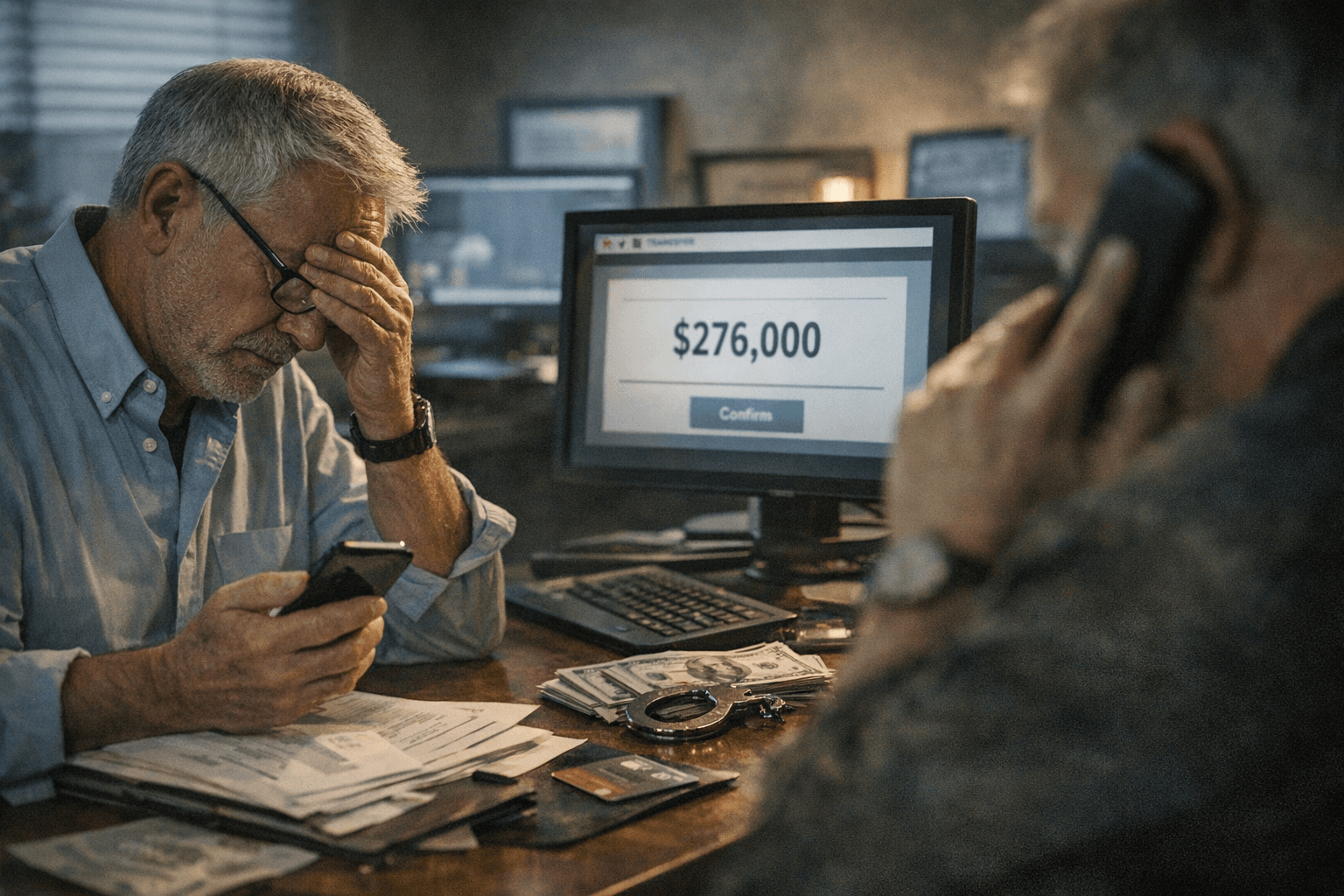

Durango publisher loses more than $276,000 in bank fraud

More than $276,000 was fraudulently moved from Ballantine Communications' account; local police and bank fraud units are investigating and residents are urged to verify bank contacts.

Ballantine Communications, the parent company of The Durango Herald, The Journal and the Tri-City Record, disclosed that more than $276,000 was fraudulently transferred from a company bank account on Jan. 17, 2026. Company accountants identified unauthorized moves and management informed staff during a company meeting; Durango Police opened an investigation into the theft.

Investigators say the suspect obtained account information by posing as a representative of Alpine Bank and then moved funds to multiple banks outside Colorado. Ballantine leadership reported the theft to the company’s insurance carrier and is working with Alpine Bank’s fraud unit to trace the transfers and seek recovery. Company chief executive John Blais told staff the incident did not affect employee paychecks, subscriber records or advertiser data; only financial assets in a single account were targeted.

Durango Police continue to pursue leads. Because the transfers went to institutions outside Colorado and Alpine Bank is federally insured, the case could draw federal authorities if warranted. That potential escalation reflects both the interstate nature of the transfers and the broader jurisdictional reach available for bank fraud cases.

Local economic implications are immediate but contained. The stolen funds, roughly a quarter-million dollars, represent a liquidity hit for a small media owner with multiple local titles. Insurance coverage and cooperation with the bank’s fraud investigators improve the chances of recovery, which would limit long-term operational effects. Still, unexpected cash losses can tighten short-term budgets for local payroll timing, vendor payments and advertising operations until funds are recovered or insurance pays claims.

The incident also underscores a persistent fraud risk for small businesses and households in Dolores County. Alpine Bank officials warned the public about common tactics including spoofed phone calls and email compromises, and advised residents to verify any caller by dialing numbers listed on bank statements or the bank’s official website rather than numbers provided by the caller. For local businesses that move funds electronically, standard risk controls, such as dual approval on transfers, out-of-band verification for large transactions, and routine reconciliation, are critical defenses.

For readers, the immediate takeaways are practical: monitor accounts closely, confirm bank contacts through known phone numbers, and report suspicious communications to local police and your bank. The Durango Police investigation and Ballantine’s work with insurers and the bank’s fraud unit will determine whether funds are recovered and whether charges are filed. The episode reinforces how small, local firms remain attractive targets for increasingly sophisticated impersonation fraud, and it highlights the value of preventative controls for the county’s businesses and residents.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip