U.S.-India Trade Framework Could Allow Zero-Duty Cut Diamonds, Impacting Engagement Rings

The interim U.S.-India framework cuts many reciprocal tariffs from an effective 50% to 18% and JCK flagged a possible path to zero-duty entry for cut natural diamonds, though timing is unclear.

An interim trade framework announced in February 2026 slashed effective U.S. punitive tariffs on many Indian exports from roughly 50 percent to 18 percent, while carving out category-specific wins such as zero-duty access for listed tropical fruits. The move followed executive action by President Donald Trump, who signed an order on Friday, February 6 to lift the retaliatory tariff, and a New Delhi dispatch on February 3 outlining the broader pact and follow-up commitments.

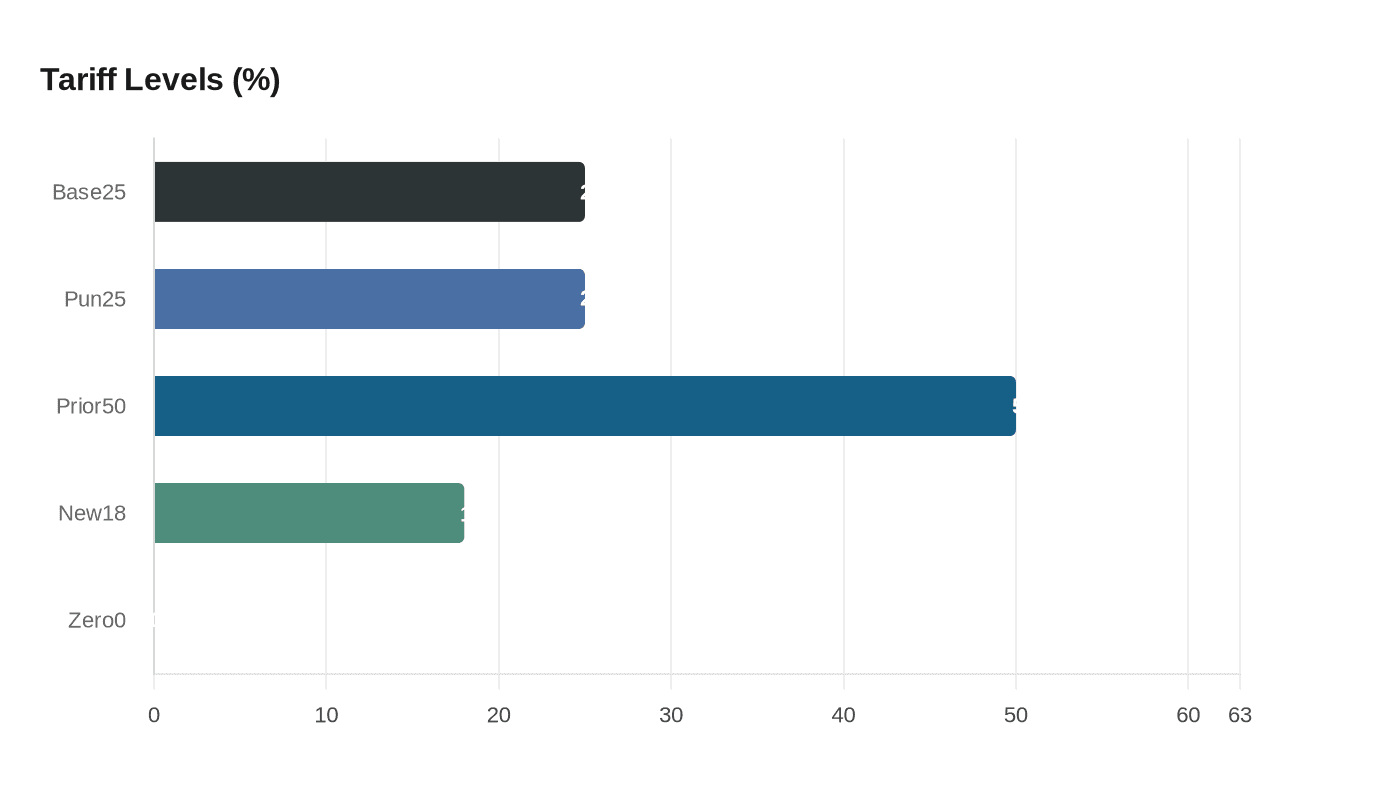

The package reduces a prior structure that industry observers traced to a baseline 25 percent tariff plus a further 25 percent punitive levy tied to Indian purchases of Russian oil, creating the effective 50 percent barrier exporters faced. Freshfruitportal described the change as "the cornerstone of the deal is the dramatic reduction of effective US tariffs on Indian exports from 50 percent to 18 percent," and specifically said "the US has entirely lifted tariffs on Indian tropical fruits, including mangoes, bananas, guavas, pineapples, papayas, and avocados, granting the country zero-duty access to the American $30 trillion market."

Agricultural mechanics are detailed in the framework. The pact eases sanitary and phytosanitary barriers and promises faster clearance protocols for premium tropical fruit varieties, a move framed as establishing a "seasonal synergy" between U.S. Pacific Northwest orchards and India’s southern and western states. Apples will enter India under quotas and Minimal Import Prices aimed at protecting producers in the Himalayan region, while the nut sector has a defined "path for reduced tariffs" on U.S. almonds, walnuts and pecans; strawberries, cherries and citrus were listed as off-limits.

The agreement also ties purchases by India to tariff relief. India will increase purchases of U.S. petroleum, defence equipment, electronics, pharmaceuticals, telecom products and aircraft, and public statements by U.S. Agriculture Secretary Brooke Rollins on social media emphasized the domestic impact, saying the deal will boost American farm exports to India, lifting prices and "pumping cash into rural America." In 2024, America’s agricultural trade deficit with India stood at $1.3 billion, a figure cited in administration commentary.

Diamond and jewelry trade watchers were quick to take notice. JCK industry coverage flagged that the trade move "may clear the way for zero-duty entry of cut natural diamonds - but timing is uncertain," while officials cautioned that it remains unclear which products will see immediate zero duties or phased cuts. One administration statement noted that although the president said India would cut tariffs to zero, "it is not yet clear which products will see zero duties or phased cuts, as in India's EU and UK trade deals."

The political condition behind the shift remains explicit: the punitive tariff was linked to India’s Russian oil purchases, and the interim framework reflects a reciprocal bargain that includes India halting those purchases in exchange for market access. For the diamond supply chain and engagement ring buyers, the framework opens a real possibility of lower costs for cut natural diamonds, but the exact tariff lines, effective dates, quota volumes and enforcement measures still await publication in White House and Indian implementation documents — and until those texts appear, timing and scope remain unresolved.

Know something we missed? Have a correction or additional information?

Submit a Tip