Erasca upsizes $225 million offering to accelerate RAS/MAPK oncology

Erasca priced 22.5 million shares at $10 to raise $225 million to advance RAS/MAPK programs and extend its clinical runway.

Erasca Inc. priced an upsized public offering that will raise roughly $225.0 million in gross proceeds by selling 22,500,000 shares of common stock at $10.00 per share, the San Diego precision oncology company disclosed. The primary offering, expected to close on Jan. 23, 2026 subject to customary conditions, was arranged by J.P. Morgan, Morgan Stanley, Jefferies and Evercore ISI as joint book‑running managers.

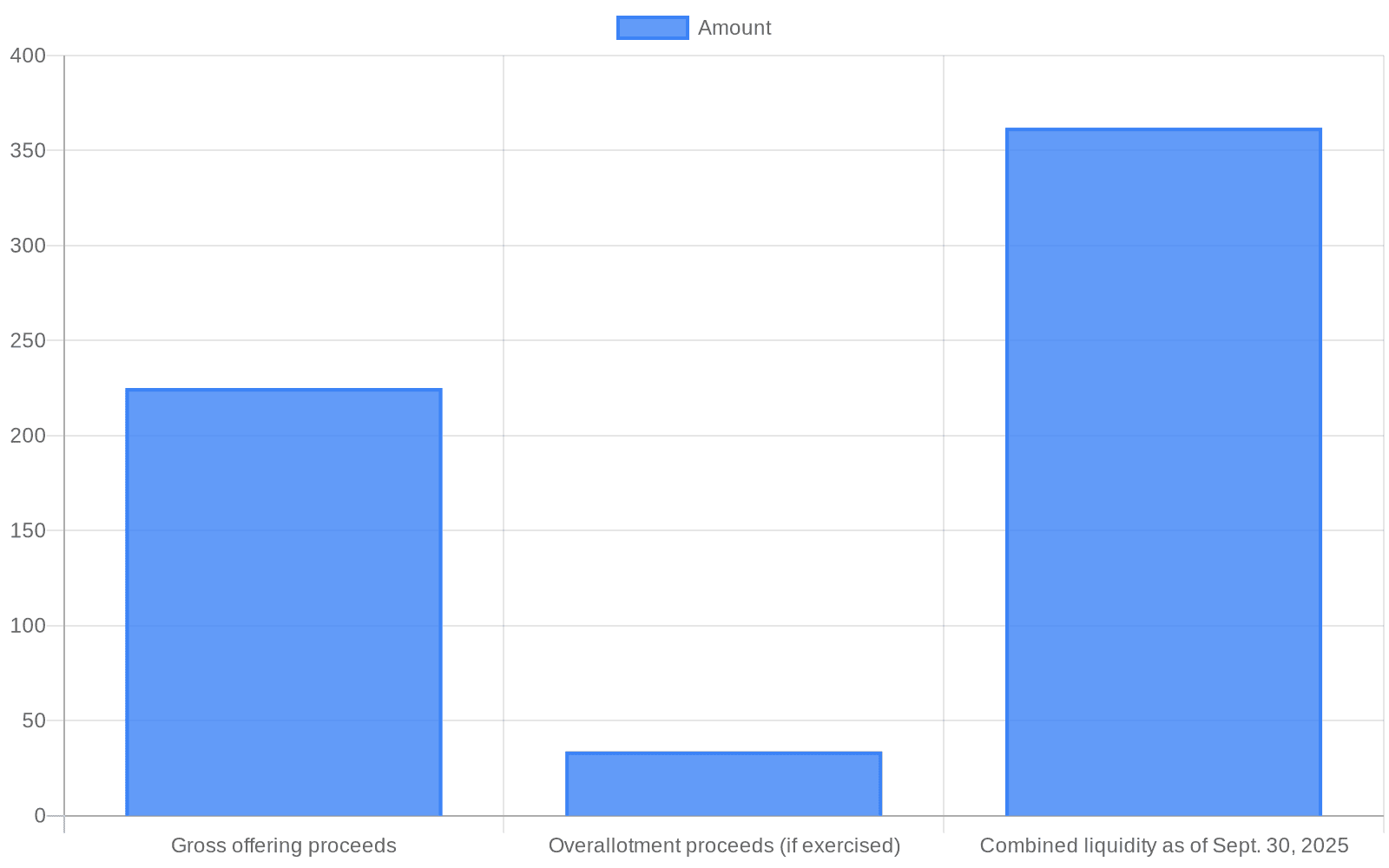

The company granted the underwriters a 30‑day option to buy up to an additional 3,375,000 shares at the public offering price, less underwriting discounts and commissions. If exercised in full, that overallotment would generate an incremental $33.75 million in gross proceeds before fees. Gross proceeds figures exclude underwriting discounts, commissions and other offering costs, which will reduce the net cash Erasca receives.

Erasca said the net proceeds from the offering, together with existing cash, cash equivalents and marketable securities, are intended to fund research and development of its product candidates—specifically RAS/MAPK pathway oncology programs—and for working capital and general corporate purposes. The securities are being offered under a shelf registration statement on Form S‑3 that the company had on file, a procedural step that allows faster access to capital markets when needed.

Analysts and market commentators framed the raise as a tactical cash infusion meant to extend Erasca’s clinical runway. Ainvest’s analysis cited by market feeds estimated Erasca had combined liquidity of $362 million as of Sept. 30, 2025 and projected that adding the expected $225 million would fund operations into the second half of 2028. That projection rests on assumptions about planned R&D spending and trial timelines; Ainvest also highlighted near‑term 2026 clinical milestones for ERAS‑0015 and ERAS‑4001 as key potential value drivers.

The financing carries the familiar tradeoff for biotechnology investors: a clearer funding runway to advance multiple trials at the cost of near‑term dilution. Issuing 22.5 million new shares at $10 represents a meaningful increase in share count, and the potential exercise of the underwriter option would add further dilution. Market commentary noted a short‑term share price reaction following the announcement, with one cited feed reporting a roughly 4.18% drop in the immediate response.

For Erasca, which focuses on therapies for RAS/MAPK pathway‑driven cancers, the capital raise buys time to pursue clinical development that could materially affect valuation, particularly if the cited ERAS‑0015 and ERAS‑4001 milestones read out positively. Failure to meet those milestones, or higher than expected development costs, would expose investors to the usual binary outcomes of clinical‑stage drug development.

The offering illustrates broader dynamics in the biotech financing cycle: companies with shelf registrations are able to tap equity markets quickly to fund costly clinical programs, shifting near‑term financing risk from uncertain private rounds to public equity that dilutes existing holders. The final size of Erasca’s cash cushion will hinge on underwriting fees and expenses and whether the overallotment is exercised. The company is expected to report closing results and any updated cash‑runway guidance after the deal completes and as management lays out forthcoming milestone timelines.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip