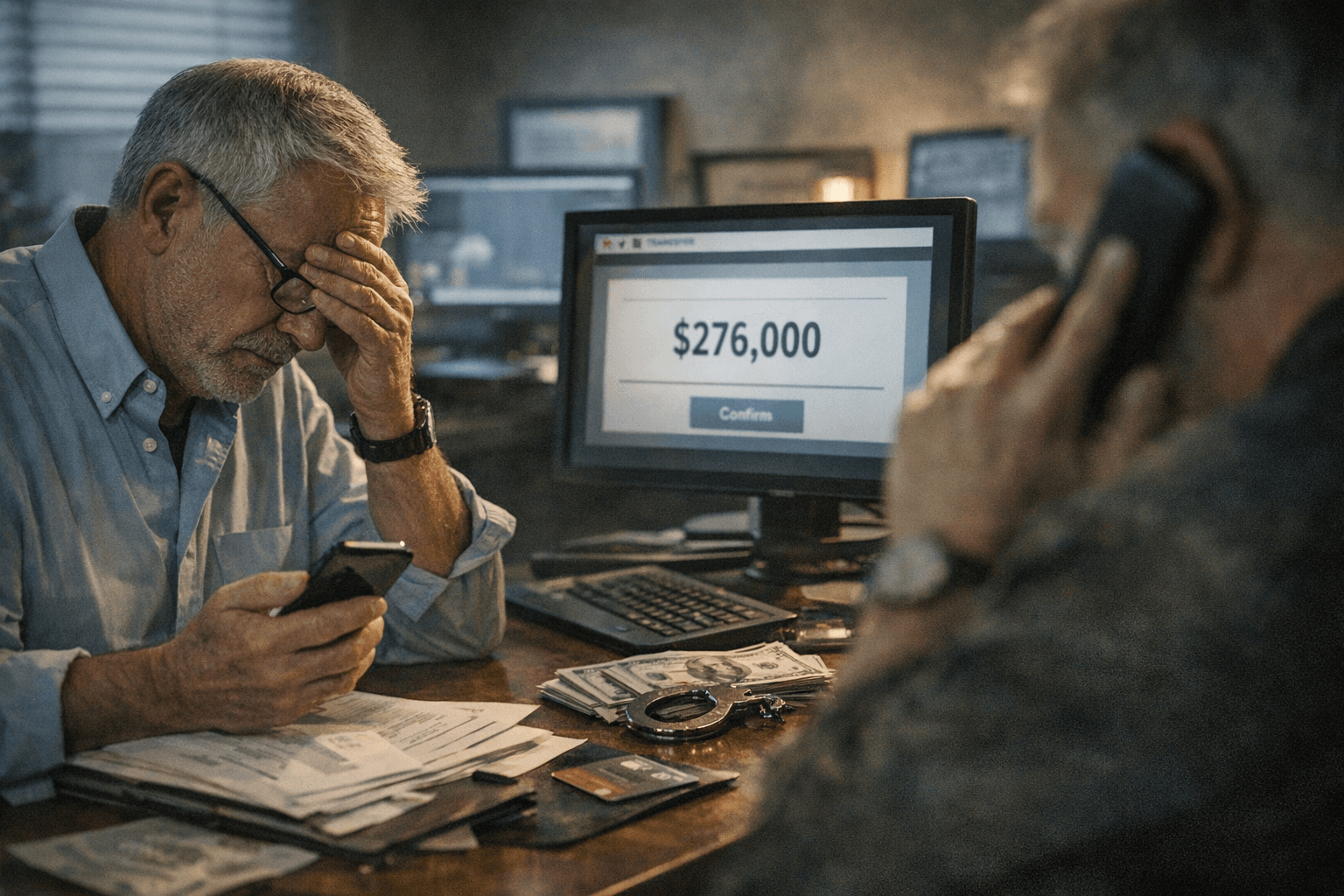

Ballantine Communications Loses $276,000 to Spoofed Bank Call Scam

Ballantine Communications lost $276,000 to a spoofed bank call, a warning to Dolores County residents to verify callers and protect financial information.

Ballantine Communications, Inc., the parent company of the Durango Herald, The Journal and the Tri-City Record, reported that more than $276,000 was fraudulently transferred out of one of its bank accounts the week before Jan. 17, 2026. Company accountants discovered the unauthorized transfers and moved quickly to notify its insurance carrier and bank fraud units, but investigators said the funds had already been routed to multiple banks outside Colorado.

Local law enforcement and bank officials are involved in the ongoing inquiry. Durango Police investigators are working the case with Alpine Bank and other agencies, and federal authorities could become involved because the affected bank is federally insured. Ballantine said payroll, subscriber and advertiser data were not affected, limiting immediate operational disruption to newsroom functions and business services.

The loss illustrates a growing risk for small and mid-sized businesses in rural markets. Spoofed calls - where fraudsters impersonate bank representatives to obtain account access information from staff - exploit gaps in phone-based authentication and human trust. Moving funds to out-of-state accounts complicates recovery efforts and requires coordination across jurisdictions, which can slow recovery and dilute the chances of full restitution.

For a regional media company serving Dolores County, a $276,000 hit is meaningful even if payroll and customer records were untouched. Such losses can pressure working capital, increase insurance premiums and prompt more conservative cash management. Local advertisers and nonprofit partners that rely on timely invoicing may see tighter payment windows. The incident also has broader market implications: banks and community institutions face incentives to harden customer authentication and to educate clients about social engineering risks.

Practical steps are simple and immediate. Verify callers by hanging up and calling a known, verified number for the bank or service; never provide online passwords or multi-factor authentication codes to an incoming caller; and route sensitive transactions through established internal controls, such as dual approvals for large transfers. These measures reduce the effectiveness of spoofing and improve forensic tracing if fraud occurs.

Policy response at the local level can include outreach and training for small businesses and nonprofits, while regulators and banks may need to accelerate adoption of out-of-band verification and stronger token-based authentication. Insurance protections can mitigate direct losses but often involve a lengthy claims process and do not substitute for preventive controls.

The investigation into the transfers remains active. For Dolores County readers, the immediate takeaway is to treat unexpected financial requests with skepticism and to tighten procedures at work and home. Strengthened vigilance and clear verification protocols will be the most valuable defenses as fraud tactics continue to evolve.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip