GE Aerospace projects 2026 earnings above forecasts as aftermarket booms

GE Aerospace expects 2026 adjusted EPS to top analyst estimates as airlines boost spare‑parts and maintenance spending amid aircraft delivery shortfalls.

GE Aerospace said it expects adjusted 2026 earnings per share of $7.10 to $7.40, slightly above analysts' average projection of $7.11, as demand for high‑margin aftermarket parts and services strengthens. The Ohio‑based aircraft engine maker also forecast revenue growth in the low double‑digit percentage range for 2026, driven by expansion in its Commercial Engines and Services business.

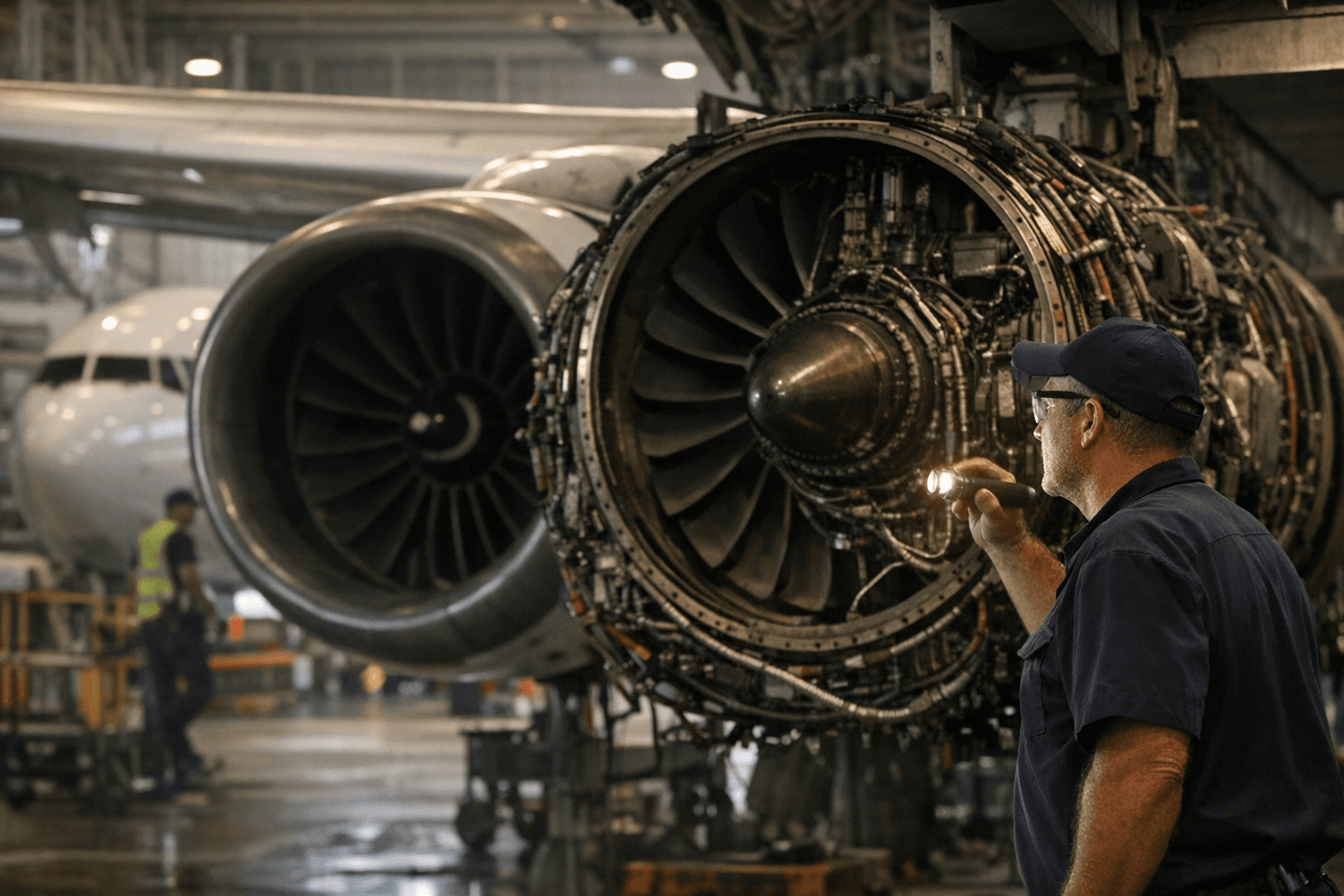

The company reported a fourth quarter that beat expectations, delivering adjusted EPS of $1.57 versus a $1.40 consensus and revenue of $11.90 billion compared with $11.27 billion expected. Management attributed the outperformance to strong margins and improved return on equity, which it said underpin a higher earnings multiple for the business. GE noted that more than 70 percent of its commercial engine revenue now comes from parts and services, and it expects the Commercial Engines and Services division to deliver mid‑teens percentage revenue growth in 2026.

Airlines are prioritizing maintenance and spare‑parts spending because deliveries of new aircraft continue to lag rising global travel demand, creating a supply gap that benefits aftermarket providers. In public comments, CEO Larry Culp said GE Aerospace "enters 2026 with strong momentum and is well positioned to deliver increased value to customers amid continued industry recovery." That commercial dynamic is reducing cyclicality for engine OEMs and shifting profit pools toward recurring service revenue.

Independent industry forecasts point to a durable expansion of the global aftermarket. Oliver Wyman projects that commercial MRO demand will grow at about a 3.2 percent compound annual rate from 2026 through 2035, with the market rising from roughly $119 billion in 2025 to about $156 billion by 2035 and the engine segment growing to capture roughly 53 percent of total MRO spend. Consultancies also highlight record backlogs and double‑digit growth in engine services, a structural tailwind for firms that control parts and support networks.

The shift toward higher‑margin services has strategic and competitive implications. Original equipment manufacturers such as GE, Pratt & Whitney and Rolls‑Royce are expanding service offerings to capture aftermarket revenue, while independent MRO providers continue to compete on price and flexibility for older fleets. Regional markets, notably in the Middle East, are expanding capacity with some operators targeting 40 to 50 percent increases over the next five years to reduce reliance on traditional maintenance hubs.

The sector faces financial and operational headwinds even as demand rises. Suppliers in the manufacturing chain often require payment months before completed deliveries, creating working‑capital pressure; Boeing has forecast a free operating cash flow shortfall in 2025 that swings positive in 2026 as production ramps. The industry is also investing in productivity levers such as AI and predictive maintenance, with IDC forecasting U.S. aerospace and defense spending on AI and generative AI reaching $5.8 billion by 2029.

For investors, GE's guidance signals a reweighting of risk and reward across the aerospace cycle. Strong aftermarket growth supports margin durability and cash generation even as airframe production scales, but the sector's capital intensity and supply‑chain financing remain potential constraints. GE's outlook positions the company to monetize tightened airline supply dynamics, while broader industry trends underscore that the most stable profits are likely to accrue to firms that control engines, parts and long‑term service relationships.

Know something we missed? Have a correction or additional information?

Submit a Tip