Beijing signals likely 2026 GDP target of about 4.5%–5.0% growth

Sources briefed on planning say Beijing will set a 2026 growth target near 4.5%–5.0%, signaling tolerance for slower but steadier expansion.

Sources briefed on government planning say Beijing is likely to announce a 2026 GDP growth target in a range of about 4.5% to 5.0%, a choice that would reflect an acceptance of moderate deceleration as policymakers emphasize higher‑quality expansion over headline speed.

The likely range, discussed by senior officials in recent planning meetings, is expected to be formalized at the National People’s Congress in March when Beijing also unveils its next five‑year plan. Setting a target below the 5.0% headline growth recorded in 2025 would mark a calibrated shift: it acknowledges persistent domestic demand weaknesses while leaving room for targeted support rather than a broad stimulus push.

China’s 2025 outturn — reported growth of 5.0% and a record merchandise trade surplus of US$1.19 trillion — frames the dilemma facing policymakers. Strong export performance helped lift 2025 growth, but a decline in fixed‑asset investment and consumption that has not recovered robustly mean that reliance on external demand is riskier if global momentum falters. “At some point in time, there is not going to be enough global growth,” cautioned Alicia Garcia Herrero, chief Asia‑Pacific economist at Natixis, underscoring the external constraint on China’s export‑led gains.

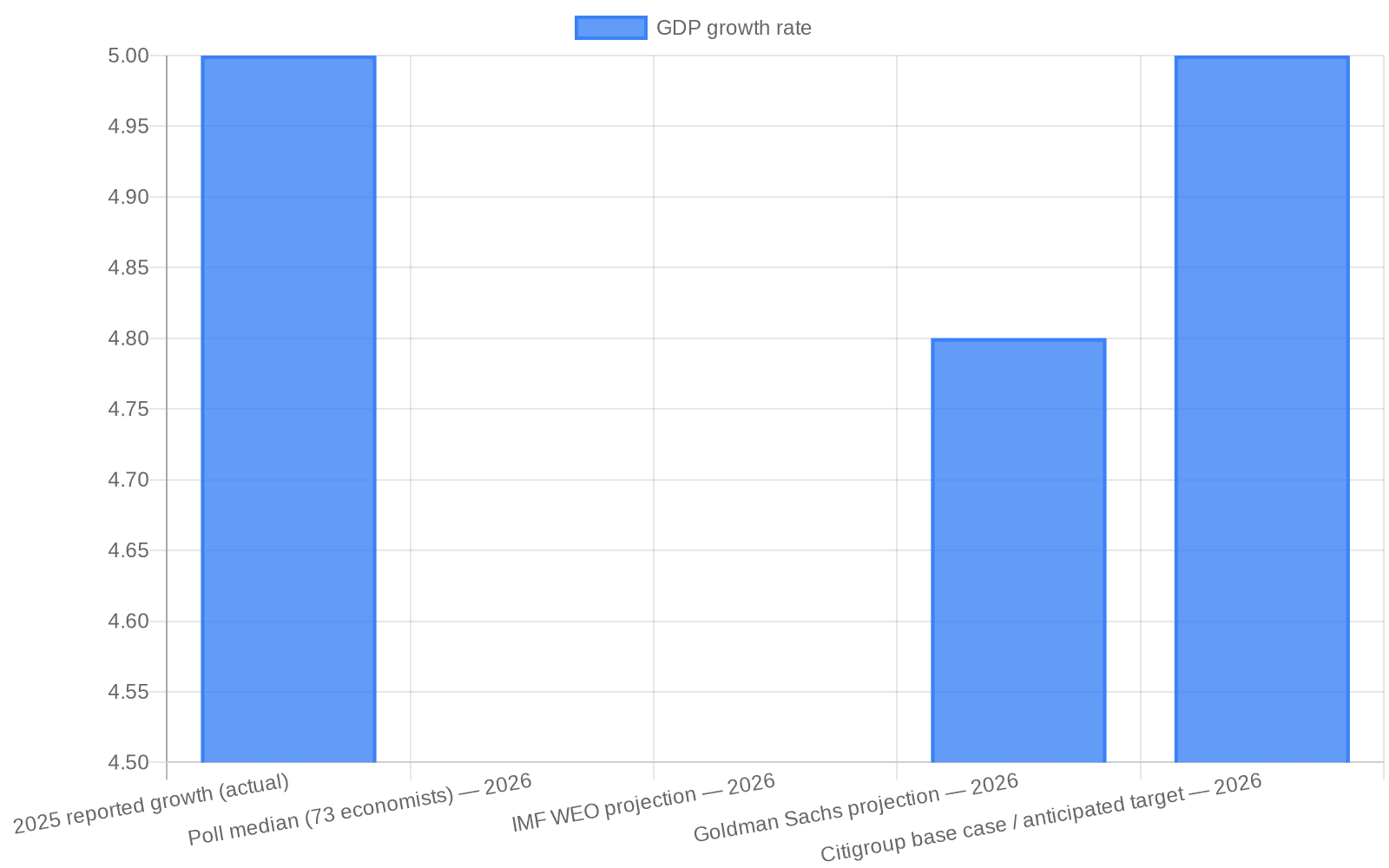

Financial institutions and economists have converged around a slowdown in 2026. A poll of 73 economists put median growth expectations at roughly 4.5% for 2026, and the International Monetary Fund in its latest World Economic Outlook projects China to expand 4.5% next year, revised up from 4.2%. Proprietary forecasts vary: Goldman Sachs models 4.8% growth in 2026, while Citigroup’s base case anticipates an official target around 5.0% and models a modest policy package of about RMB 1 trillion in incremental fiscal spending combined with roughly 20 basis points of rate cuts and 50 basis points of reserve requirement ratio reductions.

Bank of America’s Helen Qiao, speaking at a recent forum, framed the challenge for policymakers succinctly: Beijing could still reach 5% in 2026 but “only with sustained effort,” adding that doing so would not be easy. That candid assessment captures the trade‑offs Beijing faces between setting a higher target that would require aggressive stimulus and choosing a lower target that preserves policy space for structural reforms.

Policymakers retain some conventional tools. Central bank officials have signalled there is room to deploy monetary policy measures, including further reserve requirement ratio adjustments, even after a series of cuts since the pandemic. Officials must weigh those measures against the risks of amplifying imbalances, including the political and trade fallout from a sustained large surplus.

The expected 4.5%–5.0% target would shape market and policy expectations heading into March: it would likely temper immediate expectations for large‑scale stimulus, place greater emphasis on microeconomic reforms to lift productivity, and increase scrutiny of consumption and investment data for signs of durable recovery. Formal confirmation of the target at the NPC will be the definitive test of Beijing’s near‑term economic strategy.

Know something we missed? Have a correction or additional information?

Submit a Tip