Dow to cut 4,500 jobs in AI-driven overhaul

Dow will cut about 4,500 jobs and pivot to AI-driven operations to boost profitability.

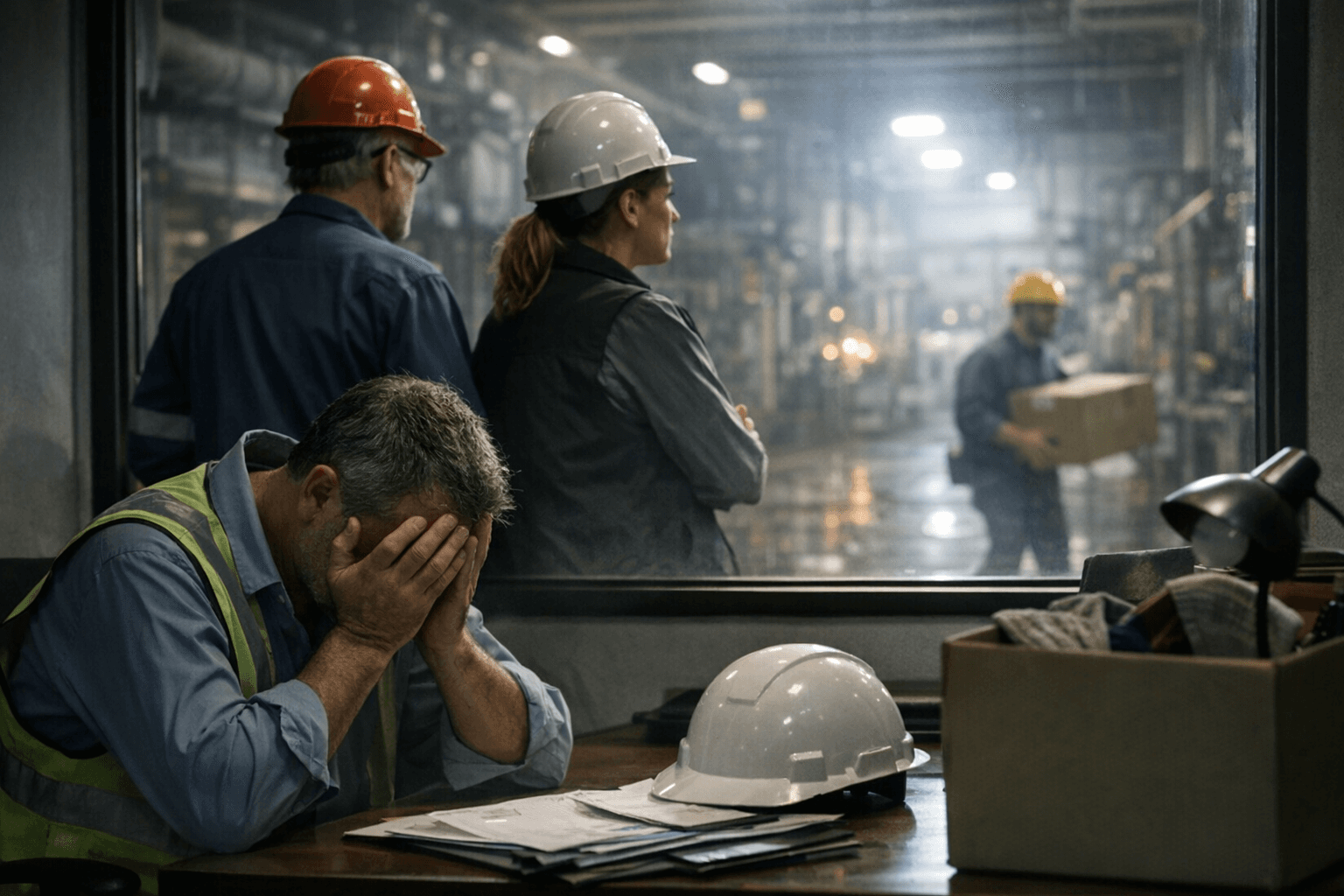

Dow Inc. said it will eliminate roughly 4,500 positions, about 13 percent of its global workforce, as part of a broad restructuring branded "Transform to Outperform" that shifts the chemical maker toward automation and artificial intelligence to lift profitability.

The Midland, Michigan-based company said the move is designed to improve profitability by at least $2 billion while driving what CEO James Fitterling described as a "radical simplification" of global operations. Dow said it expects to incur one-time implementation costs and charges in the range of $1.1 billion to $1.5 billion, including severance expenses of about $600 million to $800 million and other one-time costs of $500 million to $700 million.

Dow has about 34,600 employees worldwide, which makes the announced reduction a significant contraction of its workforce. Company statements framed the cuts as the latest step in a multi-year effort to rework cost structure after prior reductions that included about 2,000 jobs in early 2023, roughly 1,500 roles in January 2025, and plant closures in Europe that eliminated about 800 jobs. Executives have previously pursued multi-year savings goals, increasing earlier targets as business conditions evolved.

Management said the restructuring will pivot the company to an AI-driven operating model and greater automation across end-to-end processes. "We will modernize the way in which we grow with our customers through our industry-leading innovation capabilities and deeper insights into customer and end market needs," Carter said. "Finally, we will fundamentally reset our cost structure. This work will result in a renewed focus on improved raw material sourcing and logistics to drive further efficiencies." The company also described plans to adopt new ways of working to shed layers of bureaucracy and streamline decision-making.

The announcement comes after a difficult period for Dow's top line and profitability. Annual net sales fell roughly 7 percent to about $40 billion year over year, while net losses widened substantially, rising nearly 304 percent to $2.4 billion. Management has previously targeted savings of $1 billion, and updated corporate goals have pushed longer-term efficiency aims higher; the new program builds on those prior initiatives and is intended to deliver sustained cost reduction.

Financial markets reacted modestly to the news, with Dow shares slipping about 2 percent in premarket trading. Analysts and investors will be watching how quickly the company converts the one-time charges into ongoing expense reduction and whether the announced $2 billion improvement is an annual run-rate target or a cumulative figure over a defined period.

The restructuring raises immediate questions about the timing and geographic distribution of layoffs, the business units most affected, and the accounting treatment of the charges across quarterly results. Company executives said the plan will require spending of up to $1.5 billion to implement the changes, but provided limited detail on exact timelines and the allocation of job reductions by region or segment.

The move also echoes broader corporate trends as large employers redirect capital toward AI and automation while trimming headcount. For Dow, the program represents an attempt to reset its cost base amid weak demand in core packaging and plastics markets and to reposition its operations for what management called shifting end-market dynamics.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip