Stocks climb as tariff threat recedes - major indexes near records

Wall Street opened higher after the White House backed off threatened tariffs, easing trade fears and pushing major indexes toward record highs.

U.S. equities opened higher Thursday as investors cheered a sudden retreat in threatened tariffs and fresh signs of economic resilience, lifting the Dow, S&P 500 and Nasdaq nearer to record territory and trimming near-term market risk.

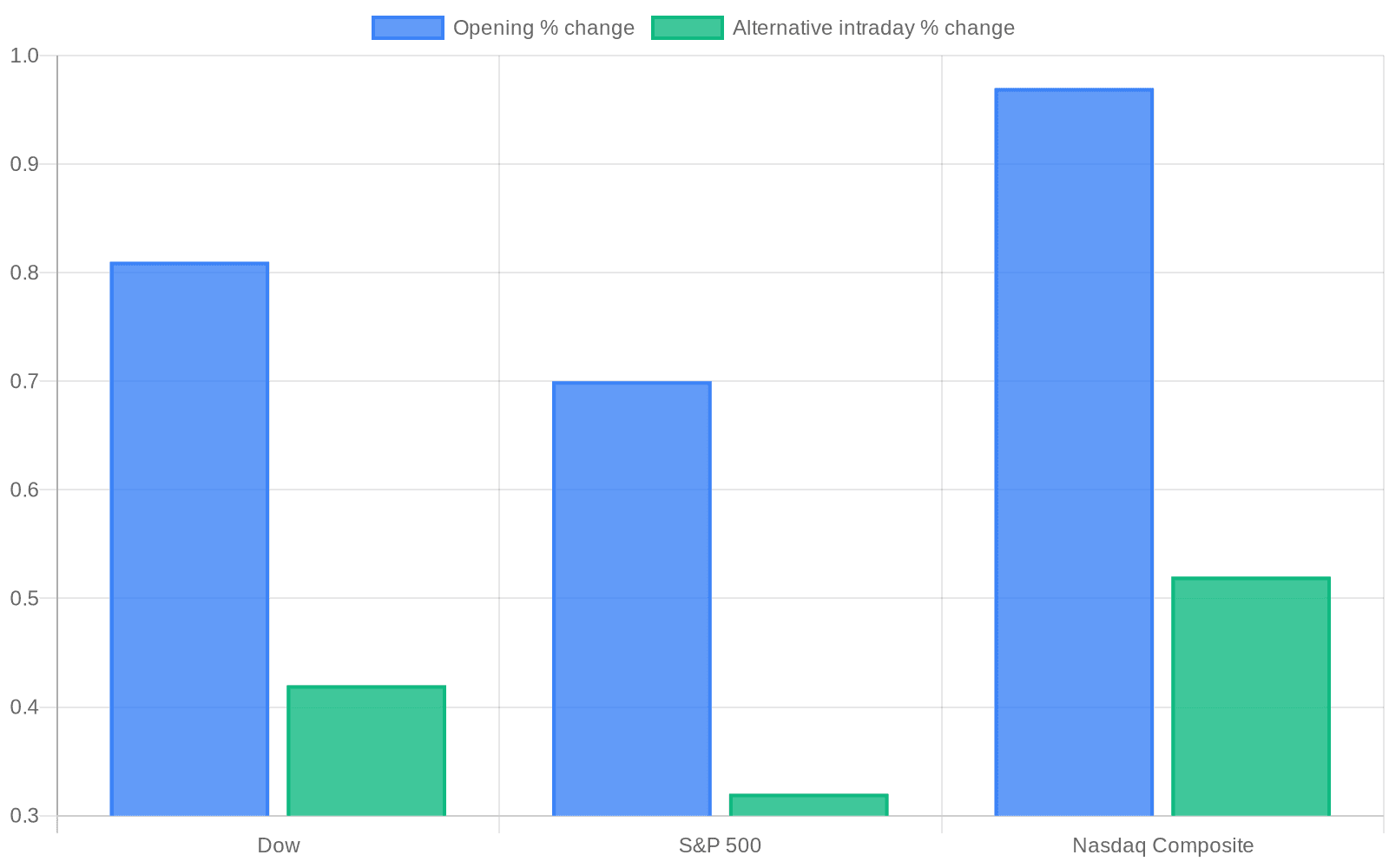

At the opening bell the Dow Jones Industrial Average rose about 0.81 percent, the S&P 500 gained roughly 0.70 percent and the Nasdaq Composite climbed about 0.97 percent. Pre-market e-mini futures showed the S&P 500 e-minis up 41.75 points, Nasdaq 100 e-minis up 219.5 points and Dow e-minis up 201 points. The CBOE Volatility Index slid further from a two-month peak touched on Tuesday, underscoring fading investor angst. Alternative intraday snapshots from an investing data feed showed the S&P up 0.32 percent, the Dow up 0.42 percent and the Nasdaq up 0.52 percent, with a VIX reading near 16.34 and the Dollar Index around 98.37; that feed carries a disclaimer that its prices may be indicative rather than real-time.

The rally followed a de-escalation of a presidential threat to impose tariffs on several European countries amid a dispute over Greenland. The White House signaled it was stepping back from those tariff threats and the president suggested a "deal was in sight" to end the dispute. Investors, who had been shaken by aggressive trade rhetoric earlier in the week, quickly returned to the market when the threat appeared to recede.

The reversal renewed attention to the so-called TACO Trade, a shorthand among strategists for buying assets hit by headline-driven tariff threats on the assumption the administration will ultimately soften its stance. "Put simply, TACO = BTD," said Michael Brown, a senior research strategist, summing up the buy-the-dip logic that has reappeared repeatedly in 2025-26. Market participants noted that buy-the-dip approaches were profitable during last year's rebound, when the S&P 500 rose more than 37 percent from April lows through the end of 2025.

Traders also digested ongoing economic data and policy signals. Attention was shifting to a slate of U.S. releases later in the day, including the final reading of third-quarter GDP, weekly jobless claims and the personal consumption expenditures index, the Federal Reserve's preferred inflation gauge. With inflation still above target in parts of the economy and labor-market data showing resilience, the Fed is widely expected to hold interest rates next week. The president has renewed criticism of Fed Chair Jerome Powell for not cutting rates faster and has said an announcement on the next Fed chair is coming soon.

Market strategists said the combination of fading trade-threat uncertainty and steady economic readings has encouraged risk-taking, at least near term. The S&P 500 had posted its biggest one-day percentage gain in two months on Wednesday amid the initial tariff retreat, and the early Thursday advance suggested buyers were seeking to lock in gains as indexes approached record highs.

Despite the upbeat open, analysts warned that fast-moving political headlines remain a source of volatility. Differences in snapshots across data providers reflected timing and methodology, and some market feeds include explicit disclaimers about non-real-time pricing, reinforcing the need for traders to monitor official exchanges and economic releases through the day.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip