Starbucks faces market share slide as rivals accelerate U.S. expansion

Starbucks' U.S. spending share fell to about 48%, prompting a push for thousands of new stores and service upgrades.

Industry data from Technomic show Starbucks’ share of consumer spending at U.S. chain coffee shops fell to roughly 48% in 2024-25, down from 52% in 2023, underscoring mounting competitive pressure even as the company remains the dominant chain by footprint.

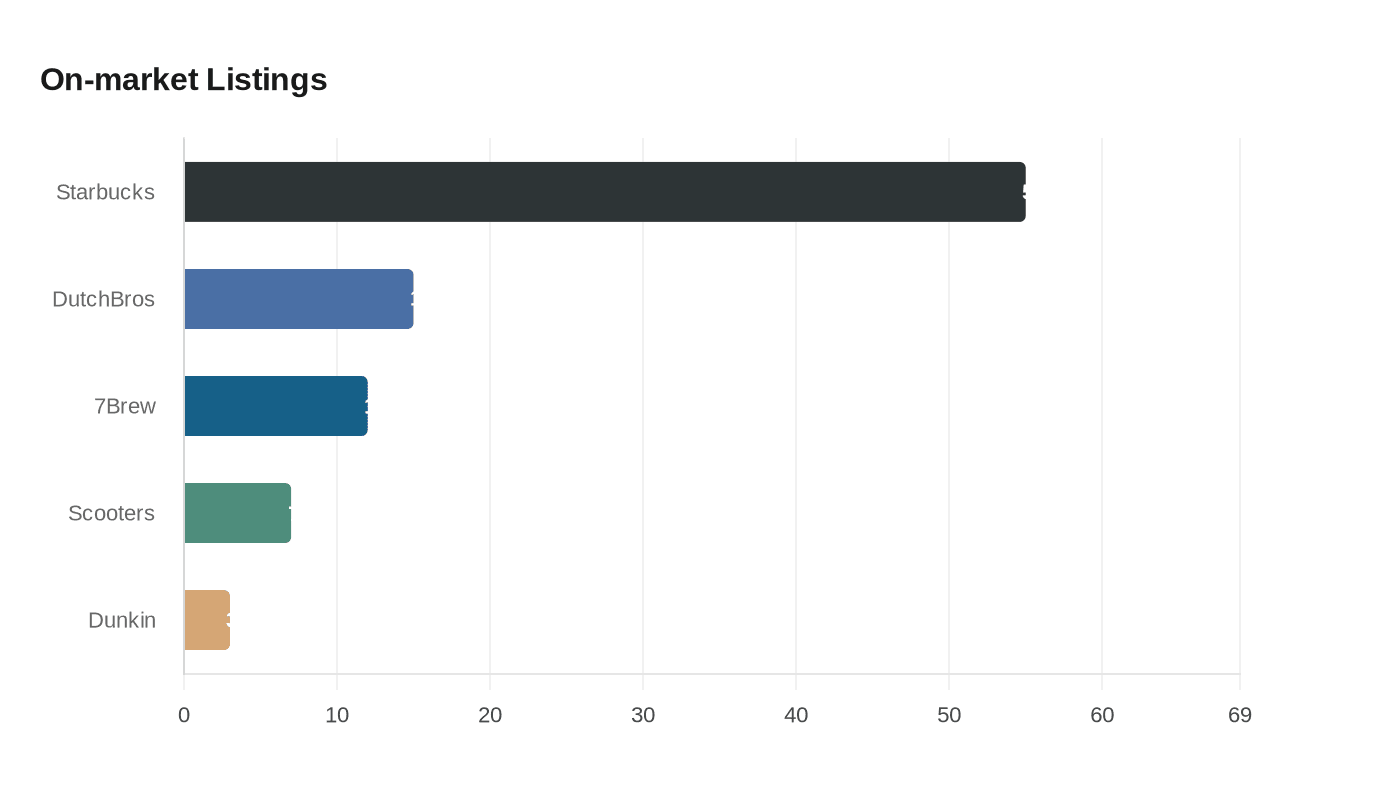

Starbucks still controls roughly 40% of U.S. chain outlets, with more than 16,000 domestic locations, according to commercial real estate analysis by Northmarq. But that outlet dominance has not insulated the company from an increasingly crowded market. Northmarq’s on-market listing breakdown for 2018 through 2024 shows Starbucks accounting for 55% of available listings, followed by Dutch Bros at 15%, 7 Brew at 12%, Scooter’s at 7% and Dunkin’ at 3%, reflecting a proliferation of brands courting landlords and investors.

Rivals are expanding aggressively. Dunkin’ operates more than 9,100 U.S. locations, Dutch Bros more than 900 units and Tim Hortons about 640 U.S. restaurants. Caribou Coffee added 159 stores in 2023 and plans similar growth this year, a sign that franchise and regional chains are regaining momentum. Northmarq describes the coffee market as “highly competitive and compressed,” noting that franchised cafes have been particularly buoyant and that at least 44% of coffee drinkers get takeaway coffee from franchise cafes several times a week. Corporate chain sales grew 10% from June 2021 to June 2022, nearing pre-pandemic levels, evidence of a broader sector rebound.

Starbucks is responding with a multi-pronged growth and service strategy. The company has set a global target of 17,000 net-new stores by 2030 and is targeting about 4% annual U.S. growth, while planning an aggressive domestic rollout. Starbucks said it expects to open up to 175 new U.S. coffee shops this year and to ramp to about 400 net-new company-operated coffeehouses in fiscal 2028. “Even with our scale, the U.S. coffeehouse growth opportunity for Starbucks is big and broad,” said Mike Grams, chief operating officer. “In fiscal 2028, we expect to ramp to build about 400 net-new coffeehouses across our U.S. company-operated business - with discipline and purpose.”

Executives are pitching operational fixes alongside expansion. Investor Day materials credit a North America rollout of Green Apron Service with faster service and higher throughput. “Green Apron Service, fully rolled out in North America company-operated coffeehouses, is driving improved service times, higher throughput and stronger customer satisfaction.” The firm also plans coffeehouse “uplifts” to restore seating and community spaces, with an expectation to add more than 25,000 café seats across the U.S. by the end of fiscal 2026. “Great execution creates better experiences, which drives repeat visits and fuels growth,” Grams added. “Connection and convenience are not tradeoffs at Starbucks - we deliver both.”

International strategy is shifting as well. Starbucks is converting its China operations toward a licensed model with Boyu Capital while retaining a 40% stake, and Starbucks International chief Brady Brewer emphasized the margin benefits of an asset-light approach. “The role of our international business is very clear,” Brewer said. “We are an asset-light growth driver for Starbucks that increases Starbucks margins.”

Company materials also flagged familiar risks: changing market conditions, local regulations and labor policies, protectionist trade measures, and supply-chain volatility affecting coffee, dairy, cocoa and other inputs. Those constraints mean expansion is capital-intensive and subject to geopolitical and local-policy headwinds.

For investors and policymakers, the story is one of structural churn: a dominant brand defending share by scaling stores and improving service while facing a fragmented, franchise-led resurgence that is altering where and how Americans buy coffee. The next two years will test whether execution and international licensing can offset the near-term decline in spending share.

Know something we missed? Have a correction or additional information?

Submit a Tip