Sun Pharma clears generic Wegovy launch as patent expires in March

Sun Pharma won DCGI approval to make generic semaglutide and will launch Noveltreat after the patent expires in March 2026.

Sun Pharmaceutical Industries has received approval from India’s Drugs Controller General to manufacture and market a generic semaglutide injection for chronic weight management and plans to introduce the product under the brand name Noveltreat after the semaglutide patent in India expires in March 2026. The move positions Sun Pharma as a major entrant in the rapidly growing market for GLP-1 therapies, intensifying competition with innovator firms and other Indian generics makers.

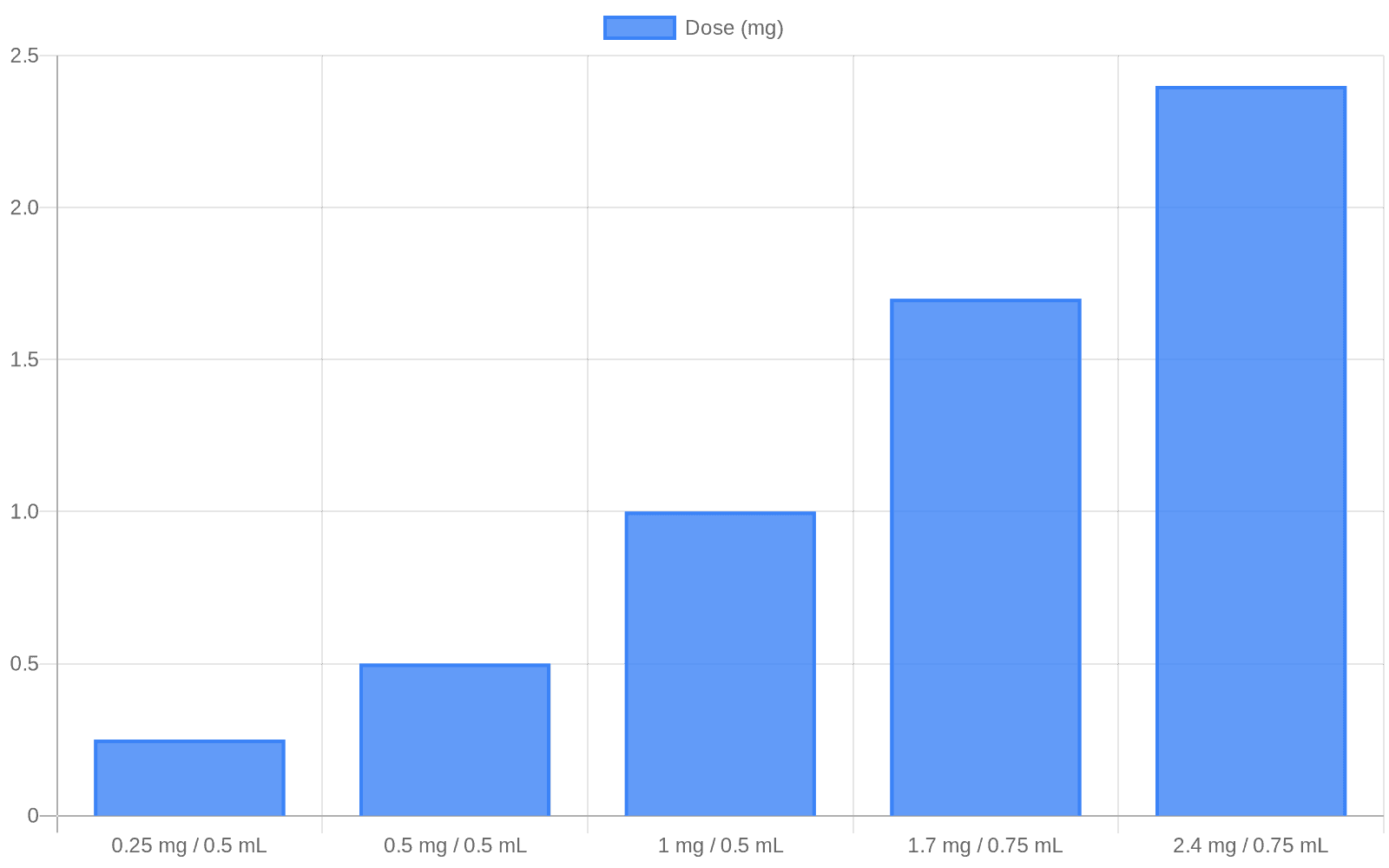

The DCGI approval covers a weight‑loss formulation with five dose strengths that mirror the innovator Wegovy: 0.25 mg/0.5 mL, 0.5 mg/0.5 mL, 1 mg/0.5 mL, 1.7 mg/0.75 mL and 2.4 mg/0.75 mL, with a maintenance dose of 2.4 mg once weekly. Sun Pharma said Noveltreat will be supplied as a prefilled pen and, in the company’s words, “meets global quality standards and is supported by robust Indian clinical evidence on efficacy and safety for weight management.”

Sun Pharma already secured DCGI clearance in December 2025 for a semaglutide injection indicated for type‑2 diabetes and plans to market that diabetes formulation as Sematrinity. A December Delhi High Court order permitted Sun Pharma to manufacture and export its semaglutide formulation but barred domestic sales until the secondary patents covering semaglutide’s formulation and delivery, held by Novo Nordisk, lapse in March 2026. The court also required Sun Pharma to file an affidavit and provide export account details as part of its undertaking.

The approval adds to a wave of regulatory clearances for Indian firms. Dr Reddy’s Laboratories and Alkem Laboratories have also signaled preparations to sell generic semaglutide, and Dr Reddy’s management is targeting production of 12 million pens in its first year. Together, these moves are likely to markedly expand supply in India and potentially for export, shifting pricing dynamics in a market that has seen rapid growth in demand for GLP‑1 receptor agonists.

Analysts expect aggressive pricing from generics to broaden access. Vishal Manchanda of Systematix Institutional Equities said generic players “will come in with lower prices and expand the number of people they can reach out to given their aggressive marketing strategy.” Lower prices in India could reduce off‑label use of diabetes formulations for weight loss and create a clearer clinical pathway for patients requiring chronic weight‑management therapy.

For innovator companies such as Novo Nordisk and other multinational competitors, the domestic entry of low‑cost alternatives will compress margins and force reassessments of launch strategies, pricing and patient support programs. The Delhi High Court’s limitation on domestic sales until March 2026 means the immediate commercial impact will start next quarter, but permitted exports could establish supply chains and volume scale ahead of the domestic rollout.

Longer term, the entry of multiple Indian manufacturers into the semaglutide market underscores a global trend: as high‑value biologic and peptide drugs face patent expiries, capable generics producers are prepared to supply large volumes at lower cost, reshaping treatment access in middle‑income countries. Regulators and payers will face pressure to update reimbursement and usage guidelines as affordability and availability change the calculus of chronic obesity management.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip