OPEC+ agrees in principle to keep March output pause intact

OPEC+ ministers agreed in principle to maintain a freeze on planned March production increases, a move that keeps near-term supply tighter amid geopolitical and outage risks.

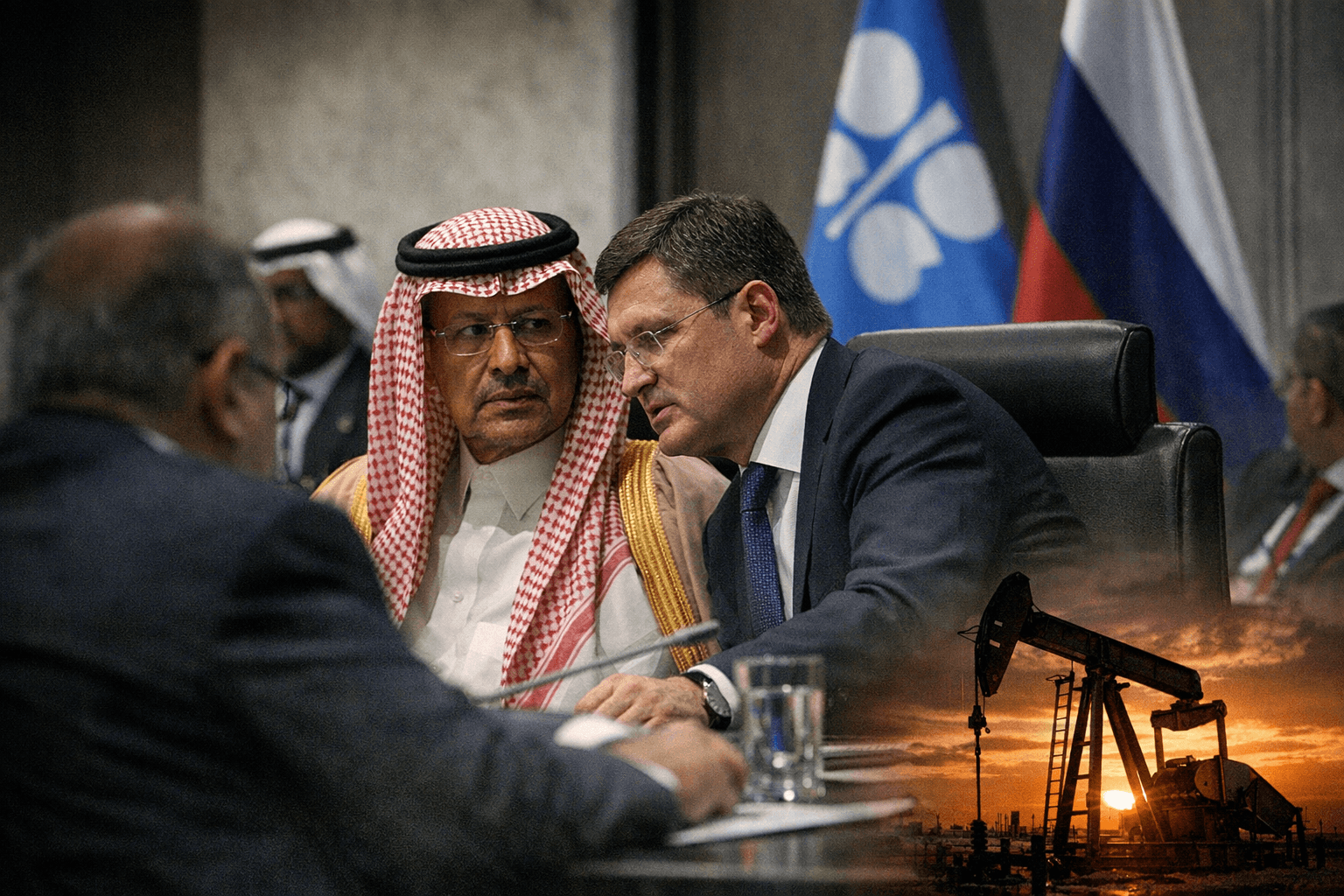

OPEC+ ministers representing Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman agreed in principle to keep a previously agreed pause on planned oil output increases for March 2026, delegates and a draft statement indicated. The step preserves a freeze first adopted for January and February and follows a 2.9 million barrels-per-day quota increase that applied from April through December 2025, roughly 3 percent of global oil demand.

The pause reflects OPEC+’s current judgment that consumption is seasonally weaker in the opening months of 2026 and that the market remains sensitive to downside and upside shocks. Brent crude traded around $70.69 a barrel on the Friday cited by market settlements, with an intraday six-month high of $71.89 on the prior Thursday. U.S. West Texas Intermediate settled near $65.21, as traders weighed the policy signal against recent price volatility.

Risk factors behind the decision are a mix of geopolitics and technical outages. Heightened tensions between the United States and Iran have pushed traders toward precautionary pricing, while physical disruptions in Kazakhstan have removed material volumes from the market. Bank estimates cited to participants indicate Kazakhstan’s Tengiz field was likely to remain offline through late January, cutting expected output toward 1.0–1.1 million barrels per day from a typical near 1.8 million barrels per day. Delegates also warned that Venezuelan output recovery will be slow; an earlier, extraordinary claim about an event involving Venezuela’s president appeared in an internal account and has not been corroborated.

Procedurally, the eight-country meeting was scheduled to start at 1400 GMT on Sunday and was not expected to take decisions for output policy beyond March. A separate Joint Ministerial Monitoring Committee is due to meet after the ministers; that panel will emphasize monitoring, compliance and any compensation for past overproduction but does not itself set production policy. Draft texts circulated to delegates reaffirmed OPEC+’s commitment to full conformity with the Declaration of Cooperation and stated that overproduction since January 2024 would be fully compensated, subject to JMMC monitoring.

Draft language seen by participants also underscored flexibility in the group’s toolkit. In internal drafts, producers noted that 1.65 million barrels per day of voluntary cuts could be returned to the market gradually if conditions warranted, and that other voluntary adjustments, including roughly 2.2 million barrels per day of cuts announced in November 2023, remain options to extend or reverse. Those details derive from draft communiqués and participant briefings and should be confirmed against the final ministerial text.

The decision to hold the March pause leaves OPEC+ pacing supply increases cautiously while watching inventories, seasonal demand and geopolitical risk. After an 18 percent fall in crude prices in 2025—the steepest annual drop since the pandemic—ministers appear determined to avoid a renewed surplus even as they preserve the option to reintroduce withheld volumes if the market tightens. Market participants will look to the formal communique and JMMC findings for operational detail and the timing of any compensation mechanisms.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip