Treasury adds South Korea to U.S. currency monitoring list amid won strain

U.S. Treasury placed South Korea on its semiannual currency monitoring list after Seoul recorded a $52bn U.S. trade surplus and a 5.9% current-account surplus; no country was labeled a manipulator.

The U.S. Treasury has placed South Korea on its semiannual currency monitoring list, saying Seoul met two of the three statutory criteria used to flag potential foreign-exchange concerns even though no trading partner was found to be a currency manipulator. The decision, recorded in the Treasury’s Report to Congress covering July 2024–June 2025, underscores renewed U.S. scrutiny of macroeconomic imbalances and financial flows as the won comes under depreciation pressure.

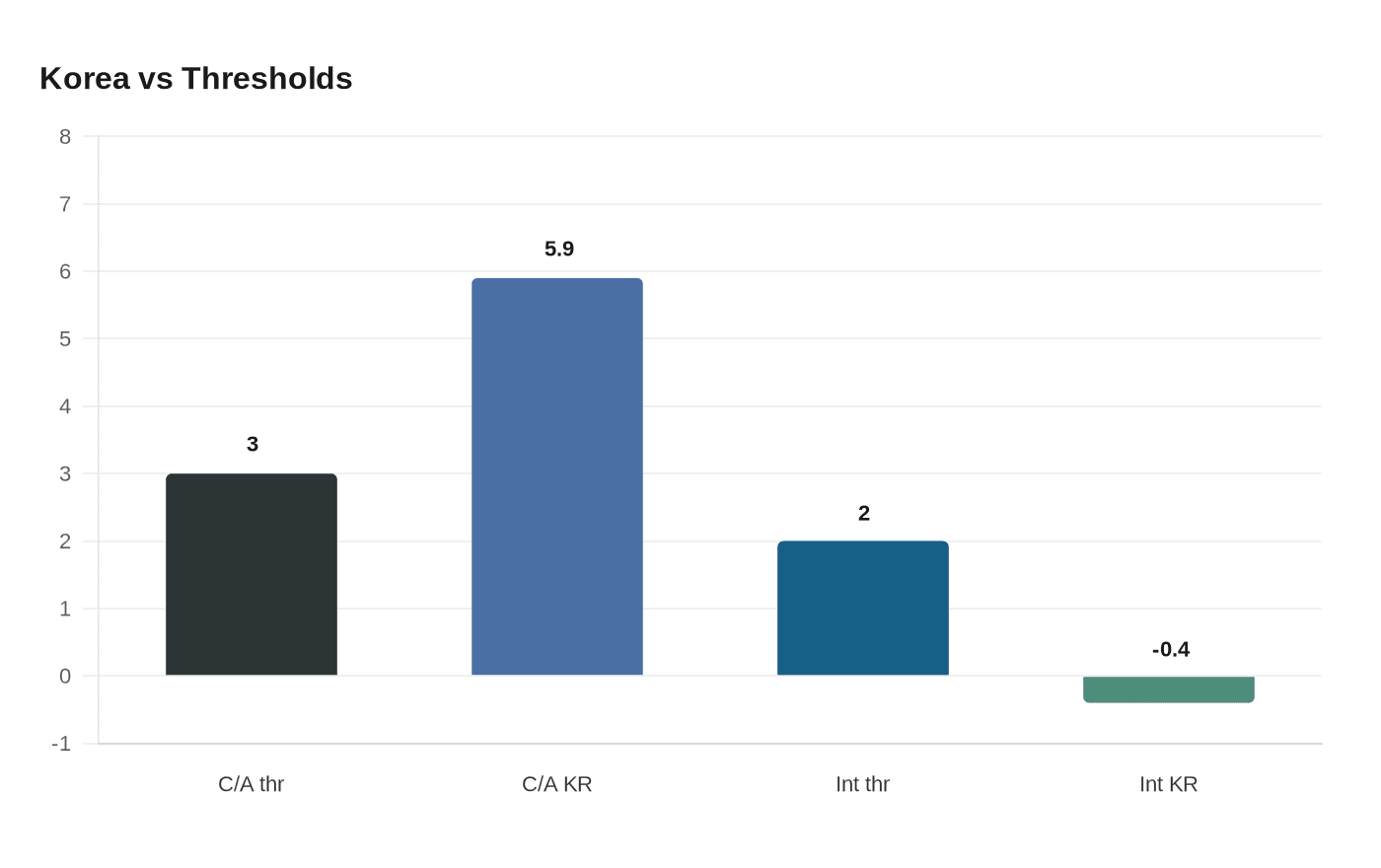

Under the Trade Facilitation and Trade Enforcement Act framework, the Treasury flags economies that meet two of three tests: a bilateral trade surplus with the United States of at least $15 billion; a current-account surplus above 3 percent of gross domestic product; and net purchases of dollars for at least eight of 12 months totaling at least 2 percent of GDP. The report said South Korea posted a $52 billion bilateral surplus with the United States and a current-account surplus equal to 5.9 percent of GDP, satisfying the first two thresholds. The country did not meet the intervention threshold, with authorities net selling dollars equivalent to about 0.4 percent of GDP during the review period.

The semiannual report placed South Korea alongside nine other economies on the monitoring list: China, Japan, Taiwan, Thailand, Singapore, Vietnam, Germany, Ireland and Switzerland. The Treasury found that no economy in this review met all three statutory criteria and therefore no country was designated for enhanced analysis as a currency manipulator.

The listing combines technical assessment with market signal. The report noted retail outflows into U.S. equities as a source of depreciation pressure on the won, quoting the Bank of Korea that the private sector outflows stem from retail investors purchasing overseas equities in a “unique phenomenon.” At onshore trading open the won was quoted at 1,432 per dollar, weakening by 5.7 won from the previous session, the report said.

On intervention and reserves, the report recorded that Korean authorities net sold dollars rather than purchasing them, and that the government used foreign exchange reserves to smooth volatility. Separately, the report said the swap line between the Bank of Korea and the National Pension Service has “likely reduced FX market volatility and mitigated outsized depreciation pressures,” a finding that Treasury analysts said offers some relief for policymakers managing sudden moves in the currency. One outlet reported the government used $7.3 billion of reserves to smooth excessive volatility during the period.

Beyond the arithmetic of surpluses and intervention, the Treasury signaled a broader shift in monitoring. The report said it would increase vigilance on factors that may influence foreign-exchange markets and expand scrutiny beyond central bank interventions to include government investment vehicles such as sovereign wealth funds and public pension funds. Treasury Secretary Scott Bessent said the administration will step up monitoring of trading partners’ currency practices under an America First trade agenda, a stance consistent with the department’s tighter lens on cross-border capital flows.

For Korea, the designation revives a familiar cycle. Seoul was first added to the watchlist in April 2016, removed in November 2023, redesignated in November 2024 and remained on the list through the June 2025 report and now this latest review. Policymakers in Seoul face the twin tasks of addressing persistent trade and current-account surpluses while managing private outflows and maintaining market stability amid intensified U.S. oversight.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip