Record Gold Prices Transform Vintage Jewelry Market, Driving Renewed Demand

Spot gold briefly touched $5,102 an ounce and spiked near $5,600 before the Centurion show, forcing designers to cut karats and push silver, lab-grown diamonds, and gold-fill alternatives.

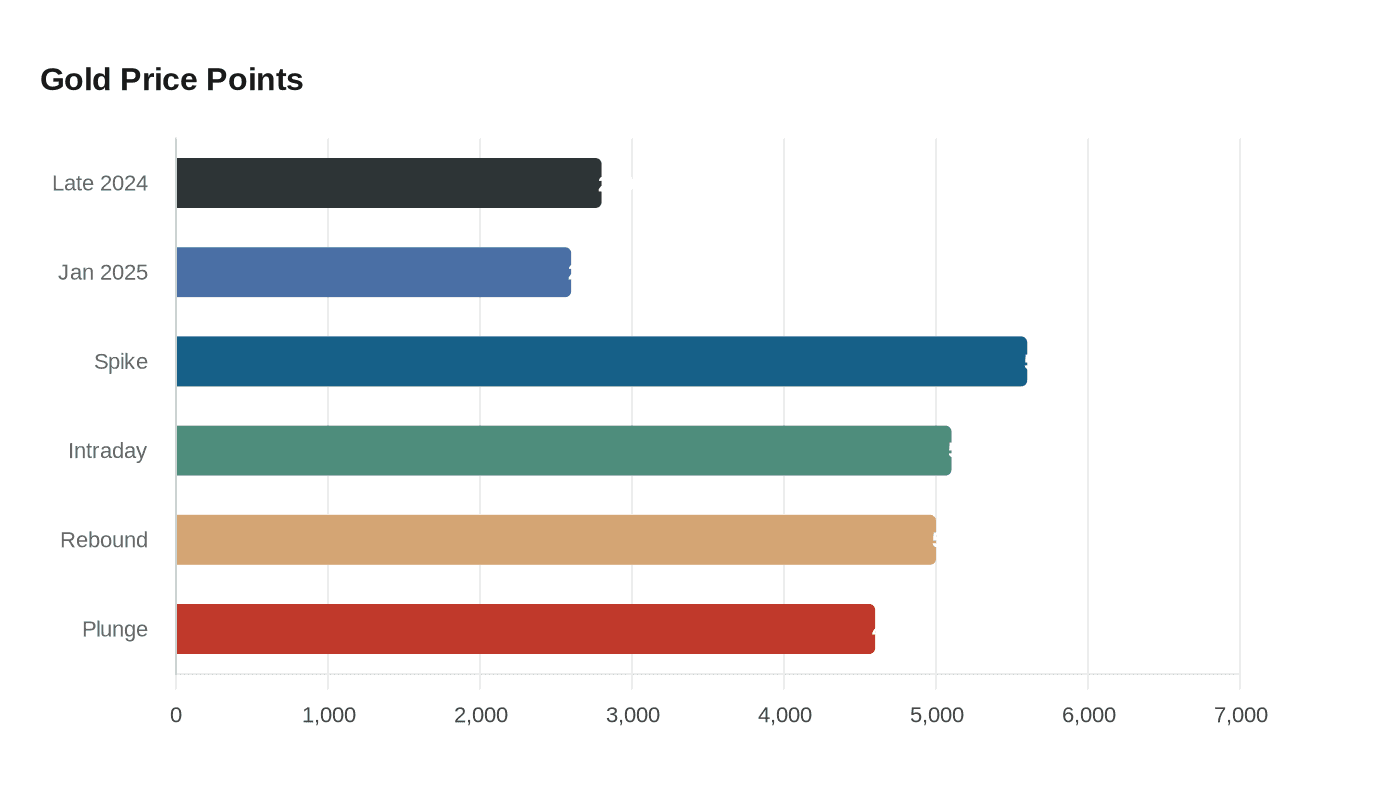

Spot gold’s recent intraday moves have become the industry’s new measuring stick: spot gold briefly touched $5,102 an ounce, capping an 8 percent weekly gain and putting the metal on track for its strongest annual performance since 1979, while Grant Mobley reported a spike to nearly $5,600 days before the Centurion trade show, a plunge to $4,600 two days later, and a rebound above $5,000 as the market settled. Those price swings landed in retailers’ invoices and designers’ sketches overnight.

The rally is not a single-day shock but a multiyear climb. Late 2024 saw a peak near $2,800 per ounce; January 2025 prices hovered around $2,600; and Miia & Me highlights more than 50 percent gains through 2025 as the surge carried into 2026. Metals and bullion flows, rather than jewelry demand, have been the dominant force: Business of Fashion reports central-bank purchases and institutional plus retail investor inflows pushed bullion higher even as manufacturing contracted.

That manufacturing contraction is stark. Metalsfocus data cited in Business of Fashion shows the amount of gold manufactured for jewellery fell about 18 percent in the first half of 2025, a decline that arrived even as jewelers wrestled with record replacement costs. The silver market moved, too — INSTOREMAG reported silver clearing $109.83 an ounce — putting pressure on mixed-metal assortments and raising costs across entry-level and mid-tier ranges.

Designers and shops are responding with real, specific changes. Cathaleen Chen’s coverage in Business of Fashion documents a shift from 18 karat solid gold toward sterling silver, brass, silk cords and lab-grown diamonds, plus thinner profiles and lower-karat pieces to keep price points accessible. An independent designer identified as Oldham summed the math this way: “A simple pearl chain necklace in sterling silver or gold fill I can offer for under $1,000. In solid gold, these days it would be closer to $5,000 to $6,000.”

Retail operations are adapting, too. Ellie Thompson of Ellie Thompson + Co. in Chicago has rethought how she quotes bespoke projects because volatility can move margins between estimate and delivery, and Nebraska Diamond owner Cheryl Kozisek in Lincoln, NE, described how political uncertainty compounds the problem: “I just can’t see the market stabilizing until things with the government stabilize. There is a lot of uncertainty.”

Brands are narrowing narratives as they change assortments. Nangi’s customer messaging stresses solidity and longevity: “Gold holds its value - and in times of economic uncertainty, it often appreciates. Today’s record-high prices only reinforce gold’s reputation as a long-term store of value.” Miia & Me echoes that thread, noting that “people gravitate toward assets they can enjoy while also trusting their enduring worth.”

Not everyone accepts the rally as a new normal. Market watcher Zimnisky warns, “It’s getting too frothy, with a lot of market speculation and short-term investors piling in.” For vintage jewelry specifically, the immediate implication is renewed demand for existing solid-gold pieces that avoid replacement-cost inflation, alongside a creative redefinition of fine jewelry through silver, mixed metals and lab-grown stones. Expect more design thrift and clearer pricing practices as the sector digests bullion markets that now move in weekly, not yearly, increments.

Know something we missed? Have a correction or additional information?

Submit a Tip