Rheinmetall projects €80 billion in potential defence orders this year

Company forecasts €80 billion in possible orders as global demand for ammunition, vehicles and naval systems surges.

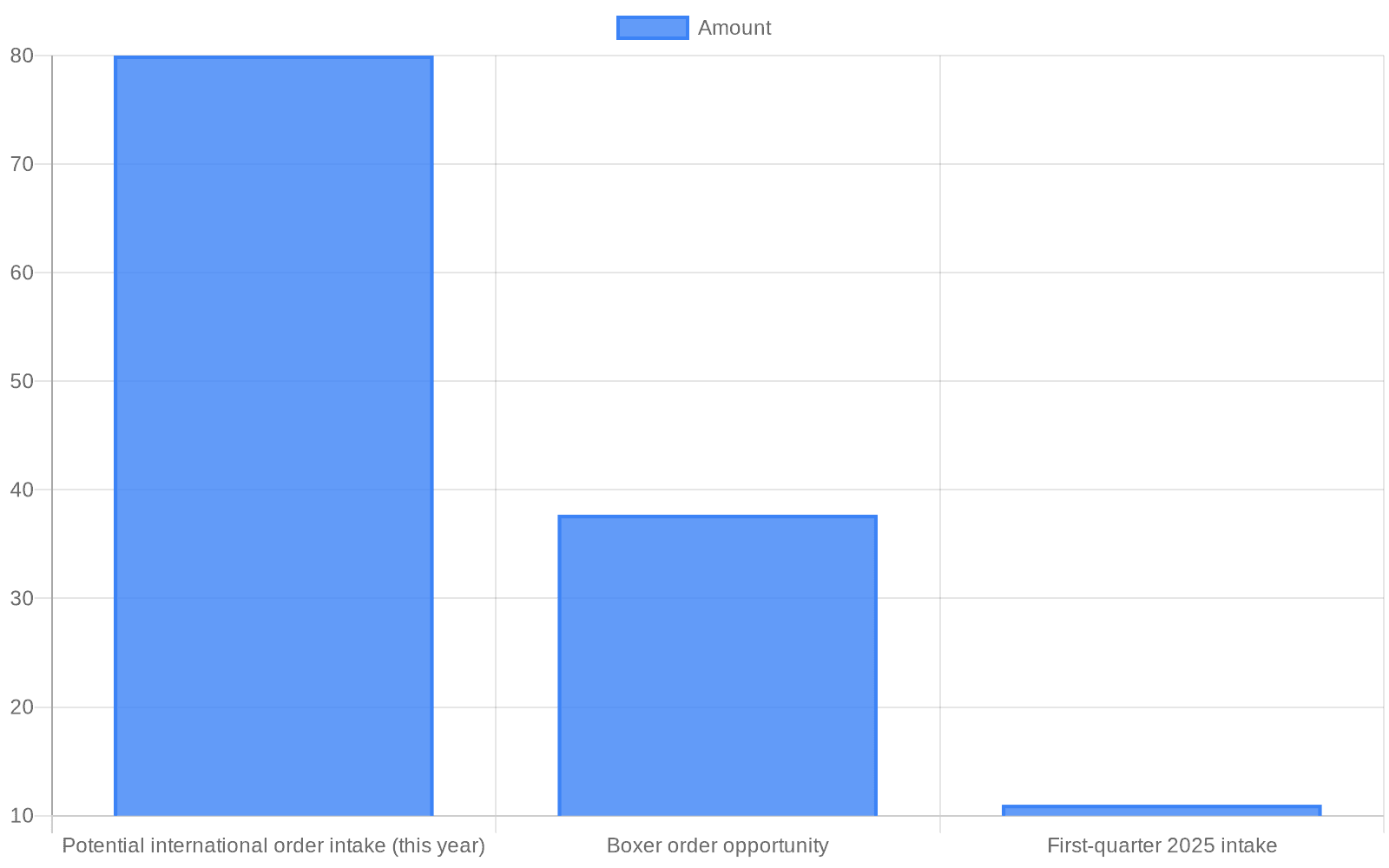

Rheinmetall’s chief executive, Armin Papperger, said at a Handelsblatt conference in Berlin that the German defence group sees roughly €80 billion of potential international order intake this year as global demand for ammunition, vehicles and naval systems intensifies. The figure, which reflects contract competitions rather than signed awards, includes large-ticket opportunities such as the Boxer armoured personnel carrier, the F126 and F127 frigate programmes and an additional batch of Puma infantry fighting vehicles. The €80 billion estimate is about $93.54 billion using the exchange rate cited by the company.

Papperger broke down the headline number, citing a Boxer order opportunity of €37.7 billion and frigate orders in the range of €12–13 billion. Those programme-level figures underpin a broader catch-up in European and allied procurement driven by years of elevated defence spending and accelerated by ongoing geopolitical tensions. Company executives framed the potential intake as the result of multiple live competitions across land, sea and ammunition supply chains rather than a single blockbuster contract.

The projection comes against a backdrop of rapidly rising demand and an already swollen order book. Rheinmetall reported a dramatic jump in early order momentum in 2025, with first-quarter intake up 181% to about €11.0 billion and an order backlog at roughly €62.6–63.0 billion as of March 31, 2025. That stock of work follows fiscal 2024 consolidated sales of €9,751 million, up 36% from €7,176 million a year earlier, with the defence segment accounting for roughly 80% of revenues.

Papperger’s Jan. 22 remarks are the most recent in a string of bullish projections. In April 2025 he said Rheinmetall could lift its order book to as much as €300 billion by the end of the decade, contingent on sustained procurement programmes and capacity expansion. The company has already taken steps to position itself: a December 2024 acquisition of Loc Performance Products for $950 million, now operating as American Rheinmetall Vehicles, aims to deepen ties to U.S. programmes such as the XM30 infantry fighting vehicle and the Common Tactical Truck, programmes analysts value at more than $60 billion combined.

Operationally, Rheinmetall is scaling production across Europe and beyond. Plans to expand ammunition and vehicle production in Romania, Lithuania, Hungary and Ukraine include a new plant at Baisogala, Lithuania, expected to be operating by mid-2026 to produce 155 mm artillery rounds. Management has set medium-term financial targets consistent with rapid growth: group revenue growth of 25–30% for 2025 and a defence segment growth of 35–40%, with an operating margin target around 15.5%.

Markets reacted cautiously to the announcement. Shares traded on XETRA were down roughly 2.25% intraday, around €1,813.25 at a mid-session snapshot. Investors appear to be weighing the scale of the opportunity against execution risks: converting potential contracts in contested procurement processes into confirmed orders requires negotiation, export approvals and production ramp-up.

The €80 billion figure underscores a wider shift in defence-industrial dynamics: governments are accelerating procurement while suppliers race to expand capacity and secure supply chains. For European defence policy makers, the scale of potential orders highlights both an opportunity to rebuild capabilities and a budgeting challenge as states balance defence needs against fiscal constraints. For Rheinmetall, turning potential into firm contracts will test its industrial footprint and financial guidance as the company seeks to convert record demand into sustainable revenue and margins.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip