Lab-Grown Diamonds Reshape Jewelry Market, Drive Prices Down and Retail Changes

Lab-grown diamonds now account for as much as 45% of U.S. engagement-ring purchases and roughly 15% of fashion jewelry sales, forcing steep markdowns and retailer reshuffles.

Lab-grown diamonds’ rapid ascent is forcing tangible change across the jewelry market, with BriteCo reporting that lab-grown stones accounted for as much as 45% of diamond engagement ring purchases in the US in 2024 and Nasdaq saying “LGDs now represent about 15% of fashion jewelry sales, nearly double from last year’s penetration.” The combined scale and falling unit costs are pressuring retail pricing and assortments, and retailers are already adjusting AURs, promotions and inventory strategies in response.

Pricing shows wide but consistent pressure: Carattrade finds “currently, lab-grown diamonds typically cost 60-80% less than comparable natural diamonds,” and gives a one-carat range for a high-quality lab-grown at $1,500 to $3,000 versus $8,000 to $15,000 or more for an equivalent natural stone. Other measures differ; Caratx reports a 20-40% price advantage and BriteCo calculates that the per-carat cost gap moved from 26.6% lower for lab-grown rings in 2019 to a 72.8% difference “today,” illustrating how methodology and timeframe change the headline discount but not the direction of price erosion.

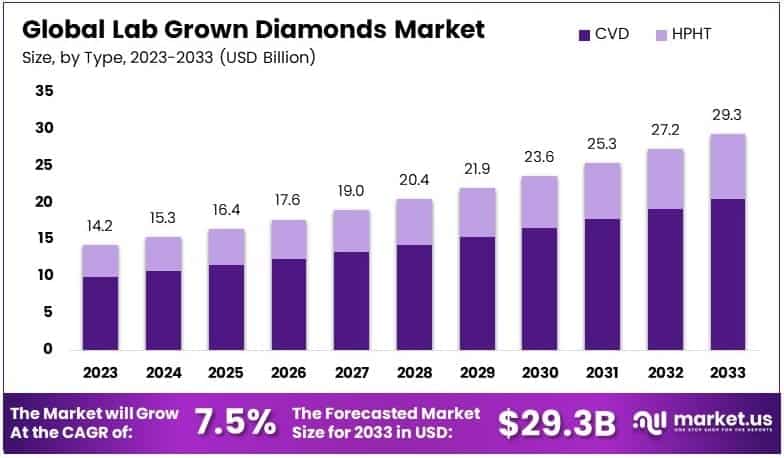

Supply and scale underline the numbers: Carattrade, citing GIA data, reports that “lab-grown diamond production has increased by over 15-20% annually since 2016,” and global market shares shifted from approximately 2% in 2018 to nearly 20% by 2023. Market-size forecasts point to continued expansion, with a Coherent Market Insights projection cited by Caratx that the global lab-grown diamond market could grow from $27.7 billion in 2025 to $44.5 billion by 2032, a 60% increase and a 7% CAGR.

Retail impact is already measurable at Signet Jewelers. Nasdaq coverage highlights that Signet sees LGDs “helping close historical assortment gaps while also supporting higher average unit retail,” with Fashion AUR up 8% year over year, Bridal AUR up 6%, Jared delivering 10% comparable sales growth, and “Signet reported 80 basis points of merchandise margin expansion, aided by refined pricing, reduced promotions and a favorable mix shift toward LGD fashion, helping offset tariff and gold-cost pressures.” Nasdaq concludes that “LGD fashion is proving to be both a traffic driver and a margin-accretive category.”

The market shift carries macroeconomic consequences. Carattrade warns that “traditional diamond mining regions, particularly in Africa, have experienced significant economic pressure” and notes that countries like Botswana “derive approximately 20% of its GDP from diamond mining,” signaling potential long-term revenue and employment risks if natural-diamond demand softens further.

Operationally, Gordonbrothers urges retailers and lenders to adapt to lower price points and faster inventory turns by rethinking compensation and credit practices. The firm suggests retailers “reconsider commission structures” because “the dollar value of a salesperson’s commissions is likely to fall,” and recommends lenders establish “inventory valuation updates every six months or so, so lenders can understand their risks as prices of lab-grown and natural diamonds continue to fall.”

Looking ahead, BriteCo frames the sector as bifurcating and offers specific watch points: lab-grown diamonds as an accessible everyday luxury, natural stones repositioning as exclusives, a possible swing back toward natural diamonds in Q1-Q2 2025, and rising demand for fancy colored lab-grown stones because of affordability and customization. Trackable signals to watch include Signet’s channel AURs and comps, GIA production volumes, BriteCo’s per-carat spreads, CMI’s market-size trajectory, and Botswana’s export and GDP receipts. Have you bought or sold a lab-grown engagement ring lately? Tell us what you paid.

Know something we missed? Have a correction or additional information?

Submit a Tip