China tells banks to curb US Treasury holdings, renminbi rises

Chinese regulators have urged banks to limit new Treasury purchases and trim large positions, a move that rattled U.S. bond markets and strengthened the renminbi.

Chinese financial regulators including the People’s Bank of China and the National Financial Regulatory Administration have verbally advised major banks and other financial institutions to limit fresh purchases of U.S. Treasuries and to reduce existing bank-held positions where exposure is high, according to people familiar with the matter. Officials framed the guidance as a risk-management measure aimed at reducing concentration and market-volatility risk in bank portfolios.

The guidance was conveyed privately to some of the country’s biggest lenders over the past few weeks, with officials stopping short of issuing a written directive or setting explicit sale targets. “The message has been conveyed to major banks over the past few weeks,” sources said. “No specific sales targets or timetable were set.” Regulators were reported to have urged banks to pare back holdings gradually where exposures are large rather than to force abrupt liquidations.

Officials made a point of distinguishing the banking-sector guidance from state asset management: “The directive doesn’t apply to China’s state holdings of US Treasuries.” Sources said the move is intended to diversify financial risk rather than signal geopolitical intent or a loss of confidence in the United States. “The sources said the move is aimed at diversifying financial risk rather than signalling geopolitical intent or a loss of confidence in the United States.”

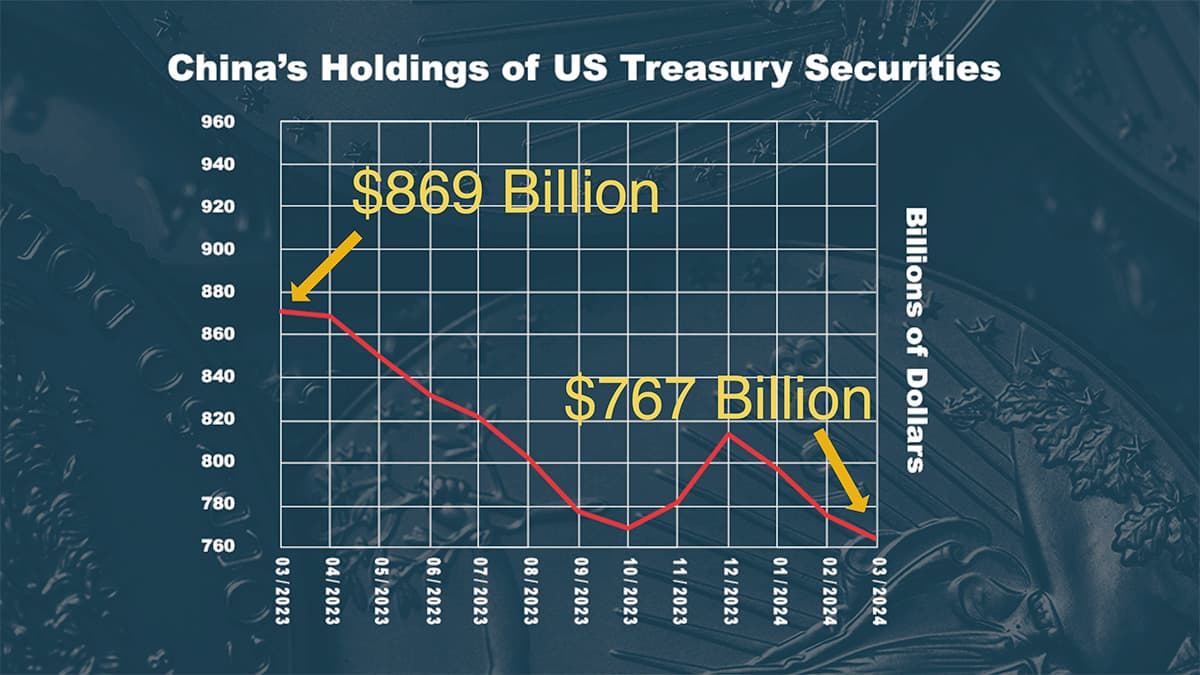

Markets reacted almost immediately after the guidance became public. Ten-year U.S. Treasury yields ticked up by about 0.04 percentage point to roughly 4.25%, while the 30-year yield rose about 0.03 percentage point to 4.88%. The Bloomberg Dollar Spot Index slipped around 0.2%, and the onshore renminbi strengthened against the dollar as investors recalibrated expectations for Chinese dollar demand. Latest data show Chinese banks hold about US$298 billion in dollar-denominated assets, though it is unclear how much of that total is invested in U.S. Treasuries.

The regulators’ verbal approach reflects a familiar trade-off in Chinese policymaking: addressing domestic financial risks without creating headline-driven market disruption or implying an official pivot in sovereign reserve policy. By excluding state-held Treasuries from the guidance, Beijing left intact central-government reserve management while seeking to limit bank-level exposure to interest-rate and liquidity shocks.

For U.S. markets, even modest trimming by big foreign holders could alter liquidity dynamics. Bank portfolio sales would add supply pressure at a time when Treasury issuance is sizeable, making yields more sensitive to marginal flows. For China, asking commercial banks to scale back dollar assets could reduce the pace of accumulated foreign-currency claims on bank balance sheets and ease the need for renminbi selling that has sometimes accompanied corporate or household dollar demand.

Several key questions remain unanswered: which lenders received the guidance, how banks will measure “high” exposure, and whether regulators will follow up with written rules or stress-testing requirements. “China’s central bank has yet to comment,” sources said. Confirmation from regulators, major banks, or published guidance would be needed to judge the scale and timing of any portfolio adjustments and the likely impact on global Treasury markets and currency flows.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip