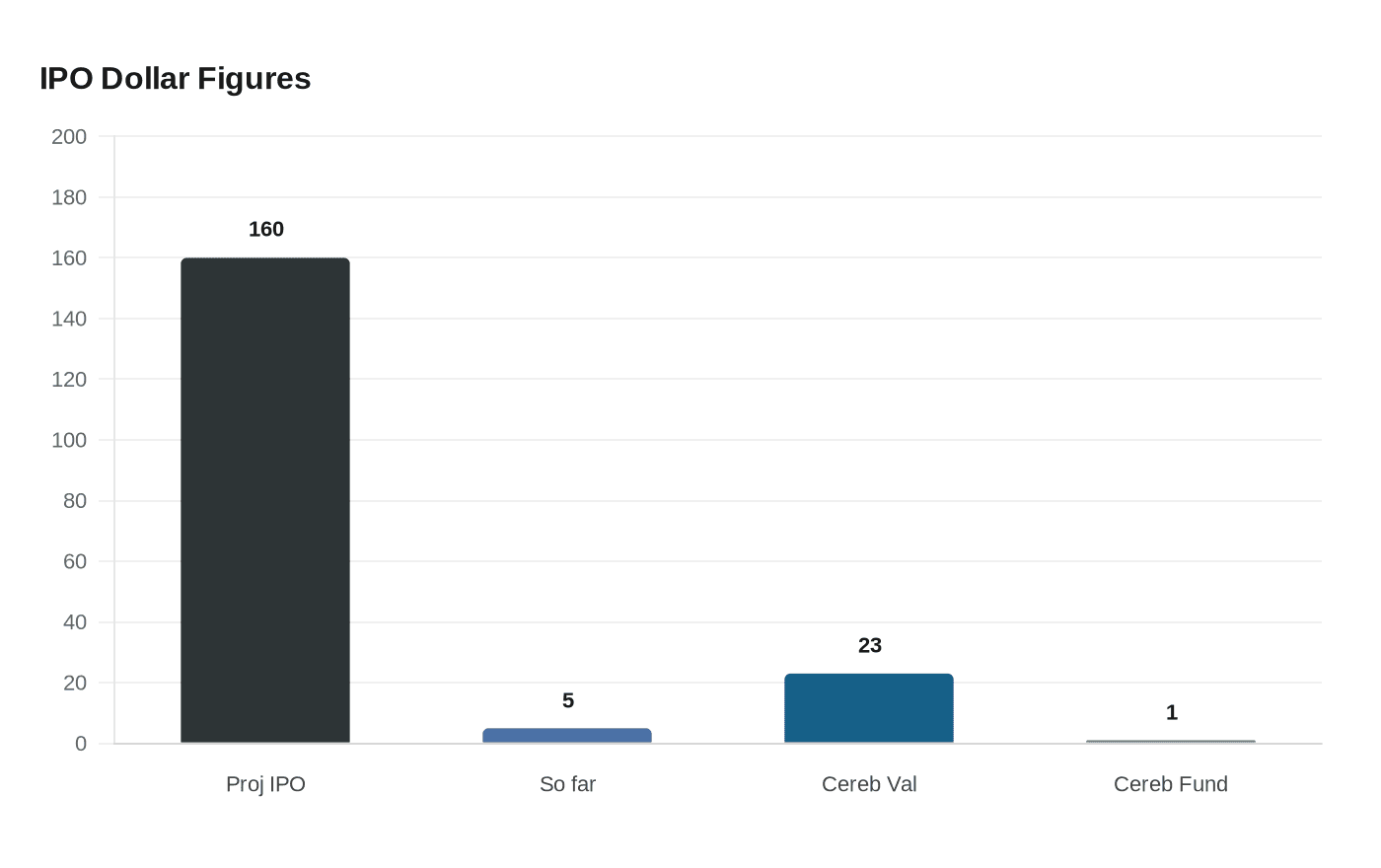

Goldman Sachs predicts U.S. IPO proceeds could surge to $160 billion

Goldman Sachs forecasts U.S. IPO proceeds could quadruple to about $160 billion in 2026, driven by marquee tech listings and easier financial conditions.

Goldman Sachs analysts forecast that U.S. initial public offering proceeds could quadruple to about $160 billion in 2026 and that the number of IPOs could roughly double to about 120 deals, a forecast the firm called the biggest year on record in absolute proceeds. The projection, outlined in a note issued on Friday, comes as improving economic growth, stronger equity prices and easier financial conditions are reviving dealmaking appetite across markets.

The bank’s outlook rests in part on a crowded backlog of large private companies edging toward the public markets. Goldman highlighted marquee names such as SpaceX, OpenAI and Anthropic as potential drivers of outsized issuance. So far in 2026 twelve firms have raised about $5 billion via IPOs, including AI equipment maker Forgent Power (FPS.N) and biopharmaceutical company Eikon Therapeutics (EIKN.O). Nvidia-rival AI chipmaker Cerebras Systems, which just raised $1 billion in a late-stage funding round that valued it at $23 billion, is also in the running.

If realized, the $160 billion projection would set an absolute proceeds record, but Goldman noted the surge would still represent a relatively small slice of overall U.S. market capitalization, reflecting the rapid growth of equity markets over the past decade. That gap between headline issuance and market share frames how the return of IPO activity may influence, but not radically reshape, the broader market landscape.

Goldman flagged risks that could undercut the rebound. An early-year selloff in software stocks has underscored valuation risks, the analysts warned, especially since software accounts for about a quarter of the IPO backlog. "Continued volatility in share prices and corporate confidence are the key macro risks to our forecast. The substantial weight of software in the IPO backlog is another risk," Goldman added.

Market implications are wide-ranging. A sharp increase in issuance would provide exits for late-stage private investors and fresh capital for high-growth companies, easing a bottleneck that has constrained some venture-backed firms. For investment banks, a larger deal pipeline would boost underwriting revenues and fees after several muted years for equity capital markets. For public market investors, the influx of new listings—especially concentrated in software and AI-related areas—could heighten sector concentration and testing of post-IPO valuations.

Policymakers and regulators will likely monitor the pace and composition of issuance. A wave dominated by a few large technology listings may intensify scrutiny of disclosure practices, valuation benchmarks and market structure implications for liquidity and price discovery. At the same time, accommodative monetary and credit conditions that Goldman cites as catalysts for the rebound could shift if inflation or growth dynamics change.

Goldman’s forecast hinges on both the timing and scale of several high-profile listings and on broad market stability. While a record dollar total would be headline-grabbing, the bank’s own caveat—about market volatility and the weight of software in the backlog—underscores that the path to a $160 billion year depends on sustained investor appetite and corporate confidence as the year unfolds.

Know something we missed? Have a correction or additional information?

Submit a Tip