Compal warns memory price surge to squeeze PCs into 2027

Compal warns soaring memory prices driven by AI demand will press PC margins and shipments into 2027, forcing strategic shifts and U.S. investment.

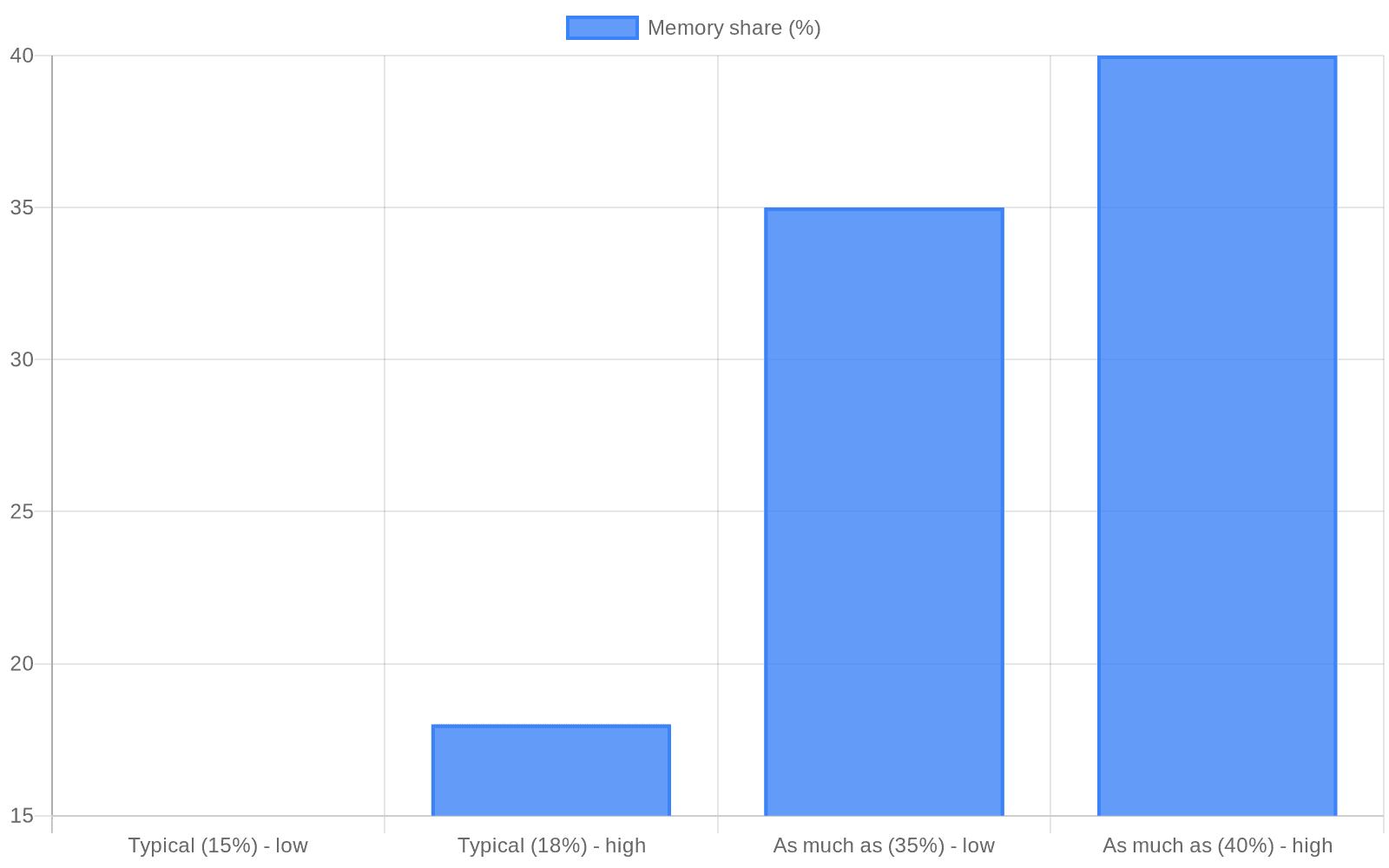

Compal Electronics Ltd. warned that sharply rising memory prices, driven by demand from AI servers, are likely to persist into 2027 and will put sustained pressure on the global PC and notebook industry. The Taiwanese contract manufacturer said the cost shock could push memory from a typical 15–18 percent share of a PC's materials cost to as much as 35–40 percent, squeezing margins across the value chain.

Executives at Compal said they expect global notebook and personal computer shipments to decline by a low-single-digit percentage in 2026 as manufacturers and brand owners contend with higher component costs. Chief executive Anthony Peter Bonadero described "pricing volatility in the memory space" and called current conditions "a true super cycle (in memory chips) that we haven't really seen." Compal added that "the total market will be impacted for sure."

Compal attributed the squeeze to a rapid reorientation of memory producers toward high-bandwidth memory for AI data centers, which has tightened availability of DRAM and NAND for PC customers. The company cited the world's top three memory vendors as struggling to keep pace with the AI-driven surge in data-center demand, a dynamic that both raises chip prices and shifts allocation toward server-grade chips.

The warning has immediate commercial implications. If memory costs occupy roughly a third to two-fifths of materials budgets for PCs, original equipment manufacturers will face hard choices: absorb costs and accept lower margins, pass them on to customers through higher prices, or accept compressed profitability that could reduce investment in new models. Compal said its own notebook and PC business should be flat or see slight growth because of its customer mix, but warned that smaller vendors and thinner-margin segments are most vulnerable.

Strategically, Compal is responding by accelerating a move up the value chain into AI-related hardware. Chairman Ray Chen said the company has been restructuring to expand its AI server business and approved about US$500 million last year to build out operations in the United States. A factory in Texas is expected to be completed by the second quarter of 2026 and to begin producing AI servers later that year, positioning Compal to capture some of the higher-margin server demand driving the memory cycle.

Not all contract manufacturers share Compal's assessment of the economic hit. Pegatron's chair has argued that brand owners, not contract assemblers, generally control component sourcing and that this structure largely insulates contract manufacturers from swings in component costs. He highlighted other supply tightnesses, such as substrate shortages, as different points of strain that can be managed through supplier engagement and capacity expansion.

Policy risk also clouds the picture. Separate reporting has flagged the possibility of U.S. trade measures that could levy tariffs on memory producers that do not manufacture in the United States, a development that could further distort supply chains and raise costs if enacted. For now, the principal market driver remains the AI data-center buildout, which is reshaping memory demand and prompting both strategic investment and industry concern about a prolonged period of elevated component costs.

Know something we missed? Have a correction or additional information?

Submit a Tip