Oregon lists Baker County governments missing multiple financial audits

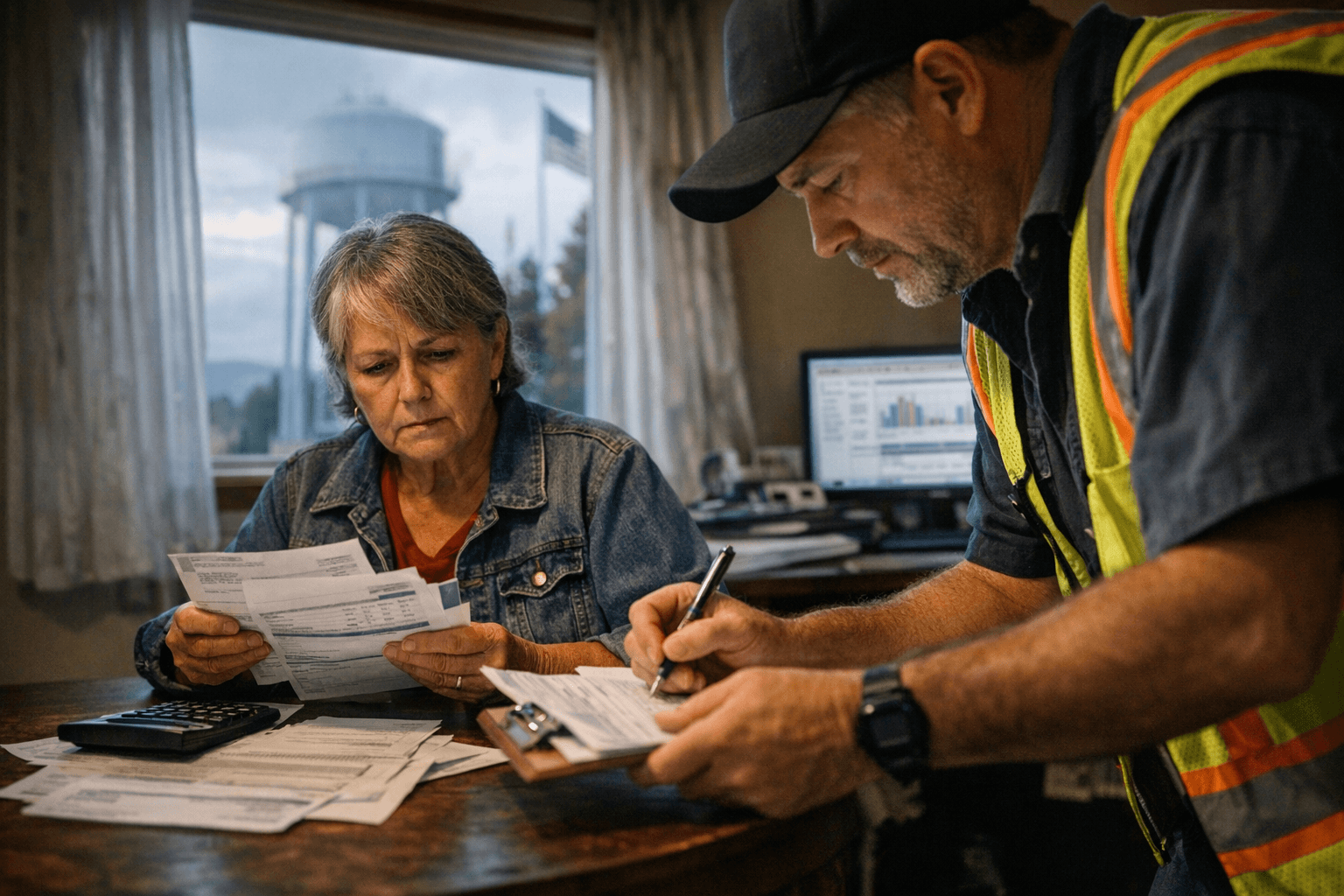

Several Baker County governments failed to file required audits, raising transparency and budget questions for local residents and service providers.

The Oregon Secretary of State’s Office released a statewide list on January 16 showing more than 200 municipalities delinquent in filing required financial reports, and several Baker County entities appear among those named. The listings cover cities, school districts, special districts, public corporations and county offices that are subject to control by local governments, and missing filings can affect public oversight of local budgets and services.

The office’s press release noted the legal requirement: “Under Municipal Audit Law, Oregon’s municipalities are required to submit annual reports with key financial information to the Secretary of State’s Office. For most entities, this report must be a financial audit conducted by a certified public accountant; for other, smaller entities, they may self-report expenditure information.”

Locally, the release identified specific gaps. The City of Baker City is missing an audit from 2024. Baker County is missing audits from 2022, 2023 and 2024. Baker Valley Irrigation District is missing audits from 2023 and 2024, and Burnt River Irrigation District is missing “In Lieu” documents from 2024. Baker Rural Fire Protection District and Baker Valley Vector Control District are each missing audits from 2024, while Pine Valley Rural Fire Protection District is missing “In Lieu” documents from 2024.

Statewide context matters for local readers. The press release acknowledged a long-running problem and slow progress: “The number of delinquent filers remains significantly higher than when the Audits Division began publishing this information in 2017; however, it is an improvement from May 2025, when 385 municipalities were delinquent.” For Baker County, the concentration of missing reports across the county office, a city, irrigation districts and rural fire districts highlights how the issue crosses government types that deliver key services here.

Missing audits reduce a community’s ability to verify how tax dollars and fees are spent, complicate budgeting decisions, and can hinder applications for state or federal grants that require up-to-date financial documentation. For districts that manage irrigation, fire protection and vector control, the absence of recent audited statements can make it harder for residents, renters and local businesses to assess long-term fiscal health and service reliability.

Residents seeking clarity should inquire at regular public meetings or contact their elected boards, treasurers or clerks to ask whether audits are underway or when filings will be completed. Accountability in small jurisdictions often depends on community oversight as much as on state reporting, and Baker County’s named gaps mean voters and ratepayers will likely see the issue discussed at upcoming council and district meetings.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip