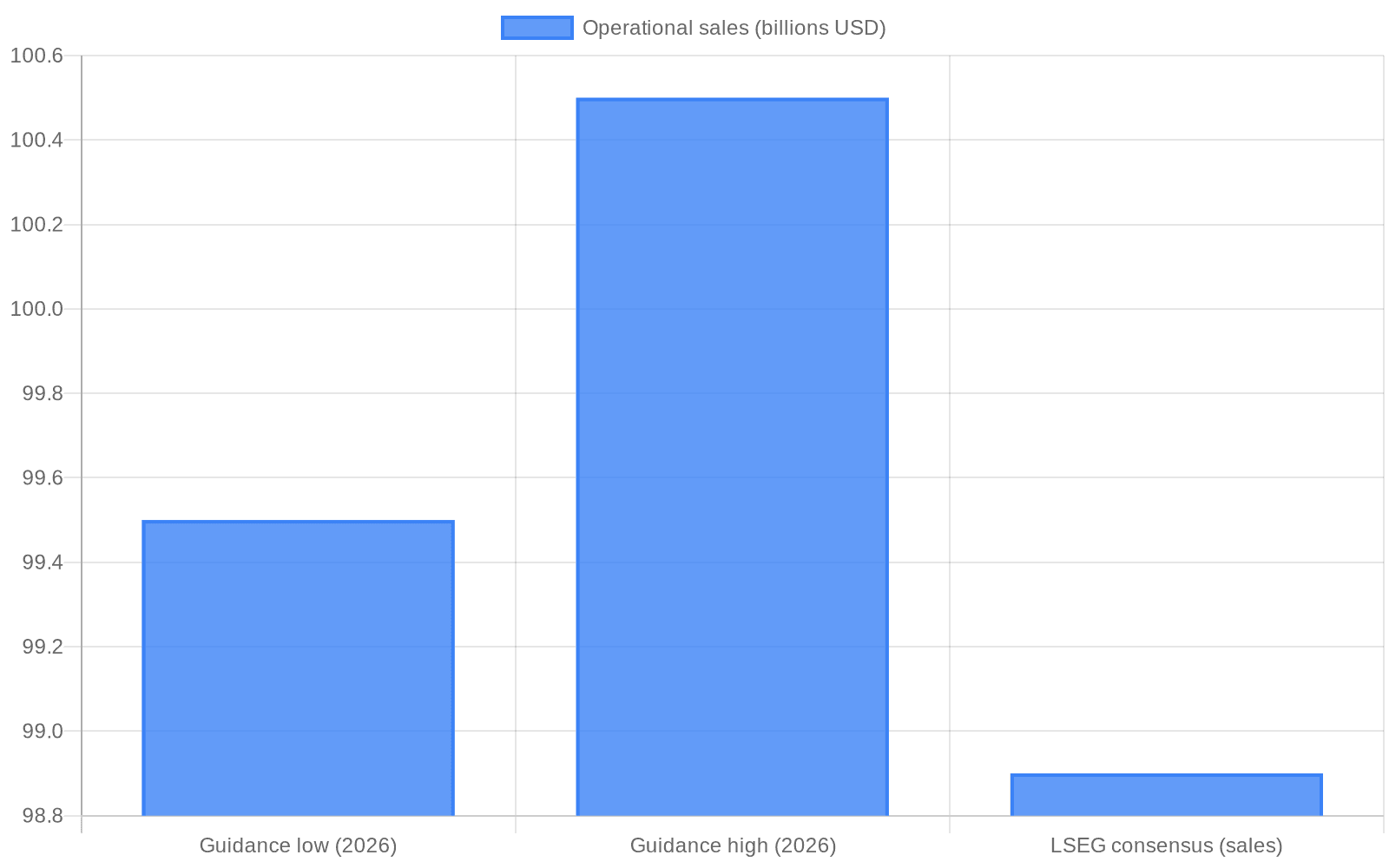

Johnson & Johnson said its full-year 2026 guidance surpassed Wall Street expectations, forecasting operational sales of $99.5 billion to $100.5 billion and adjusted earnings per share of $11.43 to $11.63. That range tops the LSEG consensus sales estimate of $98.9 billion and sits marginally above the $11.45-per-share EPS forecast used by analysts, underscoring the company’s momentum even as it absorbs regulatory and trade pressures.

The company said its guidance already incorporates an estimated hit from a drug-pricing agreement with the federal government that was finalized in January. Chief Financial Officer Joseph Wolk characterized that impact as "hundreds of millions of dollars," and said management was "able to surpass what (analyst) expectations are for 2026 by a pretty sizable amount while digesting that impact." Company commentary also flagged tariff uncertainty for its medical devices unit, with the business expected to face about $500 million in tariffs that will weigh on margins.

Johnson & Johnson closed 2025 on a firm footing. Fourth-quarter revenue was $24.56 billion, ahead of the $24.16 billion analysts had expected, and adjusted net income for the quarter was $6.0 billion, or $2.46 per share, compared with consensus of $2.44. For full-year 2025 the company delivered $94.2 billion in sales, up roughly 6 percent year over year, with adjusted EPS of $10.79 and an operating margin of about 29.5 percent.

Segment performance in the quarter highlighted the company’s growing therapeutic franchises. Innovative Medicine, J&J’s largest division, produced $15.76 billion of sales, up 10 percent year over year, while the medical devices business reported $8.8 billion, up 7.5 percent. The oncology and immunology portfolios drove much of the outperformance. Products cited as key contributors include Darzalex and Tremfya, with other growth coming from Carvykti, Spravato and Erleada. Management emphasized the breadth of the portfolio and its multi-year upside, with CEO Joaquin Duato calling 2025 a "catapult year" that launched the company "into a new era of accelerated growth" and noting that excluding Stelara the portfolio was growing in the mid-teens - "14, 15 per cent."

The guidance comes against a backdrop of legal and policy risk. A court-appointed special master recently recommended allowing expert testimony linking the company’s talc products to ovarian cancer, a development that keeps significant litigation exposure on the balance sheet. At the same time, trade policy and drug-pricing negotiation dynamics are creating a new operating calculus for large pharmaceutical companies. J&J’s disclosure that it has baked a sizable price-reduction hit into its outlook suggests management believes the company’s commercial momentum and margin structure can absorb short-term policy shocks.

For investors, the set of numbers presents a nuanced picture. Beating consensus guidance should bolster confidence in revenue and earnings trajectories, but the company’s acknowledgement of concentrated headwinds - both from pricing concessions and from tariffs on devices - underscores the fragility of near-term margin gains. Over the longer term, reliance on oncology, immunology and a diversified surgical and vision pipeline positions Johnson & Johnson to sustain above-industry growth rates if it can navigate litigation outcomes and shifting U.S. policy on drug prices and trade.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip