Shell explores sale of Vaca Muerta assets amid portfolio overhaul

Shell has held talks with potential buyers for its Vaca Muerta holdings, a move that could reshape investment flows into Argentina's shale sector.

Royal Dutch Shell has sounded out potential buyers in recent weeks to gauge interest in selling some or all of its stakes in Argentina’s Vaca Muerta shale formation, three people familiar with the matter said. The outreach is the latest step in a broader portfolio pruning under CEO Wael Sawan as the oil major focuses on higher-return assets and cost reductions.

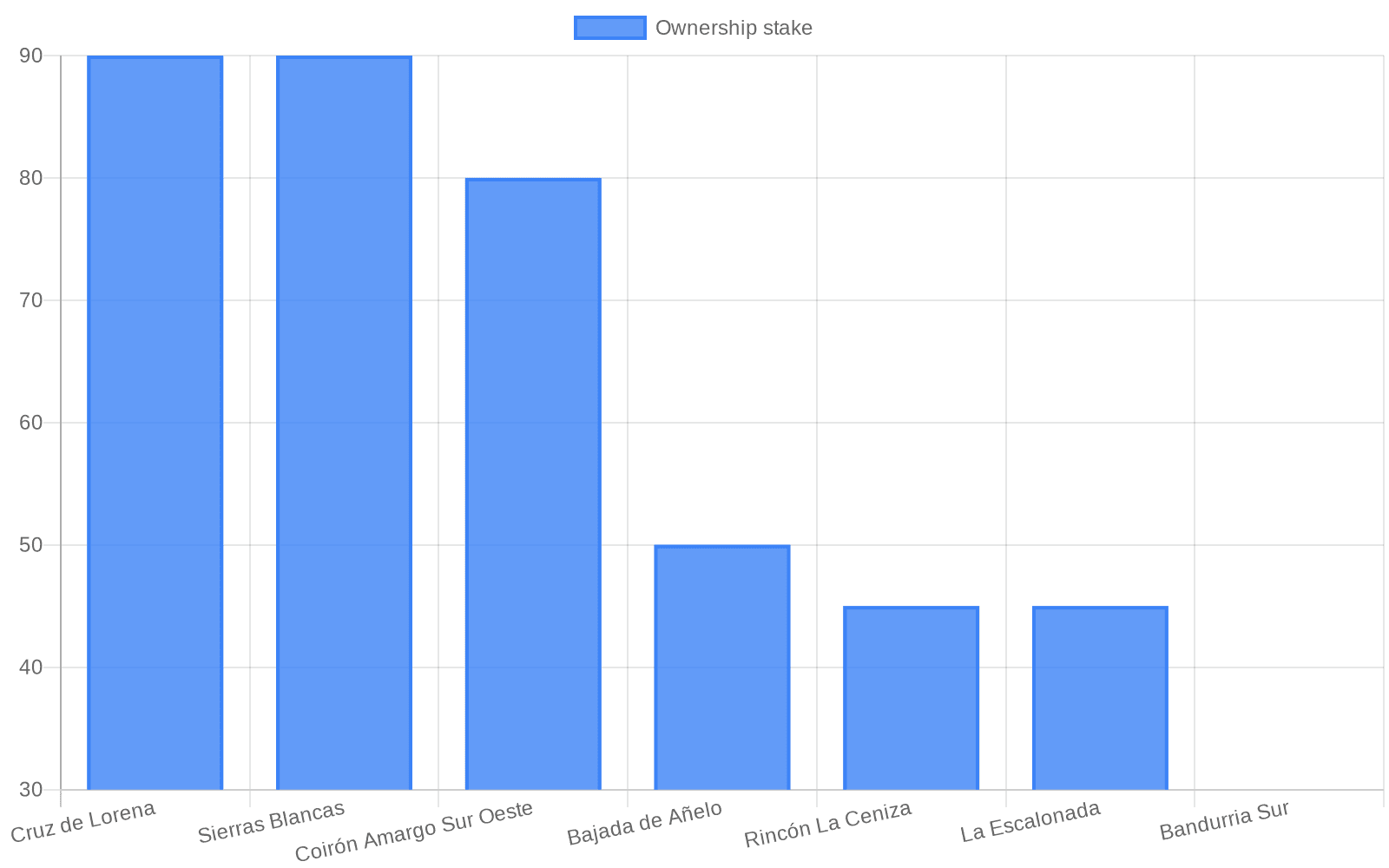

Shell entered Vaca Muerta in 2012 and now holds interests across seven license blocks in the Neuquén Basin. The company operates four majority stakes — Cruz de Lorena (90%), Sierras Blancas (90%), Coirón Amargo Sur Oeste (80%) and Bajada de Añelo (50%) — and holds minority positions in three other blocks, including 45% in Rincón La Ceniza and La Escalonada, both operated by TotalEnergies, and a 30% stake in Bandurria Sur, operated by Argentina’s YPF. Sources say Shell is open to selling a subset of assets or its entire local footprint.

Reported production figures in recent coverage are inconsistent: one source cites Shell as having “booked” 15.6 million barrels from Vaca Muerta in 2024, while another points to Shell’s annual report indicating Argentine production averaged 15,610 barrels per day last year. Both figures are included in public reporting but have not been reconciled by the company. Analysts also note that some producing assets in the basin have break-even economics near $50 per barrel of Brent, underscoring how shifts in commodity prices can quickly alter asset valuations.

Market reaction was immediate. Shell shares fell roughly 1.8% to $72.50 on the news, while YPF slipped about 1.3% to $35.62, signaling investor sensitivity to changes in ownership and operational control in the basin. Industry sources caution that any sale could fetch billions of dollars, but precise valuation is complicated by undeveloped acreage and volatile energy markets.

The potential divestment fits a pattern of strategic exits by the company. Since 2022, Shell has reported driving roughly $3.9 billion in structural cost reductions, and business moves cited by industry observers include exploring sale options for an LNG Canada stake, planning an exit from the al-Omar oilfield in Syria and stepping back from an Argentina LNG project after partner YPF cut capacity plans. These actions reflect a shift from broad geographic exposure to concentrated investment in higher-margin opportunities.

For Argentina, the stakes are material. Vaca Muerta is among the world’s largest shale formations, with industry estimates pointing to recoverable resources on the order of 16 billion barrels of oil and 308 trillion cubic feet of gas. The country’s oil output reached a record last year, topping roughly 816,000 barrels per day and making Argentina the fourth-largest oil producer in Latin America. That production surge has heightened both domestic political interest and international investor appetite, evidenced by recent minority-stake purchases by U.S. independent Continental Resources and others.

If Shell proceeds with a sale, buyers could range from national oil companies and regional independents to private equity-backed energy investors, reshaping the basin’s ownership landscape and potentially accelerating development of undeveloped acreage. Yet industry sources stress that a sale is not guaranteed; Shell could opt to retain assets if bids fall short or market conditions shift. No formal price, timetable or buyer names have been disclosed, leaving the basin’s near-term trajectory dependent on both corporate strategy and global energy-market dynamics.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip